Alex Cheong Pui Yin

14th September 2022 - 3 min read

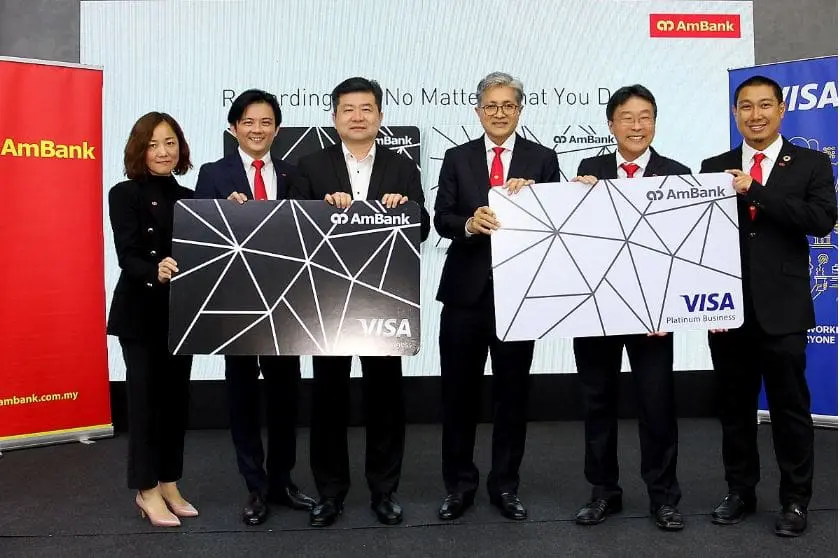

AmBank has launched two new business credit cards, the AmBank Visa Platinum Business Card and the AmBank Visa Infinite Business Card, to serve the various needs of Malaysian business owners. Both cards are designed to offer improved convenience, especially in terms of payments and the ability to streamline and consolidate their corporate expenses under one account.

Specifically, the AmBank Visa Platinum Business Card is targeted at SME customers, offering 1x AmBonus Point for every RM1 spent on eligible local expenses, and 2x AmBonus Points for overseas spend. Note that AmBank defines overseas spend here as only card transactions made outside of Malaysia; all online transactions performed with overseas vendors are not eligible to earn 2x AmBonus Point.

Other perks that AmBank Visa Platinum Business cardholders may also enjoy include 2x access to the Plaza Premium Lounge and rebates via the Club Marriott Malaysia annual membership. These are in addition to complimentary personal accident and travel coverage valued at RM30,000 and RM1 million, respectively, as well as an interest-free repayment period of 28 days (after billing period) and easy payment plans for better cash flow optimisation.

Meanwhile, the AmBank Visa Infinite Business Card is designed for larger corporations, such as wholesale banking and business banking customers. These cardholders can earn up to 1% cashback on overseas transactions and selected business expenses – with no cap on how much you can earn and no minimum spend requirement. The cashback rewards that can be earned are tiered as below:

| Expense category | Cashback |

| Overseas transactions (excluding online transactions) | 1% |

| Petrol, airlines, hotel, and F&B | 0.5% |

| Other spend (excluding cash advance, JomPay, and government services) | 0.1% |

Moreover, cardholders will enjoy 5x complimentary access to the Plaza Premium Lounge, rebates via the Club Marriott Malaysia annual membership, and travel insurance coverage of RM2 million. They can also tap into a similar interest-free repayment period of 28 days (after billing period) and easy payment plans.

Retail banking manager director of AmBank, Aaron Loo said that the two new cards are meant to fill a critical gap in the needs of business owners, especially as they are still recovering from the setbacks caused by Covid-19. The bank also hopes to assist SMEs as a largely underbanked and underserved segment, citing data from Visa’s SME Digital Banking Study.

Country manager of Visa Malaysia, Ng Kong Boon, further said that providing SMEs with payment cards will encourage business owners to embark on their digitalisation journey. “Digital payments can also help SMEs to have better visibility of their expenses, which will lead to an improved cash flow for their businesses,” he said.

Both the AmBank Visa Platinum Business Card and the AmBank Visa Infinite Business Card do not come with annual fees; eligible cardholders can utilise it for free for life, with no added conditions.

(Sources: AmBank [1, 2], The Edge Markets)

Comments (0)