Alex Cheong Pui Yin

4th April 2022 - 3 min read

Bank Muamalat has partnered with Visa to launch its maiden credit cards, the Bank Muamalat Visa Platinum-i and the Bank Muamalat Visa Infinite-i. Both cards are fully shariah-compliant, and will offer cashback for e-commerce, contactless, as well as overseas spend.

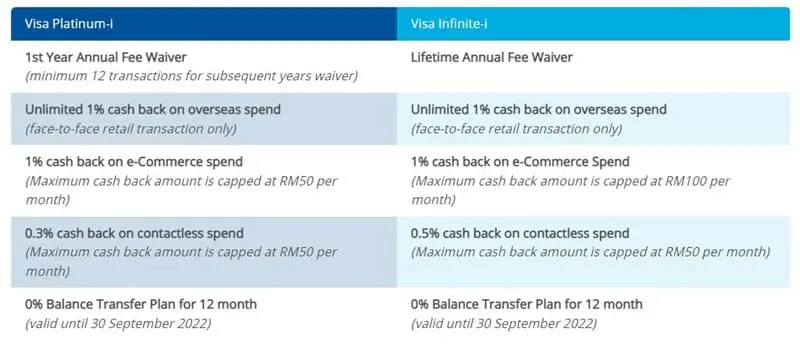

Specifically, the Bank Muamalat Visa Platinum-i will allow cardholders to earn 1% cashback on e-commerce spend and 0.3% cashback on contactless spend – capped at a maximum of RM50 per month for each spend category. On top of that, they can get unlimited 1% cashback on overseas spend, but only for offline retail transactions. There is also an ongoing 0% balance transfer plan for 12 months that cardholders can tap into via the card (valid until 30 September 2022).

Meanwhile, cardholders of the Bank Muamalat Visa Infinite-i credit card will also be entitled to 1% cashback on e-commerce spend, but it is capped at a higher maximum limit of RM100 per month. Additionally, they get to enjoy 0.5% cashback on contactless spend (capped at RM50 per month) as well as unlimited 1% cashback on overseas spend (also for offline transactions only). The 12-month 0% balance transfer plan is also made available for these cardholders.

As for annual fees, the Bank Muamalat Visa Platinum-i card has a charge of RM168.00 per year to use, waived for the first year. For subsequent years, this fee can be waived with a minimum of 12 swipes of the card. Cardholders of the Bank Muamalat Visa Infinite-i credit card, on the other hand, will be able to enjoy a lifetime annual fee waiver.

Here’s a table from Bank Muamalat to better summarise the features of each card:

The president and chief executive officer of Bank Muamalat, Khairul Kamaruddin said he expects the two new cards will meet consumers’ everchanging needs. This is especially as Malaysia is now removing all restrictions to business operating hours following the nation’s transition into the endemic phase with regard to Covid-19.

“The Bank Muamalat Visa Platinum-i and Visa Infinite-i will allow cardholders to consolidate their everyday purchases, including online, contactless, and physical shopping into one card, and at the same time provide cardholders with savings from cashback every time they spend on their daily essentials,” said Khairul, adding that Bank Muamalat is aiming to sign up 20,000 new cardholders within the first year, with a primary focus on its internal customer base.

Meanwhile, the country manager of Visa Malaysia, Ng Kong Boon said that Visa is excited to launch its first credit card product with Bank Muamalat, and that the move is timely.

“In the last 18 months, we have seen rapid adoption of digital payments and digital commerce among Malaysians, and believe that this product caters to the current needs of our Malaysian cardholders. We are also seeing many Visa cardholders who were previously inactive on e-commerce now shopping online for the first time,” said Ng, adding that this trend affirms Bank Muamalat’s move to launch their credit cards in this period.

(Source: Bank Muamalat [1, 2])

Previously covered recruitment-related stories and had a short stint as a copywriter for the property industry. She subsequently developed an interest in investment and robo-advisors.

Comments (2)

does eWallet reload consider as e-commerce spend ?

it depends on whether the bank determines “e-commerce spend” via MCC codes, keywords (Lazada, Shopee etc), or a combination of both. best to check with the PDS and/or the bank to confirm.