Alex Cheong Pui Yin

2nd January 2024 - 2 min read

Standard Chartered Bank is running a year-long RM1 Daily Deals campaign, where credit cardholders can enjoy a variety of deals at the price of RM1 from today until 31 December 2024. Provided as part of the bank’s The Good Life Privileges programme, the available promos cover a range of products, from dining to shopping.

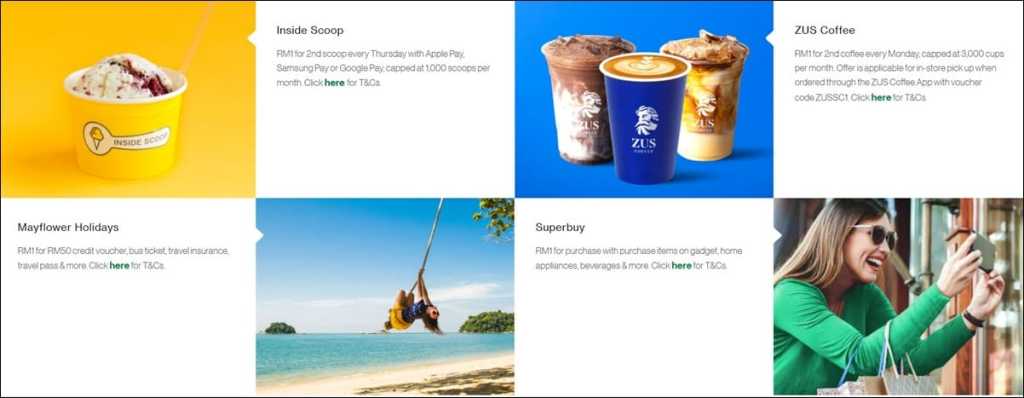

Open to both new and existing credit cardholders, notable brands that are participating in this campaign include eateries like Inside Scoop, ZUS Coffee, and EL&N London. There are also RM1 promos for selected products or services by companies like shipping agent Superbuy and tour agency Mayflower Holidays.

Of course, note that each individual merchant will have its own requirements that you must fulfil in order to enjoy the RM1 deals. For instance, Inside Scoop’s RM1 deal allows you to get your second scoop of ice cream for RM1 on every Thursday, provided that you pay for your purchase using a Standard Chartered credit card via Apple Pay, Samsung Pay or Google Pay. Provided on a first-come first-served basis, this deal is capped at 1,000 scoops per month.

Meanwhile, other merchants may need you to purchase selected items and packages to tap into the deal. As an example, Mayflower Holidays is offering a variety of products – such as overseas travel vouchers worth RM50 and travel insurance worth RM68 – for just RM1, but you must purchase selected ground and travel packages from the agency to redeem it.

On the part of Standard Chartered, the bank noted that each cardholder is only allowed to make one RM1 deal redemption per day. Additionally, do be reminded that the offers will be subject to service and/or government tax where applicable.

You can browse through the full list of RM1 deals that are provided under this campaign on Standard Chartered’s RM1 Deals webpage.

(Source: Standard Chartered)

Comments (0)