Samuel Chua

5th November 2025 - 3 min read

The ringgit is trading close to its strongest level in a year, supported by expectations that Bank Negara Malaysia (BNM) will maintain its policy rate and by renewed confidence in the country’s economic prospects.

As of early November, the ringgit was less than 1% away from RM4.18 against the US dollar, which would be its highest point since October 2024. If the currency continues to strengthen, it will record its biggest yearly gain against the greenback since 2017.

Strong Fundamentals Support the Ringgit

Malaysia’s currency has been lifted by stable economic fundamentals, careful fiscal management, and a smaller interest rate gap with the United States.

“Malaysia’s resilient macro fundamentals, prudent fiscal management, and narrowing policy rate gap with the US will support the ringgit,” said Lloyd Chan, strategist at MUFG Bank Ltd.

He expects the ringgit to reach 4.15 per dollar by the end of the year.

So far in 2025, the ringgit has gained about 6.4% against the US dollar, making it one of the strongest currencies in Asia. It has also appreciated against the Singapore dollar, trading less than 1% away from its highest level since September 2022.

Malaysia and Singapore have close economic ties, with large volumes of goods, services, and workers moving across their shared border daily. These links continue to provide stability for both economies.

Trade Recovery Strengthens Confidence

Malaysia’s trade-driven economy is benefiting from signs of stronger global demand. Market confidence improved after the United States and China, Malaysia’s largest trading partners, agreed at a recent summit to extend their tariff truce and ease certain export restrictions.

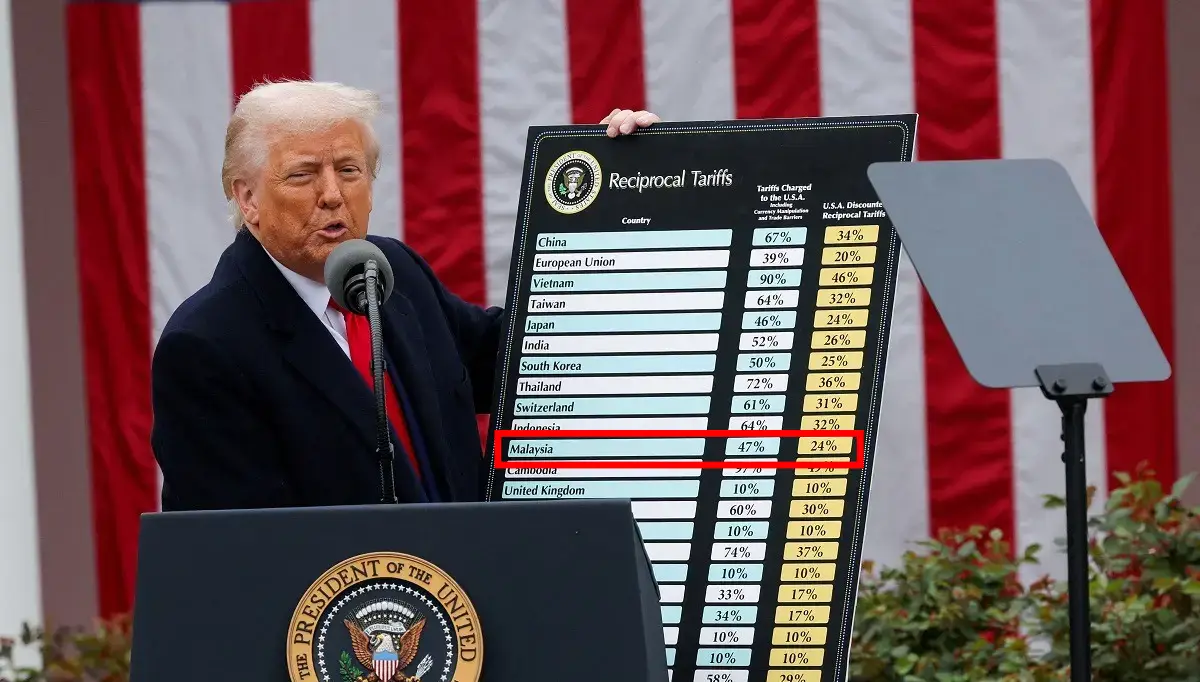

Earlier, Prime Minister Datuk Seri Anwar Ibrahim and US President Donald Trump signed a trade agreement to promote investment and market access. While the deal has sparked debate about Malaysia’s long-term interests, it has helped boost optimism for short-term export growth.

Domestic Growth Remains Firm

Economic growth has continued to exceed expectations. Malaysia’s gross domestic product expanded by 5.2% in the third quarter of 2025, surpassing all forecasts in a Bloomberg survey and growing faster than in the previous three quarters.

The stronger results reflect steady domestic spending, improving labour market conditions, and a gradual recovery in exports. Government support programmes and stable inflation have also helped maintain household purchasing power.

Policy Rates Likely to Stay Steady

Financial markets expect Bank Negara Malaysia to keep its Overnight Policy Rate (OPR) at 2.75% for at least the next year. Swaps that track market expectations show no major signs of a rate cut.

This is a change from mid-August, when traders anticipated a small reduction in borrowing costs. Economists surveyed by Bloomberg now believe the policy rate will remain unchanged through 2026, even if the United States begins to lower interest rates earlier.

“We expect Bank Negara Malaysia to keep its policy rate at 2.75% in November, given favourable growth and inflation dynamics,” said Chan.

Follow us on our official WhatsApp channel for the latest money tips and updates.

Comments (0)