Alex Cheong Pui Yin

24th August 2022 - 4 min read

Digital insurer Tune Protect has officially rolled out its very first critical illness insurance plan, dubbed Critical Safe+. Positioned as an affordable plan with the option to stack and customise coverage based on customers’ lifestyle needs and budget, it covers up to 39 critical illnesses with sum insured of up to RM200,000.

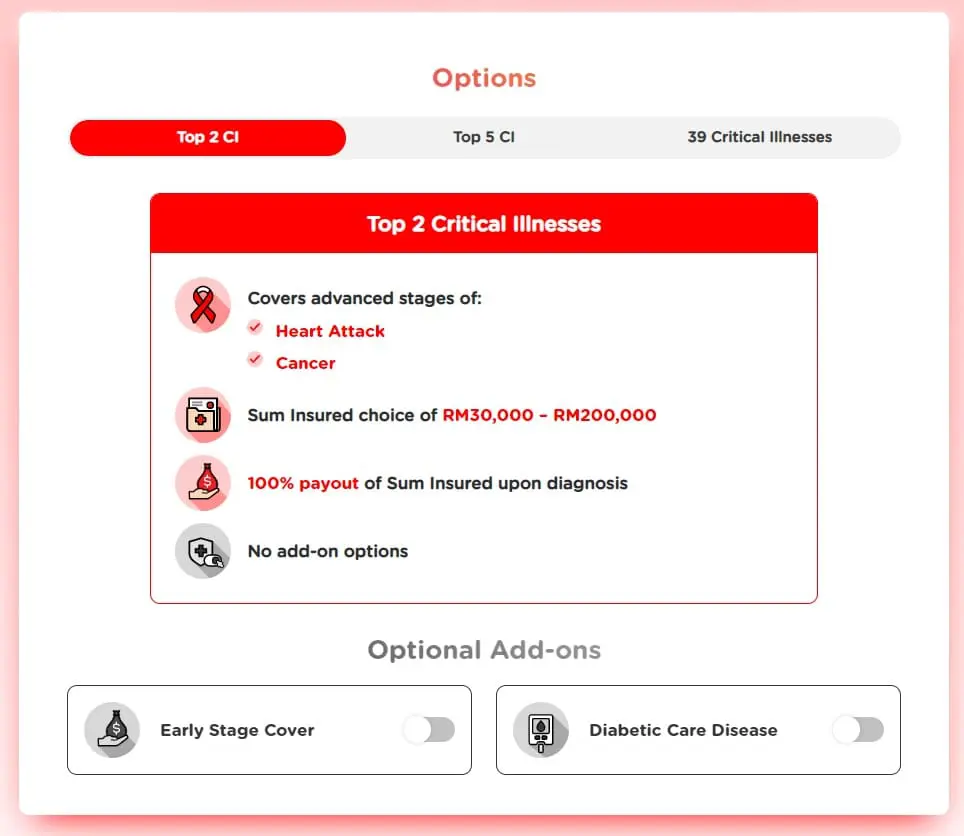

Specifically, Critical Safe+ comes in three options for customers to choose from, namely the Top 2, Top 5, and full 39 Critical Illnesses plans. Here are some key details of the options:

| Option | Coverage | Sum Insured | Payout |

| Top 2 Critical Illnesses | Advanced stages of: – Heart attack – Cancer | Between RM30,000 to RM200,000 | 100% payout of sum insured upon diagnosis |

| Top 5 Critical Illnesses | Advanced stages of: – Heart attack – Cancer – Stroke – Serious coronary artery disease – Kidney failure | Between RM30,000 to RM200,000 | 100% payout of sum insured upon diagnosis |

| 39 Critical Illnesses | Advanced stages of 39 critical illnesses, including coronary artery bypass surgeries, paralysis of limbs, angioplasty, Alzheimer’s, and encephalitis | Between RM30,000 to RM200,000 | 100% payout of sum insured upon diagnosis |

For those who would like to enhance their protection, they have the flexibility to opt for the Early Stage Cover and Diabetic Care Disease add-ons with additional premiums to their main plans. The Early Stage Cover add-on will enable 50% payout of the sum insured upon diagnosis, while Diabetic Care Disease offers an additional sum insured of up to RM50,000.

Note, however, that these optional covers are only available for the Top 5 and 39 Critical Illnesses options. They must also be purchased when you buy your main plan; you cannot add on an optional cover after purchasing the main plan.

Aside from that, Tune Protect also highlighted that they are committing to a 3:3:3 obligation with Critical Safe+, where customers can buy their plans in three minutes, receive a response in three hours, and get their claims paid in three working days from approval date. In the event that customers do not receive their claims within the three working days promised, they’ll be entitled to an additional 1% pf the sum insured.

Critical Safe+ is open to all Malaysian citizens, permanent residents of Malaysia, as well as individuals with a legal employment pass – aged between 15 days to 60 years old. The option to renew the plan, meanwhile, is available until up to the age of 70. Additionally, no medical check-ups are required to purchase the plan, and customers can opt for either a monthly or annual premium payment schedule (with some savings if you opt to pay premiums annually).

“Critical Safe+ is a much-awaited addition to our Health portfolio, one of the three key business pillars for the Group. This is a tangible outcome of our efforts to further diversify the business, particularly in the Health segment,” said the group chief executive officer of Tune Protect, Rohit Nambiar, who also revealed that Tune Protect is in the midst of working on a Health Tech proposition – in the form of a mobile app – to complement the insurer’s insurance offerings.

Meanwhile, chief executive officer of Tune Protect Malaysia, Jubin Mehta said that Critical Safe+ allows customers the flexibility to decide on the extent of coverage, sum insured, and optional add-ons that they want – which most other insurers do not offer. “With Critical Safe+, customers can customise their insurance plan based on their budget and obtain the necessary financial protection against these critical illnesses. Leveraging on digital, we hope to expedite customers insurance journey and appeal to the Millennials and Zillennials,” he further stated.

Those who are interested in purchasing the Critical Safe+ plan can do so via Tune Protect’s website and mobile app, where all purchases online will be eligible for a 15% discount. There is also a special launch promo that offers customers an additional RM50 e-wallet credit if they purchase Critical Safe+ between today until 30 September 2022.

(Source: Tune Protect)

Comments (0)