Samuel Chua

17th April 2025 - 3 min read

The Socio-Economic Research Centre (SERC) has revised its forecast for Malaysia’s gross domestic product (GDP) growth in 2025 to 4%, down from 5%, amid increasing uncertainty surrounding United States tariff policies.

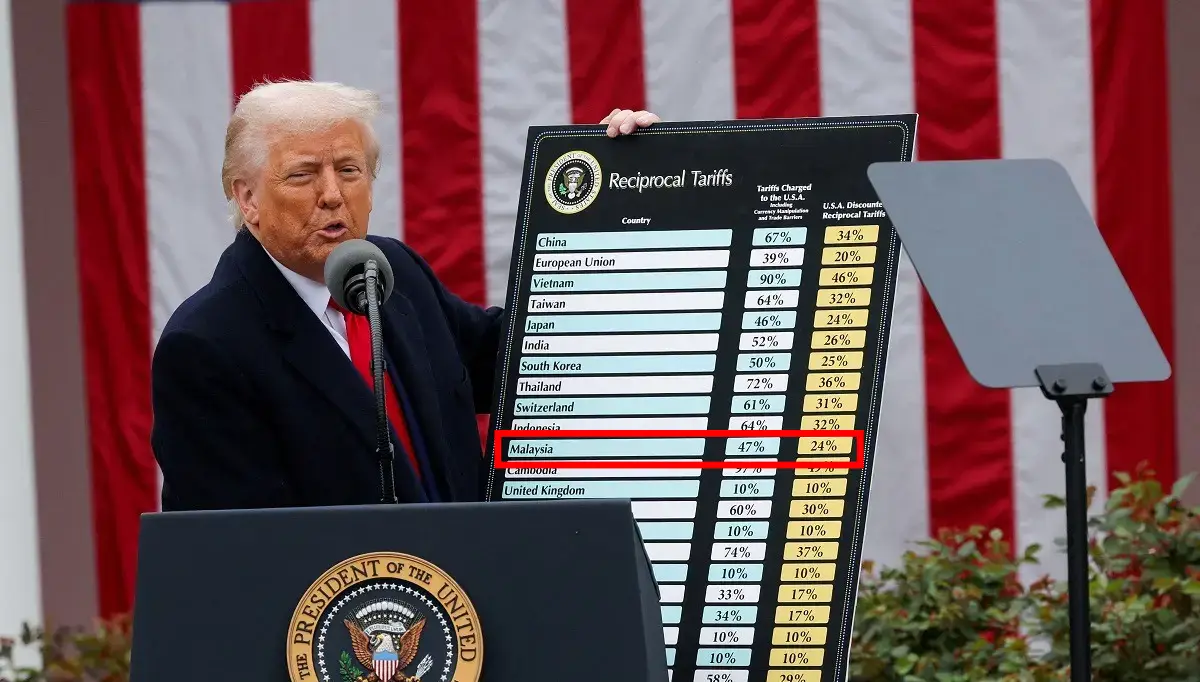

SERC executive director, Lee Heng Guie, said the revision came in response to the recent announcement of reciprocal tariffs by US President Donald Trump. “Following the announcement of the reciprocal tariff by Trump, we immediately revised our GDP forecast down from 5% to 4% as an initial adjustment,” he said during a media briefing on Malaysia’s Quarterly Economy Tracker for January to March 2025, and the country’s broader outlook for the year.

The projection remains contingent upon the outcome of negotiations during the current 90-day pause, the potential introduction of further US trade restrictions, and the possibility of retaliatory actions by affected countries. SERC’s updated forecast sits below Bank Negara Malaysia’s estimate of 4.5% to 5.5% GDP growth for 2025. For context, Malaysia recorded GDP growth of 5.1% in 2024.

SERC also anticipates a marked slowdown in export performance, projecting a 3% growth in the export of goods and services in 2025, compared with 8.5% the previous year. Lee attributed this to the anticipated negative effects of tariffs on electrical and electronics (E&E) products — Malaysia’s largest export segment, which represents 54.6% of the RM198.6 billion worth of exports to the US. He warned that American consumers may continue to view imported goods as expensive, potentially restraining demand as households prioritise spending.

Lee further noted that the risks posed by tariffs could disrupt global supply chains in the technology sector. Despite the current exemption of semiconductors by the US, he cautioned that E&E exports remain vulnerable.

On the domestic front, SERC expects private consumption growth to slow to 4.4% in 2025 from 5.1% in 2024, influenced by the dampening effects on income. “If export growth declines significantly, it will have a spillover effect on domestic demand,” Lee said, highlighting the potential for negative consequences on income, employment, and consumption.

As of February 2025, Malaysia’s unemployment rate stood at 3.1%. Although SERC did not provide updated projections on employment or wages, Lee noted a cautious outlook on unemployment trends. Meanwhile, the Malaysian Employers Federation (MEF) projects a wage growth of approximately 5% for the year.

SERC has also projected inflation to range between 2.5% and 3% in 2025. Key inflationary drivers include the absence of retaliatory tariffs on US imports into Malaysia, the scheduled rationalisation of subsidies for RON95 fuel mid-year, mandatory Employees Provident Fund (EPF) contributions for non-citizen workers from the fourth quarter, the possible introduction of a multi-tiered foreign worker levy, and a potential electricity tariff hike in the second half of the year.

Regarding the local currency, Lee said the ringgit is expected to remain stable within a range of 4.5 to 4.6 against the US dollar in 2025, although this outlook depends on developments in the US, global, and Malaysian economies. “As the dollar index has been declining, it reflects investor concerns about the US economy, which is likely to strengthen other currencies against the dollar,” he said. The ringgit, he explained, is assessed relative to a basket of currencies, which continues to show overall stability.

He added that Bank Negara Malaysia is closely monitoring the ringgit and encouraging corporations and government-linked companies to repatriate realised investment income. This measure, along with steps such as fiscal deficit reduction, is expected to ease downward pressure on the local currency and further support its value.

(Source: The Edge)

Comments (0)