RinggitPlus

17th April 2014 - 4 min read

When it comes to Credit Cards, there’s no general rule set in stone over how many cards one person can own. In fact, as long as you meet the requirements set by the Bank, you can apply for (and possibly get approved for) as many Credit Cards as you see fit. That may be all fine and dandy if you’re a high roller with money in the bank, but if you’re just a regular Joe then holding that extra card might not really be doing yourself a favor.

If you already own a Credit Card and have been having thoughts about applying for another one, perhaps you should ask yourself the following because depending on your spending habits, you might want to hold that thought.

Are You Spending More Than You Can Handle?

With a Credit Card in your arsenal, you can essentially shop for all sorts of things like clothes and electronics, swipe your card and not worry about making any repayments until the end of the month. In fact, you don’t even need to repay your entire balance at the end of the month, all you need to do is make the absolute minimum payment set by your bank and you’re all set. Sounds Great Right? WRONG!

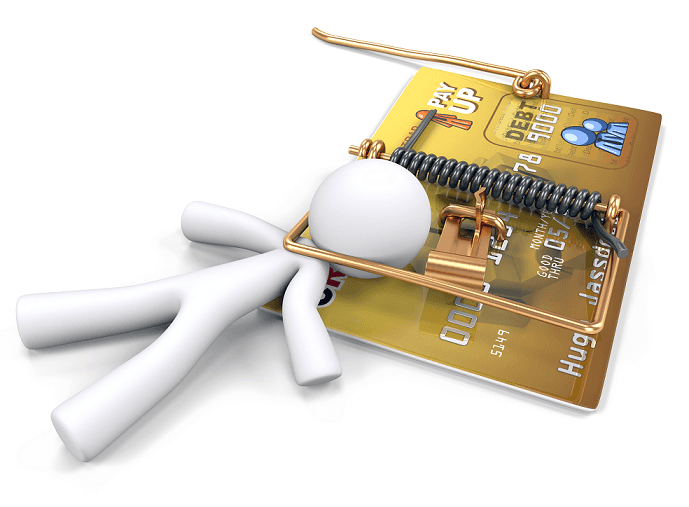

What most people often take for granted when it comes to Credit Cards is INTEREST. If you’re constantly maxing out your credit card month after month and only making the minimum repayment, then over time all you’ll be doing is snowballing large amounts of interest. Credit Card Interest can be really sneaky, they usually present themselves as small insignificant amounts at the bottom of your bill every month, so insignificant that most people often brush them aside as “collateral damage”. But have you ever thought about how much accumulated interest you’ve been forking out over unpaid balances every year? If interest rates leave you feeling fuzzy, then perhaps you should check out our previous article on credit card interest rates.

Nobody likes paying interest. So if your current credit card spending habits are leaving you buried under a mountain of debt and interest payments, then perhaps you should reconsider taking on a second card and throwing yourself under more debt.

Has Your Current Credit Card Become Forgotten?

Ever look through your wallet, notice your credit card and instantly experience a mini “oh I forgot I had that” kind of moment? If you do then either you’re suffering from early on-set dementia or more likely it’s probably a tell tale sign that you’re not using your credit card enough. There’s nothing wrong with saving your credit card for emergencies only, in fact, practicing a little restraint is probably the best way to avoid racking on too much debt. With that said, if you’re barely using your current credit card, what’s wrong with taking on a second card?

Most credit cards come with annual fees and other fancy surcharges. Even if you do encounter cards that come with “no annual fees”, there’s usually a catch involved such as, for example, a minimum annual spending amount. So if you’re barely using your current credit card except for

the occasional bulk purchase, do you really need to be getting yourself a

second card? Why pay annual fees for a second card when you don’t even use your current card that often?

Alternatively, if you rarely even touch your current credit card, perhaps you might want to consider not holding one at all and just using a debit card. If you want to know the pros and cons of using a debit card instead of a credit card, you can check out our previous article.

Will You Take Full Advantage of All the Perks on your Second Credit?

So you read the brochure for the latest Visa or MasterCard from your favorite bank and got all excited about the special perks associated with your next potential card. But before you grab your pen and fill out the application form, perhaps you should stop and think about whether the benefits actual apply in your daily life. Credit cards come with a wide array of benefits in Malaysia, whether it be cash-back on gasoline from certain pumps or one-for-one coffee from selected coffee retailers. Thanks to smart marketing by most credit card companies, it’s easy to get suckered into signing up for a card just because of the perks.

Work out a budget before you make your decision and think about whether visiting the participating list of retailers offered by the card fits into your aforementioned budget plan. After all, the last thing you want to be stuck with is another “forgotten card”.

Comments (0)