Pang Tun Yau

2nd November 2020 - 2 min read

Standard Chartered has launched the new Standard Chartered Smart Credit Card, a cashback credit card designed for digital lifestyle expenditure. It is also Malaysia’s first carbon-neutral card, thanks to offset emissions in the production process.

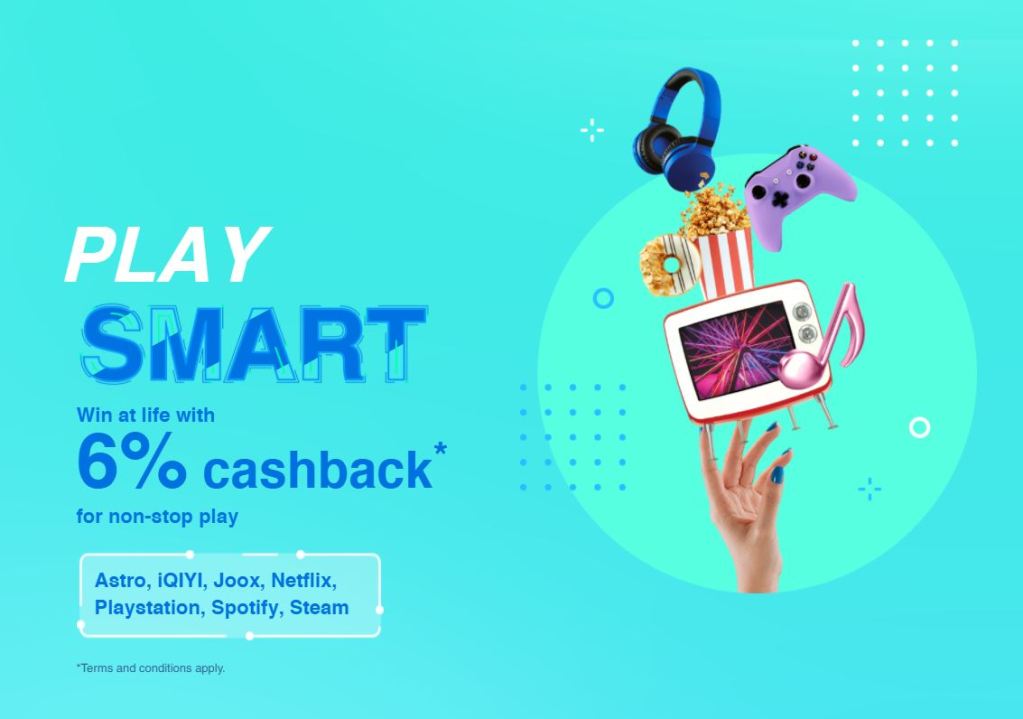

The Smart credit card by Standard Chartered offers 6% cashback for the following seven digital lifestyle merchants:

- Astro

- iQIYI

- Joox

- Netflix

- Playstation Network

- Spotify

- Steam

However, there is a minimum spend requirement of RM1,000 per month on any retail transactions, and total cashback is capped at RM20 per month – giving it an effective cashback rate of 2%, which is around the ballpark of SC’s two other cashback cards, the JustOne Platinum and the Liverpool FC Cash Back Card.

As part of the new card launch, new cardholders will enjoy quite a fair amount of perks. For instance, in addition to the 6% cashback above, cardholders can also earn up to 30% cashback in online-centric expenditure for the first six months, covering the following merchants:

Shopping: Lazada, Shopee, Zalora; capped at RM15/month

e-Wallets: Boost, GrabPay, Touch ‘n Go eWallet; capped at RM15/month

Travel: Agoda, Klook, Roamingman; capped at RM50/month

This special 30% cashback campaign will be available for all new Smart credit cardholders who successfully apply for the card before 30 April 2021. From there, cardholders will enjoy the special 30% cashback for six calendar months, which means a theoretical total of RM480 in special cashback. Cashback is also given in limited quantities on a first-come, first served basis each month -do check the campaign’s T&Cs for more info.

In addition, new cardholders will also get two extra perks: zero cash advance fees as well as a Cheque-On-Call Plus at 0% for up to RM15,000 for a 12-month tenure with RM100 cashback. Finally, cardholders also get access to the same benefits that all SCB credit cardholders enjoy, such as up to 30% dining cashback at participating restaurants, up to 20% off on online shopping platforms, and special perks for topping up GrabPay e-wallet or using GrabFood.

As a card with digital-centric benefits, it’s expected that the Standard Chartered Smart Credit Card has entry-level requirements. With a minimum annual income requirement of RM36,000 (RM3,000 per month) and first-year annual fee waiver, the RM120 annual fee is also waived with an annual spend of RM12,000.

The Standard Chartered Smart credit card is now open for applications, and can be applied via RinggitPlus.

Comments (0)