Pang Tun Yau

29th June 2021 - 2 min read

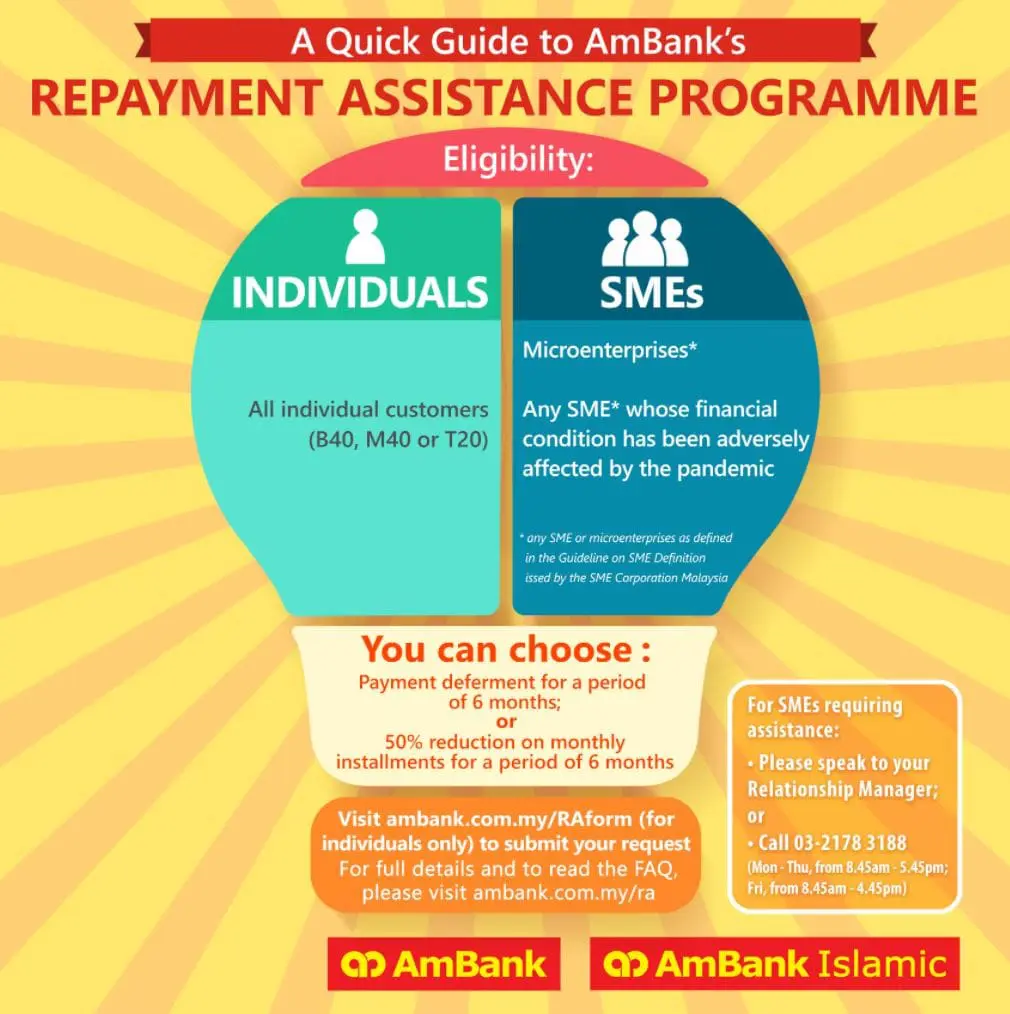

With the announcement of the upcoming loan moratorium under the PEMULIH stimulus package (will it be known as Loan Moratorium 2.0?), a local bank has shared further information on the programme, including interest accrual and two different deferment options.

Thus far, only AmBank has opened applications for the upcoming loan moratorium. At the time of writing, CIMB, Maybank, and Alliance Bank have updated their pages to indicate that further updates will be shared at a later date. The other bank websites we’ve checked, including RHB, Public Bank, Hong Leong Bank, Affin Bank, UOB, Citibank, Standard Chartered, HSBC, and OCBC have not yet included yesterday’s announcement into their sites.

While we cannot confirm that the loan moratorium mechanics shared by AmBank will be the same for all banks, it sheds some light on what we can expect to be announced on 7 July. AmBank’s new loan moratorium mechanics, interestingly, will include two options:

1. Full payment deferment for a period of 6 months

2. 50% reduction in monthly instalment payment for a period of 6 months

The second option was not shared by Prime Minister Tan Sri Muhyiddin Yassin in his speech yesterday. In addition, AmBank also confirms another aspect that was not present in the announcement:

1. Interest/Profit continues to accrue on the deferred amounts

2. The Bank can recover additional interest/profit costs from changes in instalment payments

This is largely similar to the original loan moratorium terms last year as well as the Targeted Repayment Assistance programme that followed. The assistance above will apply to all loans and financing facilities that are approved before 1 July 2021 and are not in arrears exceeding 90 days. Finally, as the PM announced yesterday, it will apply to all individual borrowers as well as microenterprises and SMEs as defined in the Guideline on SME definition issued by the SME Corporation of Malaysia. However, AmBank’s Repayment Assistance FAQ has not yet been updated to reflect the changes in Loan Moratorium 2.0.

The full mechanics for the upcoming loan moratorium is expected to be announced on 7 July, the day when applications will be opened. In the meantime, the current Repayment Assistance programme is still running for borrowers who need it.

A seasoned tech journalist who now focuses on his other passion, Pang is a firm believer in old-school DCA and optimised spending.

Comments (0)