RinggitPlus

11th October 2017 - 3 min read

“Your health is your wealth” is a popular saying. And it’s closer to the truth than you think. If you’re serious about keeping your finances in good health, it’s important to do the same for your body too.

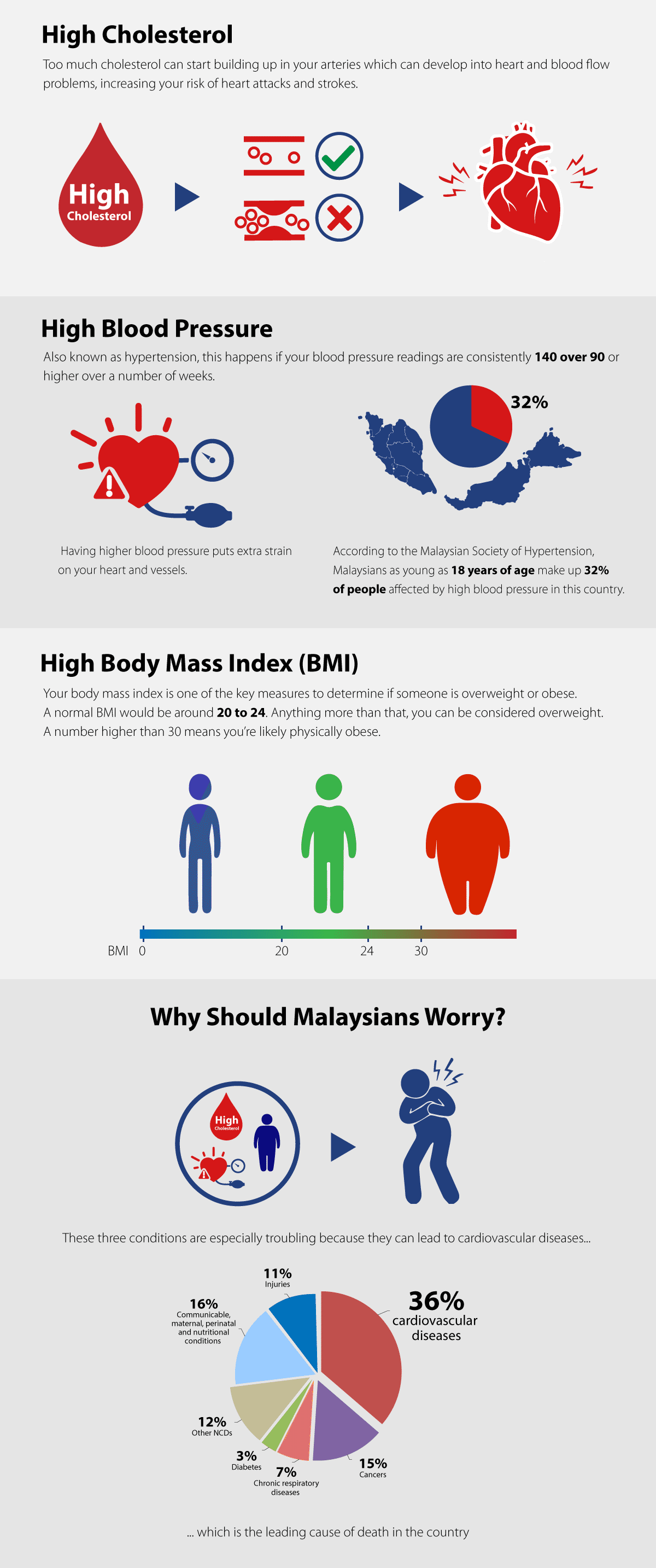

Why? Because your health and medical condition can negatively affect your personal finances in ways you may not realise. There are in fact, three major medical conditions that are more likely to impact your finances much more than others:

Source: World Health Organisation

What is more worrisome is that you can have two out of these three conditions without ever noticing any outward symptoms.

How Exactly Do They Affect Your Personal Finances?

#### It Costs More to Keep Yourself Healthy

Hypertension and high cholesterol, if left ignored for long enough, can eventually require expensive medication to keep them under control. These expenses also tend to be recurring, and managing these conditions will be long-term.

Your Energy Levels Will Be Affected

These conditions can contribute to poor stamina and a lower level of focus which will affect your ability to be productive. Not only will your performance at work be affected, sufferers of these conditions also tend to have less energy to carry out day-to-day tasks, and will therefore be more likely to spend more on convenience services (food delivery, ridesharing, cleaners, etc), thus creating a vicious cycle that worsens your condition

Negatively Impacts Your Insurance

Serious critical illnesses are not the only things that can drive your premium up. Medical conditions like the three described above can also make insurers drive up your premium, limit your coverage, or even decide not to cover you at all.

That being said, Allianz has a plan specially designed for those who suffer from High Cholesterol, High Blood Pressure, and High Body Mass Index. The basic coverage provides protection against Death as well as Total and Permanent Disability (TPD), and there is also an optional rider which can protect you against 4 major critical illnesses associated with these 3 High conditions.

Allianz 3H Cover will protect you in four key ways:

- Death and TPD Protection provides coverage of up to RM200,000 together with the balance in the investment account upon death and TPD.

- Optional Critical Illness Coverage Rider provides additional coverage of up to RM200,000 upon diagnosis of any of these 4 critical illness conditions: heart attack, stroke, cancer and kidney failure.

- Long Term Peace-of-Mind with coverage up to 85 years old.

- Complimentary Added Coverage where you receive a 50% increase in your death and TPD coverage and the ability to upgrade your critical illness plan to a comprehensive 36 critical illness plan if your health condition returns back to normal.

Do you or somebody you know have one or more of these three High conditions? Then, you may want to learn more about Allianz 3H Cover, check out their official website now.

Comments (0)