Samuel Chua

21st May 2025 - 3 min read

Small and medium-sized enterprises (SMEs) in Malaysia are still grappling with slower payment cycles and tighter liquidity despite a broadly improving national economic landscape, according to Experian Malaysia’s newly released State of Credit 2025 report.

Based on credit repayment data from Experian’s Industry Debts Turned Cash (iDTC) database, the report analyses payment patterns across seven key sectors, including construction, manufacturing, services, hospitality and F&B, transport and logistics, retail, and wholesale. It offers a snapshot of the country’s business cash flow health.

The report highlights that Malaysia’s economic recovery over the past two years has supported modest improvements in payment behaviour. Nationally, average payment delays fell from 64 days to 61 days over four years. SMEs recorded a slightly stronger improvement, shortening their average delay by five days to 64 days. Large corporations, meanwhile, saw only marginal change, maintaining an average delay of 58 days.

However, Experian warns that this progress masks growing disparities in financial resilience. The gap between corporate and SME payment performance remains wide, particularly in high-cost, supply chain–sensitive sectors. In the first quarter of 2025, payment lags between SMEs and corporates reached 26 days in the transport and logistics sector, 13 days in hospitality, and 10 days in wholesale.

“Smaller enterprises continue to face disproportionate pressure,” said Dawn Lai, Chief Executive Officer of Experian Information Services Malaysia. “While we’re seeing signs of improved payment behaviour, many SMEs remain highly exposed to cash flow gaps. Without early credit insights and stronger financial controls, these pressures could escalate further in 2025 with businesses seeing delayed expansion plans, tighter supplier terms, and even higher borrowing costs.”

Cost inflation, subsidy reforms, and global trade uncertainties have compounded the problem. In sectors like F&B and hospitality, rising input costs and delayed customer payments continue to stretch cash reserves. Construction, while exhibiting better payment discipline, now faces overheating risks as demand and operational costs rise. Transport and logistics businesses are contending with average delays of 76 days, worsened by fuel price increases and supply chain disruptions.

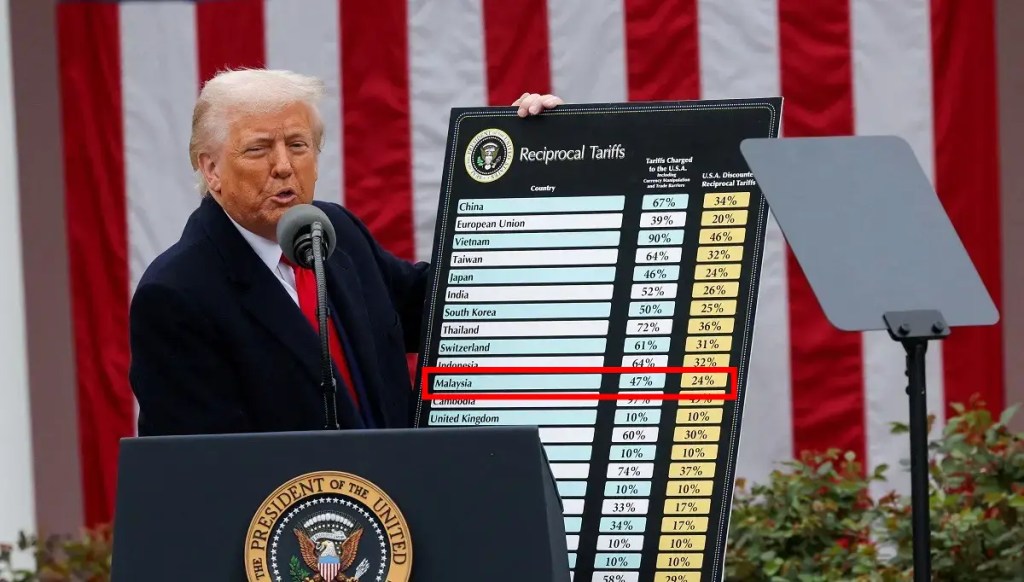

The report also flags that recent global tariff developments could strain Malaysia’s export-reliant sectors. If fully implemented by mid-2025, these trade measures may prompt businesses to delay outgoing payments in an effort to conserve cash, reversing recent gains in repayment behaviour, particularly among SMEs.

“In today’s dynamic marketplace, Experian aims to better support Malaysian enterprises with new trended analytics solutions,” added Lai. “These tools will help distinguish sustainably operated companies and identify those needing support to boost their resilience.”

Experian’s findings suggest that while Malaysia’s broader economy is on a stable growth path, driven by sectors like construction and tourism, financial pressure points remain, particularly for smaller businesses. As uncertainties persist, access to credit insights and proactive cash flow management will be critical for long-term stability.

The full State of Credit 2025 report is available on the official Experian Malaysia website.

Comments (0)