Alex Cheong Pui Yin

23rd November 2023 - 4 min read

TNG Digital has introduced a new insurance product on its Touch ‘n Go (TNG) eWallet platform called Insure360, which gives users the option to purchase medical and critical illness insurance at an affordable price starting from RM10 per month (not inclusive of tax).

Underwritten by AIA General Bhd, Malaysians tapping into the Insure360 insurance product will have three options to choose from, namely:

- Insure360 (Medical)

- Insure360 (Critical Illness)

- Insure360 (Bundle Plan 2-in-1)

Insure360 (Medical)

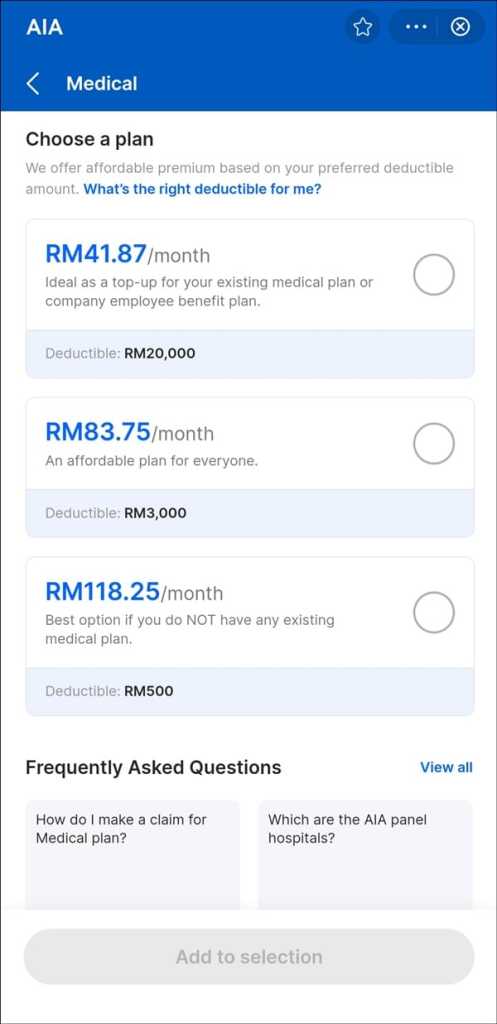

For those who are interested in purchasing medical insurance via Insure360 (Medical), you’ll be prompted to choose from three plans that offer up to RM100,000 annual coverage, with the need to pay an amount of deductible. To explain, an insurance deductible is the upfront amount that you must pay for your medical fees, before your insurance policy kicks in to pay for covered expenses.

Here are the full details of the medical insurance plans that are provided under Insure360 (Medical), for your convenience:

| Plan A | Plan B | Plan C | |

| Annual coverage limit | RM100,000 | RM100,000 | RM100,000 |

| Deductible amount (per any one disability) | RM500 | RM3,000 | RM20,000 |

| In-patient and surgical benefits | As charged, subject to reasonable and customary charges | As charged, subject to reasonable and customary charges | As charged, subject to reasonable and customary charges |

| Personal medical case management (PMCM) service – Access to specialists – Review and re-evaluate your medical condition – Offer medical recommendation based on reviewed diagnosis – Ongoing guidance and support | Included | Included | Included |

Price-wise, the premium that needs to be paid depends on the plan that you select, your age, and gender. Take note of government taxes that will be included as well. If you do take up any of the Insure360 (Medical) plans, you can choose to pay your premium either on a monthly or yearly basis.

Insure360 (Critical Illness)

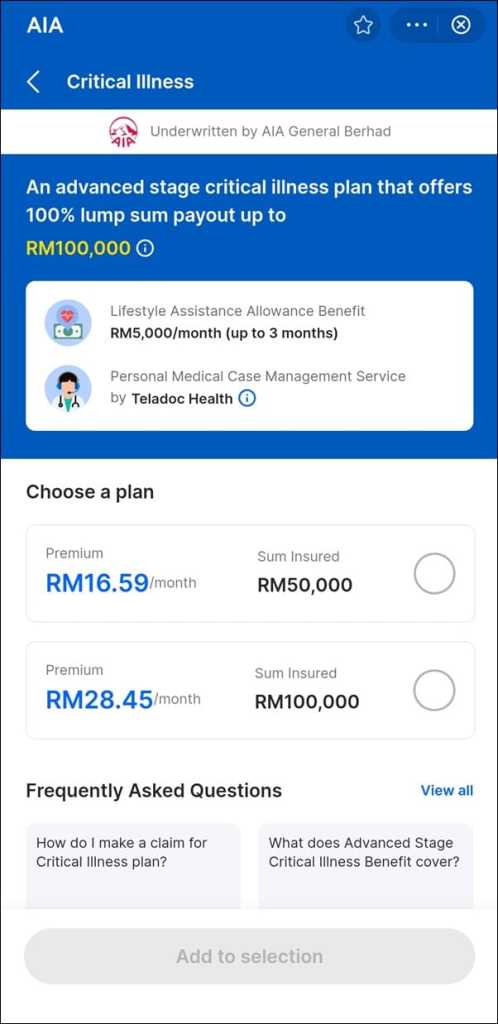

Meanwhile, Insure360 (Critical Illness) offers two plans to choose from, both of them covering five main critical illnesses – cancer, heart attack, stroke, kidney failure, and serious coronary artery disease – up to advanced stage. Here are the details:

| Plan B | Plan C | |

| Advanced stage critical illness benefit (lump-sum payment) – Cancer – Heart attack – Stroke – Kidney failure – Serious coronary artery disease | RM50,000 | RM100,000 |

| Lifestyle assistance allowance benefit | RM5,000 (per month, up to three months) | RM5,000 (per month, up to three months) |

| Personal medical case management (PMCM) service – Access to specialists – Review and re-evaluate your medical condition – Offer medical recommendation based on reviewed diagnosis – Ongoing guidance and support | Included | Included |

Similar to the plans under Insure360 (Medical), the premium of your critical illness insurance under Insure360 (Critical Illness) also hinges on the plan selected, your age, and gender – but it also considers some additional factors, like your smoking habit. Payment can be made on a monthly or an annual basis too.

Insure360 (Bundle Plan 2-in-1)

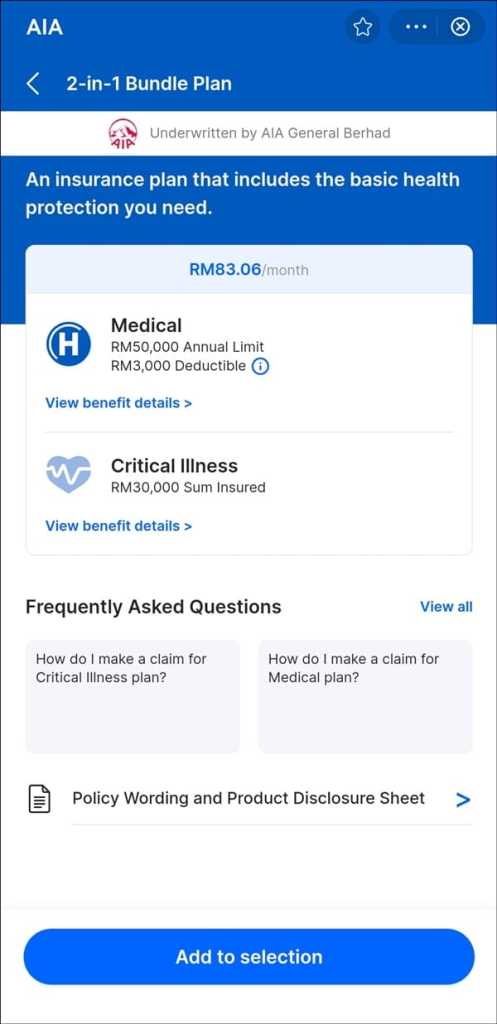

Finally, the Insure360 also offers a medical and critical illness insurance bundle, which is aimed at making the process easier for first-time buyers who are looking to purchase both types of insurance. There are no options provided for bundles; instead, you’ll be able to tap into the following combined benefits:

| Coverage & benefits | |

| Medical insurance | – Annual coverage of RM50,000 – RM3,000 deductible required – In-patient and surgical benefit (as charged, subject to reasonable and customary charges) – Personal medical case management service included |

| Critical illness insurance | – Advanced stage critical illness benefit of RM30,000 – Lifestyle assistance allowance benefit of RM3,000 per month (up to three months) – Personal medical case management service included |

Again, the premium that you need to pay will depend on factors like your age, gender, and smoking habit.

***

Note that if hospitalised, Insure360 policyholders can tap into an additional benefit, in the form of cashless admissions at various AIA panel hospitals nationwide. Outside of these panel hospitals, you will be required to pay admission fees.

Do note that Insure360 plans are available to individuals aged between 18 to 50 years old, and are renewable up to 70 years old. You must also be a verified TNG eWallet user to purchase them, having gone through the eKYC process. TNG Digital clarified as well that users will receive their policies via email after purchasing the insurance.

If you’d like to check out the new product, simply tap on the GOprotect tile in the home screen of your TNG eWallet, followed by “Insure360”. You’ll then be prompted to answer some quick questions regarding your personal details, before being allowed to view and choose your preferred insurance and plans.

Aside from the latest Insure360, TNG eWallet also offers a range of other insurance products under its GOprotect label. These include WalletSafe, CarInsure, and SafeTrip – just to name a few.

You can find out more about TNG Digital’s Insure360 on its official website here.

Comments (0)