Samuel Chua

18th August 2025 - 2 min read

Malaysia’s economy expanded 4.4% in the first half of 2025, underpinned by policies introduced through the Madani Economy Framework, said Finance Minister II Datuk Seri Amir Hamzah Azizan.

He noted that reform efforts have strengthened domestic demand and sustained growth momentum, despite a challenging global backdrop marked by trade and geopolitical uncertainties.

Growth Within Target Range

GDP rose 4.4% in the second quarter of 2025, maintaining growth within the official projection band of 4% to 4.8% for the year.

According to Amir Hamzah, stronger household spending, a firm labour market, and stable inflation were key contributors to the quarter’s performance.

Employment and Inflation Trends

The unemployment rate declined to 3% in 2Q 2025, compared with 3.1% in the previous quarter, signalling healthier job creation. Headline inflation moderated to 1.3%, down from 1.5%, reflecting more stable price conditions for consumers.

Domestic Demand and Sector Contributions

Domestic demand grew 7% in 2Q 2025, faster than the 6% increase recorded in 1Q 2025. This was supported by household consumption, private-sector investment, and sustained wage growth.

On the supply side, the services sector expanded 5.1%, lifted by consumer spending and tourism activities. The manufacturing sector grew 3.7%, supported by both export-oriented and domestic industries.

Ringgit Performance and Fiscal Targets

The ringgit appreciated by 5.3% against the US dollar in 2Q 2025, making it one of the region’s strongest currencies during the period. Amir Hamzah said this reflected investor confidence in Malaysia’s economic management and fiscal discipline.

The government is on track to narrow the fiscal deficit to 3.8% in 2025, consistent with earlier commitments.

Addressing External Pressures

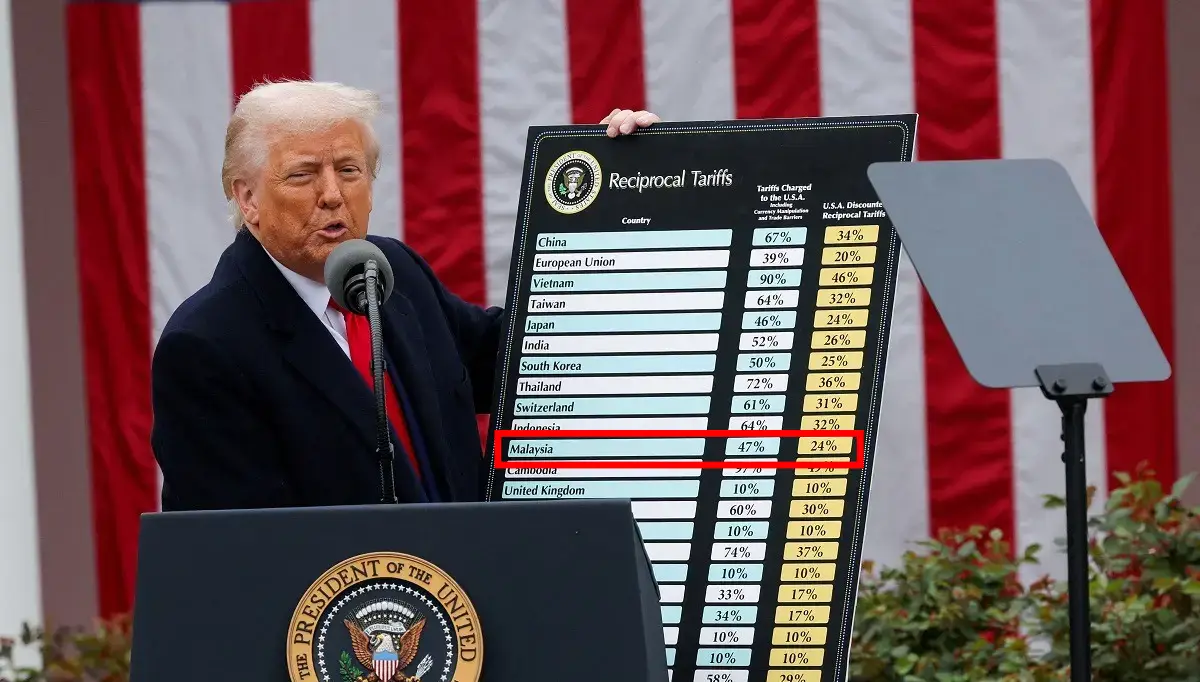

Amir Hamzah acknowledged that recent tariff measures abroad may affect certain industries. The government, he said, is closely monitoring the situation and will provide targeted support to safeguard competitiveness and minimise trade disruptions.

He added that structural reforms have played a central role in maintaining broad-based growth momentum.

Next Steps: Budget 2026 and Structural Reforms

The Ministry of Finance is preparing Budget 2026 through stakeholder engagements across key sectors and states. Guided by the Madani Economy Framework and the 13th Malaysia Plan (RMK13), the budget will focus on structural reforms and ensuring growth benefits are shared equitably among Malaysians.

“These efforts are critical to strengthening Malaysia’s economic fundamentals and ensuring the nation remains agile in a dynamic global environment,” Amir Hamzah said.

Follow us on our official WhatsApp channel for the latest money tips and updates.

Comments (0)