Nur Adilah Ramli

13th April 2022 - 3 min read

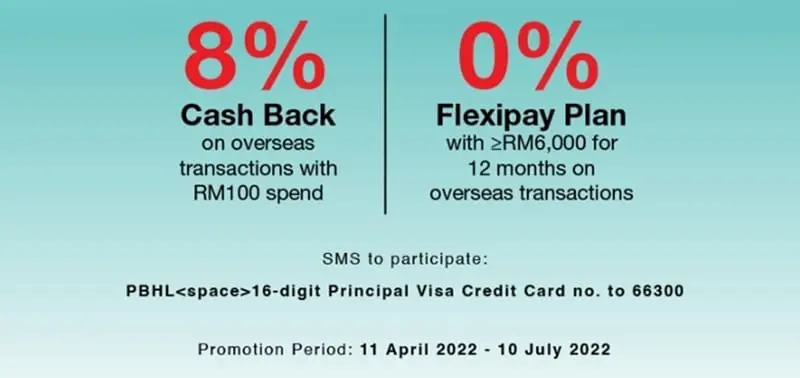

Public Bank and Public Islamic Bank are currently running its Overseas Reward With PB Visa Credit Card campaign, rewarding eligible credit cardmembers with 8% cashback for overseas transactions. Along with that, there is also a 0% Overseas Flexipay Plan offer, which allows cardmembers to convert their overseas transactions into a 12-month instalment plan with 0% interest.

This campaign is eligible for both new and existing principal cardmembers. The first offer allows you to earn 8% cashback by spending a minimum of RM100 in a single receipt on overseas transactions in foreign currencies and capped at RM88 per month. Offered on a first-come, first-served basis, cardholders can earn cashback for three months across the campaign months:

| Participating months | Dates |

| Month 1 | 11 April – 10 May 2022 |

| Month 2 | 11 May – 10 June 2022 |

| Month 3 | 11 June – 10 July 2022 |

Qualifying transactions include all overseas retail spending, online purchases and new zero-interest instalment plans (full purchase amount). Meanwhile, e-wallet transactions, balance transfers, recurring payments, and payments for utilities are among some of the transactions that are not eligible for this campaign.

Public Bank has allocated a total of RM105,000 for this sub-campaign, with RM35,000 earmarked for each campaign month. If you do earn any cashback, it will be credited into your account within four to eight weeks after the end of each campaign month.

Meanwhile, to tap into the 0% Overseas Flexipay Plan, you’ll need to meet a minimum spend of RM6,000 for overseas transactions in foreign currencies. You can then convert the transactions into a 12-month instalment plan with 0% upfront interest or management fee. Note as well that you may apply for this plan more than once during the campaign period, as long as you have enough credit limit and meet the minimum RM6,000 transaction amount.

To participate in the Overseas Reward With PB Visa Credit Card campaign, you need to send an SMS (“PBHL<space>16-digit principal Visa credit card number”) to 66300, after which you’ll receive a confirmation from the bank if you’re successfully registered. In the case of the 0% Overseas Flexipay Plan, you are also required to contact Public Bank with the details of the transaction that you wish to convert; this should be done three days after the purchase, or five days before the next statement date. You can do so by contacting the bank at 03-2176 8000 or emailing it at [email protected].

Finally, note that this campaign is slated to run until 10 July 2022.

(Source: Public Bank)

Comments (0)