Alex Cheong Pui Yin

28th October 2022 - 3 min read

Affin Bank has announced that starting from 1 December 2022, all cardholders who opt to renew their Affin Visa Signature credit card upon its expiry will receive the Affin Duo+ pair credit cards instead. This comes as Affin Bank has also discontinued the application and issuance of new standalone Affin Visa Signature following the introduction of the Affin Duo+ cards last year.

“Effective 1 December 2022, Affin Visa Signature renewals will be issued with the Affin Duo+. As your card is due for renewal soon, we are pleased to inform you that you will be issued with the Affin Duo+ comprising of both Affin Duo+ Visa and Affin Duo+ Mastercard,” the bank shared in a notice to clients.

Meanwhile, in an FAQ, Affin Bank emphasised that although this re-carding exercise is set to take effect from 1 December onwards, you will only be issued the Affin Duo+ cards when your Affin Visa Signature is due for renewal. If your card is not due for renewal, you can still continue to use your existing Affin Visa Signature card as per usual.

Additionally, the bank will mail the two Affin Duo+ cards to you separately. You can expect to receive the Affin Duo+ Visa card first, and then subsequently the Affin Duo+ Mastercard card. Once the cards have been mailed out, you will be notified via SMS. You can also track the delivery of the new cards by contacting Affin Bank’s contact centre at 03-8230 2222.

For those who are unaware, the Visa half of the Affin Duo+ cards is actually a reiteration of the Affin Visa Signature card; they both offer 3% cashback for contactless transactions (excluding government services and charity transactions), with a cap of up to RM100 per month. The RM100 cap is applicable only if you have a previous statement balance of RM8,000 and above; if less, then the maximum cashback that you can earn is limited to RM50.

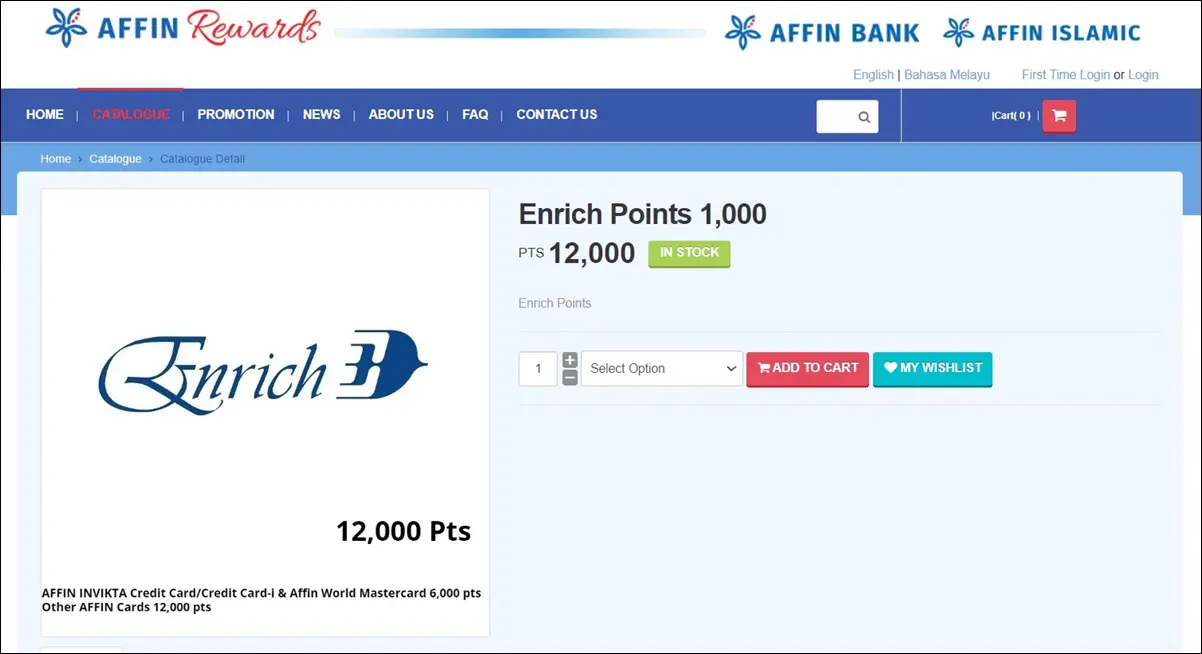

Meanwhile, the Affin Duo+ Mastercard card complements the Visa half as a rewards points card, awarding you 3x AFFIN Rewards Points for every RM1 spent on airlines, e-commerce/online purchases, duty-free purchases, hotels, and overseas transactions. There is no cap on the amount of points that you can earn each month, but note that these points are only valid for three years from the date of issuance.

The Affin Duo+ cards were launched back in December 2021 with a minimum annual income requirement of RM48,000. The annual fee stands at RM100 per card (RM50 for supplementary cards), although they are waived for the first three years. For subsequent years, the fee can also be automatically waived with a minimum of 12 swipes for retail transactions per annum.

(Source: Affin Bank)

Comments (1)

According to Affin bank website that contactless transaction is a transaction made by tapping/waving AFFIN DUO+ Visa in front of the Contactless Reader and without having to insert or swipe the card whenever you see the universal contactless symbol.

So in another way this means reloading ewallet with DUO+ card will not get 3% cash back.