Alex Cheong Pui Yin

7th December 2021 - 4 min read

Affin Bank has officially unveiled its latest credit card offering today, following its earlier teaser post that promised a new card product that “does it all”. Clearly taking a cue from the popular Affin Duo cards, the new Affin Duo+ cards are also a Visa-Mastercard pair that offers 3% cashback and 3x rewards points on selected transactions, respectively.

Affin Duo+ Visa Credit Card

The Visa card for this Affin Duo+ pair is a cashback credit card that allows you to earn up to 3% cashback on contactless transactions, capped at a maximum amount of RM100 per month. However, there’s a caveat to this; the RM100 cap only applies if you have a previous balance of RM8,000 and above in your credit card statement. Otherwise, the maximum cashback that you can earn is limited to a lesser amount of RM50.

These caps, of course, affect the effective cashback rate of the card – as we’ll show you here:

| Previous balance | Cashback cap | Official cashback rate | Effective cashback rate |

| Below RM8,000 | RM50 | 3% | 0.625% and 3% |

| RM8,000 and above | RM100 | 3% | 1.25% and below |

As you can see, you won’t be able to earn the official 3% cashback rate if you attempt to meet the previous balance requirement needed to get the RM100 cashback cap. You’ll only earn the official 3% cashback rate up to a maximum for RM1,667 of spending (and max out the RM50 cashback cap). If you wish to earn the RM100 cashback, you’ll need to spend RM8,000 the previous month, which greatly reduces the effective cashback rate (which you’ll see in the table above). This mechanic is similar to that of the Affin Duo Visa, so if you already own those cards you’d be familiar with the “previous monthly balance” requirement.

Aside from that, the Affin Duo+ FAQ clarified that contactless transactions will encompass payments that are made by tapping the card against a payment terminal (not exceeding RM250) – excluding government services and charity transactions.

Affin Duo+ Mastercard Credit Card

The Mastercard of the pair, meanwhile, awards 3x AFFIN Rewards Points for every RM1 that you spend on airlines, e-commerce/online purchases, duty-free purchases, hotels, and overseas transactions. Clearly, this card is intended to meet the preferences of e-commerce shoppers, as well as travellers who are eager to go places – especially now that Malaysia is gradually reopening its borders after almost two years of lockdown due to Covid-19.

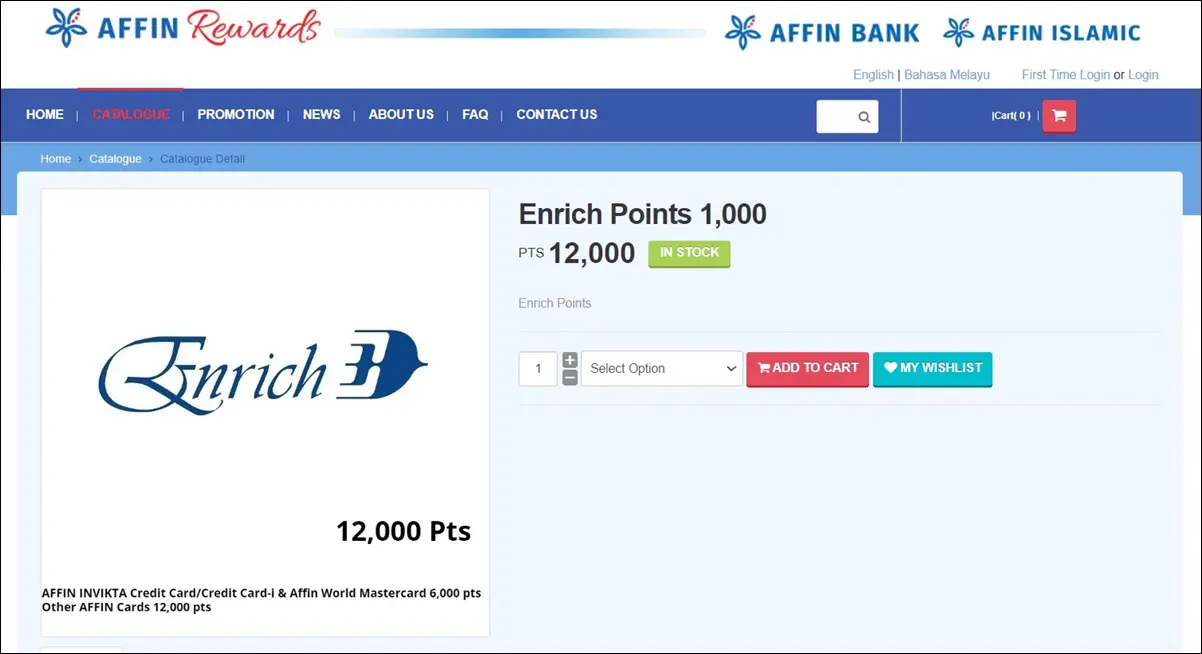

Affin Bank further noted that the AFFIN Rewards Points earned can be converted to Enrich Points, AirAsia BIG Points, and Malindo Miles which you can then use to redeem tickets for your next flight. There is no cap on the amount of AFFIN Rewards Points that you can earn via this card each month – although do be aware that the points have a three-year validity period from the date of issuance. For easy reference, the conversion rates are as below:

- 1,000 Enrich Points = 12,000 AFFIN Rewards Points

- 1,000 AirAsia BIG Points = 10,000 AFFIN Rewards Points

- 1,000 Malindo Miles = 9,000 AFFIN Rewards Points

***

If you thought the Visa half of the Affin Duo+ card is familiar, you’re not wrong – its design and features does look like it is based off the bank’s existing Affin Visa Signature credit card. In fact, the Affin Duo+ FAQ explicitly stated that current Affin Visa Signature cardholders who apply for the Affin Duo+ cards will only receive the Affin Duo+ Mastercard. Subsequently, their existing Affin Visa Signature will be tagged along with the Mastercard card as Affin Duo+.

Finally, note that Affin Bank has not announced the annual fees for the Affin Duo+ cards yet, but a chat with the customer service team revealed that these charges will be waived for the first three years. For subsequent years, the fees can also be waived with a minimum of 12 retail transactions per annum. Additionally, the minimum annual income requirement to apply for the Affin Duo+ cards is set at RM48,000.

(Source: Affin Bank)

Comments (0)