Latest Articles

Credit Cards

How to Choose Your First Credit Card

Ready to apply for your first new credit card? Here are the basic things to consider before settling on your first credit card.

Credit Cards

Maybank 2 Gold & Platinum Cards Review 2018: Evergreen Essentials

With 5x TreatsPoints and 5% weekend cashback, this is a must-have pair of credit cards.

Credit Cards

AEON BiG Visa Gold Review 2018: Quietly Rewarding

The Aeon Big Visa Gold is a well-kept secret that you should consider adding to your credit card arsenal.

Credit Cards

Survey Shows Malaysians Are Becoming More Comfortable With Going Cashless

According to a Visa survey, Malaysians are embracing the future of going cashless, with some even able to go up to three days without spending cash.

Credit Cards

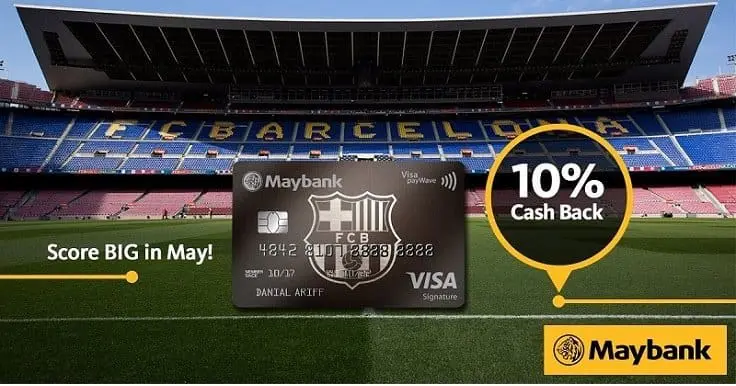

Maybank FC Barcelona Visa Signature Review: Cashback King For May & August

Despite being a football-themed credit card, this is one of the best credit cards for cashback in Malaysia. Here's our verdict.

Credit Cards

The Most Reliable Credit Card For Getting Your Cashback

The Maybank American Express Cash Back Gold credit card does exactly what it says – it gives you up to 1.5% unlimited cashback on your spending, no strings attached.

Credit Cards

How Do You Know if Your Credit Card Rewards Are Worth It?

Not all credit cards are created equal. To know which credit cards bring the best rewards that fit your needs, check out this quick guide we made just for you.

Credit Cards

How to Build Good Credit With or Without a Credit Card

It's important to have good credit if you want to be able to take out big loans. Here is our quick guide to building good credit with or without a credit card!

Credit Cards

Are Travel Packages Better Than Planning Your Own Trip?

Can't decide between planning everything for your travels or signing up for a travel package? We break down the differences so you know which one to choose!

Credit Cards

Frequently Asked Questions About Credit Cards

Do you have questions about credit cards or are you looking to apply for your first credit card? Check out our FAQ on credit cards for all the need-to-know information.

Load More

Posts pagination

Get personal finance news in your inbox weekly

Subscribe to our exclusive weekly newsletter and we’ll bring you the week’s highlights of financial news, expert tips, guides, and the latest credit card and e-wallet deals.

Thank you

for subscribing!

Stay tuned for what’s to come next in the personal finance world