Alex Cheong Pui Yin

17th March 2023 - 6 min read

Malaysians filing taxes for the year of assessment (YA) 2022 will see the introduction of several new tax reliefs and a number of updates to existing ones. There are also a number of special tax benefits – introduced as part of previous Covid-19 economic stimulus packages – that are coming to an end in YA 2022, or are further extended to YA 2023 (and beyond).

When filing your taxes this year, it’s good to know of these updates to ensure you are maximising your tax benefits. After all, these benefits are readily available to all taxpayers, so not claiming them is simply leaving money on the table!

New tax initiatives applicable for YA 2022

1) Purchase, installation, or rental of charging equipment for electric vehicles

The government introduced this new tax relief of up to RM2,500 as a way to encourage public interest in adopting electric vehicles (EV) within Malaysia. Specifically, it is allowed for these four types of payments on EV charging facilities:

- Purchase/Hire-purchase of EV charging facility

- Rental of EV charging facility

- Subscription for use of EV charging facility

- Installation cost of EV charging facility

Note that the EV charging facility installed must be for your personal use, and not for business use; the tax relief is not applicable otherwise. The tax relief is currently provided for YA 2022 and YA 2023.

2) Tax relief for medical expenses expanded to include mental health

The income tax relief for medical examinations (claimable up to RM1,000) has been expanded to cover the consultation costs of psychiatrists, clinical psychologists, and licensed counsellors as well – applicable for self, spouse, or child. To tap into this tax relief, you must make sure that the expert consulted are properly registered:

- Psychiatrist as defined under the Mental Health Act 2001 (Section 2)

- Clinical psychologist registered with Malaysia Allied Health Professions Council

- Counsellor registered with Board of Counsellors

Prior to this, the tax relief for medical examinations – which is a sub-category under the tax relief provided for medical expenses – was only applicable for complete medical examination for self, spouse, and child, as well as Covid-19 detection tests (including purchase of self-detection test kits).

3) Tax relief limit for SOCSO increased and expanded

The tax relief that can be claimed for contributions to the social security protection scheme under the Social Security Organisation (SOCSO/PERKESO) has been increased from RM250 to RM350. Its scope is also expanded to include employees’ contributions through the Employment Insurance System (EIS); this was previously excluded.

4) Tax relief for EPF expanded to include voluntary contributions

The tax relief for EPF contributions (claimable up to RM4,000) was previously provided only for mandatory contributions by employees in the private sector (non-public servants). For YA 2022, this tax relief is expanded to encompass voluntary EPF contributions, and will apply to those who are self-employed in the gig economy as well as pensionable civil servants (who make voluntary EPF contributions too).

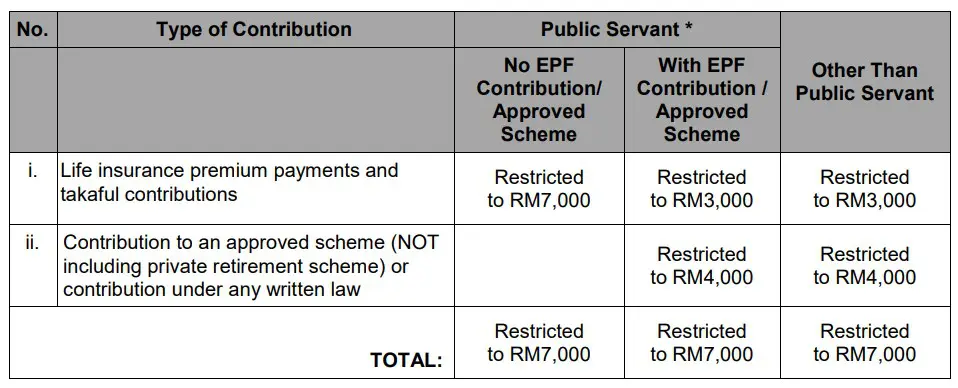

Here’s a table from the Inland Revenue Board to summarise this update (which shows you the tax relief allowed for life insurance premiums as well since it is typically lumped together with the EPF tax relief):

Special tax measures/incentives extended from YA 2021

1) Special tax relief for personal computer, smartphone, or tablet

This special tax relief of RM2,500 was originally introduced as part of the PENJANA economic recovery plan back in 2020 to encourage the work-from-home (WFH) culture during the onslaught of Covid-19. Originally meant to last from June to December 2020, it was eventually extended twice: until the end of 2021 under the Permai stimulus package, and then until 31 December 2022. No extension has been provided after that, which means YA 2022 is the last time you can tap into this tax relief.

If you’re not already aware, this special tax relief is provided on top of the existing tax relief for lifestyle purchases (which is also set at RM2,500). For example, let’s say you’ve bought a laptop at the price of RM3,500. You can claim RM2,500 under the tax relief provided for lifestyle purchases, and the remaining RM1,000 under this special tax relief for personal computer, smartphone, or tablet.

2) Special tax relief for domestic tourism expenses

Similar to the above special tax relief (for personal computer, smartphone, or tablet), the RM1,000 special income tax relief for domestic tourism expenses was also introduced under previous economic stimulus packages to help boost the tourism industry during Covid-19. It was extended once to 31 December 2021 as well, and then again until the end of 2022.

As there are no further extensions provided after that, YA 2022 is also the last time you can claim this tax relief. It covers a range of tourism-related expenses, including:

- Payment for accommodation (must be registered with the Commissioner of Tourism Malaysia)

- Payment for entrance fees of tourist attractions

- Purchase of domestic tour package through licensed travel agents, inclusive of fees for local tour guide services, purchase of local handicraft products, F&B, and transportation (including hop-on hop-off buses)

3) Tax relief for upskilling & self enhancement courses increased

The government has increased the tax relief limit for self-enhancement and upskilling courses from RM1,000 to RM2,000 for YA 2022, in a bid to encourage Malaysians to pick up new skills to venture into new fields. Of course, you will need to check that the courses taken are recognised by the Department of Skills Development under the National Skills Development Act 2006.

First announced under Budget 2021 to help unemployed individuals regain their employability, Malaysians were allowed to claim a lesser amount of RM1,000 from the total education fees relief of RM7,000 for upskilling or self-enhancement courses in YA 2021. It was slated to end in 2022 (but was subsequently extended to YA 2023).

4) Tax relief for childcare centre and kindergarten

For YA 2022, parents paying fees to registered childcare centres and kindergartens will be allowed to continue claiming an increased tax relief of RM3,000. This increased limit has also been extended to YA 2024.

Prior to this, parents were only allowed to claim a relief of RM2,000 for this expense category, but it was increased to RM3,000 under the PENJANA stimulus package during Covid-19, to be provided until the end of 2022, but was subsequently extended until YA 2023 under Budget 2022. Then, it was extended once more to YA 2024 under the revised Budget 2023.

5) Tax deduction for Covid-19 donations

Taxpayers who have contributed donations in the country’s fight against the Covid-19 pandemic can still continue to enjoy tax deductions, restricted to 10% of their aggregate income (inclusive of other forms of donations made to other organisations as well). Essentially, donations of this nature will continue to be accepted for tax deductions until the government officially declares that the pandemic is over.

***

With this, we hope that you will not miss out on these new and special tax reliefs, in addition to the usual ones! If you need in-depth help on filing your income tax form for YA 2022, our comprehensive YA 2022 income tax guide is also available as well. Alternatively, check out all of our income tax-related articles here.

Comments (0)