Alex Cheong Pui Yin

5th July 2023 - 5 min read

UOB Bank has officially unveiled the designs of the new credit cards that were added to its portfolio to replace various Citi cards, following UOB’s acquisition of Citi Malaysia’s consumer banking business. Specifically, the card faces of five new UOB cards – along with their minimum annual income requirement and annual fee – are now revealed, namely the UOB Zenith, UOB PRVI Miles Elite, UOB World, Lazada UOB, and UOB Simple cards.

Of the five new cards, four are rewards points cards – UOB Zenith, UOB PRVI Miles Elite, UOB World, and Lazada UOB – whereas UOB Simple is a cashback card. Here’s a look at the new cards that will be coming your way in October, if you’re a Citi cardholder (meanwhile, new customers who are interested in applying for the cards can do so soon):

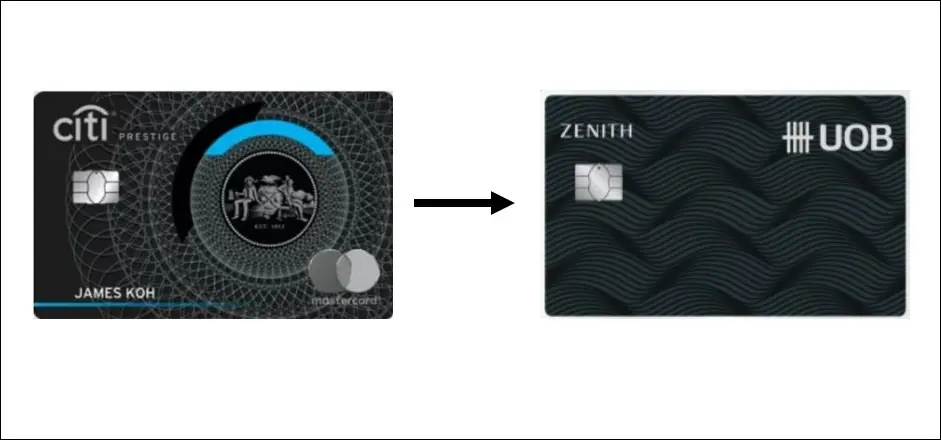

UOB Zenith

Replacing the Citi Prestige card, UOB Zenith’s design utilises a blue palette, along with a repetitive motif of waves to create a minimalist and elegant look.

Benefits of the UOB Zenith card:

- 1x UNIRM for every RM1 spent on local transactions

- 2x UNIRM for every RM1 spent on overseas transactions

- Bonus 250,000 UNIRM with minimum annual spend of RM240,000

- Up to 50% additional UNIRM on annual spend via Relationship Bonus Programme

- 12x complimentary airport lounge access per year (Plaza Premium Lounge and affiliate partners)

- Complimentary limo rides from airport to home

- Complimentary fourth night stay at selected hotels and resorts

- UOB Zenith Global Concierge Services

Minimum income requirement: RM192,000 per annum

Annual fees: RM1,000 (principal), complimentary for supplementary cardholders

UOB PRVI Miles Elite

UOB PRVI Miles Elite replaces the Citi PremierMiles card, which featured a shade of gray. The UOB PRVI Miles Elite card, meanwhile, is a classy black card that also brings back the little airplane motif (this was featured in an older design of the Citi PremierMiles card).

Benefits of the UOB PRVI Miles Elite card:

- 10x UNIRM for every RM1 spent on overseas spend

- 5x UNIRM for every RM1 spent on airline expenses

- 1x UNIRM for every RM1 spent on local transactions

- Bonus 60,000 UNIRM upon annual fee payment

- 8x complimentary airport lounge access per year (in 9 countries and territories)

- Complimentary limo rides from airport to home

- Special conversion rate from UNIRM to Enrich Points (9,000 UNIRM to 1,000 Enrich Points)

- Personal accident coverage of up to RM300,000

Minimum income requirement: RM100,000 per annum

Annual fees: RM600 (principal), complimentary for supplementary cardholders

UOB World

The UOB World card has a cleaner design compared to the Citi Rewards World Mastercard that it is meant to replace. It features a burst of rays from the centre of the card, in various shades of blue.

Benefits of the UOB World card:

- 12x UNIRM for every RM1 spent on selected e-commerce and e-wallet transactions (up to RM300 per merchant)

- 5x UNIRM for every RM1 spent at selected departmental stores and supermarkets/hypermarkets (up to RM3,000)

- 5x UNIRM for every RM1 spent on overseas expenses (up to RM24,000 equivalent per year)

- 1x UNIRM for every RM1 spent on local transactions

- Bonus 125,000 UNIRM with minimum annual spend of RM48,000

- 6x complimentary airport lounge access per year (KLIA 1 and 2)

- Personal accident coverage of up to RM50,000

Minimum income requirement: RM60,000 per annum

Annual fees: RM600 (principal) and RM150 (supplementary)

Lazada UOB

The Lazada UOB card replaces the UOB Citi Platinum credit card. Design-wise, it is a blue vertical card that features Lazada’s logo as its background motif, arranged repetitively across the card in hexagonal shapes.

Benefits of the Lazada UOB card:

- RM28 Lazada discount voucher every Monday (RM200 min spend)

- RM8 Lazada discount vouchers on the 8th of every month (RM45 min spend)

- Lazada RM5 free shipping vouchers every Friday (RM15 min spend)

- Other exclusive Lazada vouchers offered every month

- 10x UNIRM for every RM1 spent on Lazada or via Lazada Wallet (up to RM500)

- 5x UNIRM for every RM1 spent on selected online lifestyle, telco, and insurance spend (up to RM500 for online lifestyle spend, and another RM500 for telco & insurance spend)

- 1x UNIRM for every RM1 spent on local retail expenses

- Bonus 1,000 UNIRM for minimum monthly spend of RM1,500

Minimum income requirement: RM24,000 per annum

Annual fees: RM100 (principal) and RM70 (supplementary) – waived automatically in following years with minimum annual spend of RM15,000 during current year.

UOB Simple

Finally, the UOB Simple – which replaces the Citi Simplicity+ card – is also a blue vertical card, with a simple S-curve in the background, likely to signify the “S” for Simple.

Benefits of the UOB Simple card:

- 10% cashback on finance charges on purchases and cash advances each month when you pay at least the minimum monthly due amount on time (no cap)

- No extra fees (such as annual fees and late payment charges)

Minimum income requirement: RM24,000 per annum

Annual fees: N/A

***

In addition to rolling out these new credit cards, UOB has also been revising some of its existing cards over the past months to better meet the needs and expectations of onboarding Citi cardholders. These include the UOB ONE Classic and Platinum cards, as well as the UOB Preferred card. UOB is also set to commence its migration of Citi accounts to its ecosystem next week, between 14 July (8pm) to 16 July.

Citi first announced its intention to exit retail banking in Malaysia – along with several other markets – in April 2021, as part of the bank’s realignment strategy. Following that, it agreed to sell its consumer banking business in Malaysia to UOB.

Comments (1)

Zenith card no insurance coverage?