Alex Cheong Pui Yin

18th November 2020 - 2 min read

Last week, Affin Bank launched a new financial and wealth planning segment, Affin Avance, aimed at the mass affluent group of on-the-go professionals. Featuring a variety of personalised solutions – including access to a dedicated personal financial consultant and financing with preferential rates – the banking membership also serves up a new credit card for its members: the Affin Avance credit card.

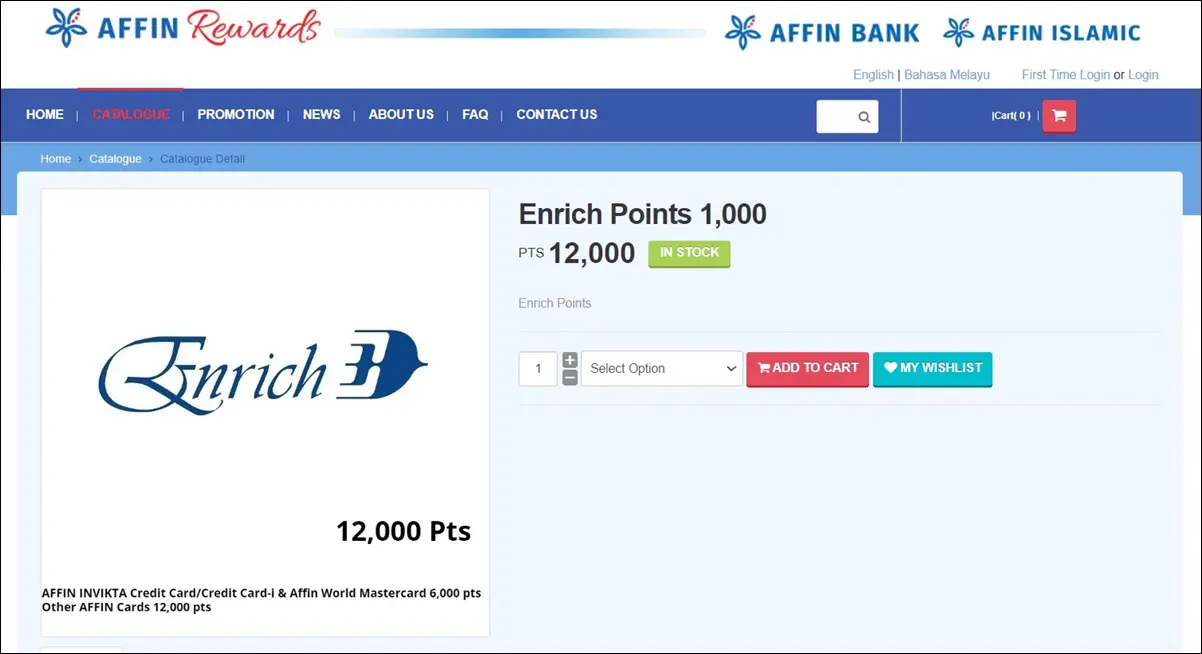

Available either as a Visa credit card or a Mastercard credit card-i, the Affin Avance credit card is a rewards points credit card that offers up to 3x AFFIN Rewards points when you perform selected transactions. Specifically, the points are awarded as such for the following transactions:

- Dining: 3x AFFIN Rewards points for every RM1 spent

- Professional bodies (in Malaysia): 3x AFFIN Rewards points for every RM1 spent

- Retail: 1x AFFIN Rewards points for every RM1 spent

Note that the bank will not award AFFIN Rewards points for charity, government, and petrol transactions. Also, AFFIN Rewards points have a validity period of 3 years starting from the date of issuance.

Aside from rewards points, the Affin Avance credit card also lets you take up an easy instalment plan of up to a maximum of 24 months at 0% interest when you spend a minimum of RM3,000 in a single receipt. On top of that, you also get to enjoy a lifetime waiver of the annual fee.

At present, Affin Bank has yet to share more in-depth details about the Affin Avance credit card. There is also no mention of the exact application requirements for the card. However, knowing that one of the eligibility criteria for the Affin Avance membership is that you must have a minimum monthly salary of RM7,000, we expect the Affin Avance credit card to share a similar – if not higher – income requirement.

According to Affin Bank, the Affin Avance credit card will be available starting from December 2020; more information will be revealed by then. In the meantime, you can check out the new Affin Avance credit card on the bank’s website.

Comments (0)