Alex Cheong Pui Yin

20th March 2024 - 2 min read

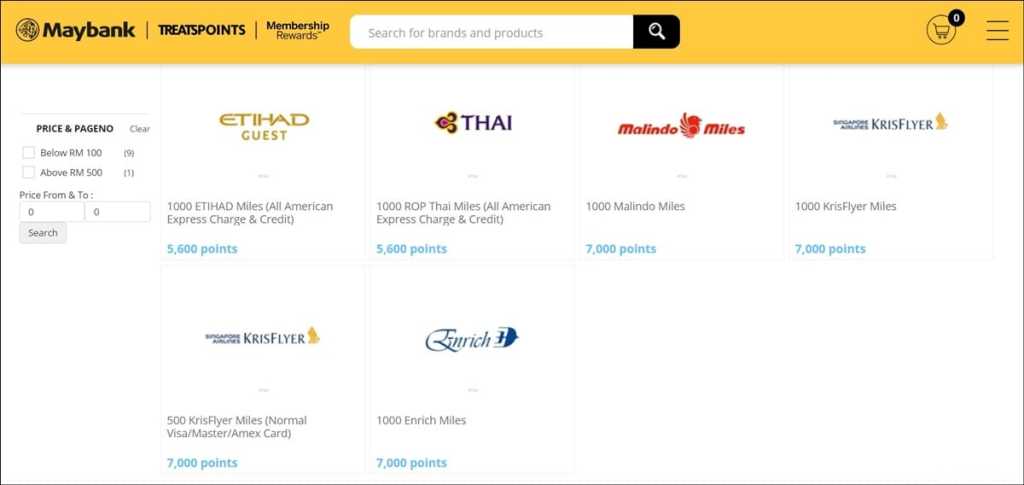

Maybank has announced that it will be implementing some new conditions for the redemption of TreatsPoints and Membership Rewards Points for air miles, including introducing a new sub-limit on the amount of air miles that can be redeemed during bonus air miles campaigns. These revisions are set to take effect on 12 April 2024.

At present, Maybank customers are limited to a maximum redemption of two million air miles per calendar year, regardless of airlines – but aside from this, there are no other conditions or constraints. With this latest revision, Maybank clarified that this two million maximum limit will also include the conversion of TreatsPoints or Membership Rewards Points to air miles during any bonus air miles campaigns organised by any airlines (such as the Enrich Bonus Points campaigns by Malaysia Airlines).

Furthermore, Maybank is introducing a sub-limit for amount of air miles that you can convert using your TreatsPoints or Membership Rewards Points during these bonus miles campaign. Starting from 12 April, each customer may only convert up to 250,000 air miles per campaign.

On top of that, there will also soon be a “collective monthly conversion limit” allocated for the purpose of air miles redemption, capped at 100 million air miles per month. This means that Maybank will earmark a pool of 100 million air miles for redemption each month, and cardmembers can convert their points on a first-come first-served basis. Once the 100 million air miles provided for the month are fully redeemed, you’ll have to wait for the next month to convert more. This pool will be refreshed on the first day of every calendar month.

Aside from these updates, the other privileges and benefits for all your Maybank cards remain unchanged, and you can continue to use them as per usual. The terms and conditions document for Maybank’s TreatsPoints and Membership Rewards Points Redemption programme has also been updated to reflect these upcoming changes.

If you’d like to get more clarification regarding this latest revision, you can reach out to the bank’s customer care hotline at 1300 88 6688 (or 603-7844 3696 if you’re abroad). Alternatively, you can visit the nearest branch to you to speak to a representative.

(Source: Maybank)

Comments (0)