RinggitPlus

24th June 2025 - 4 min read

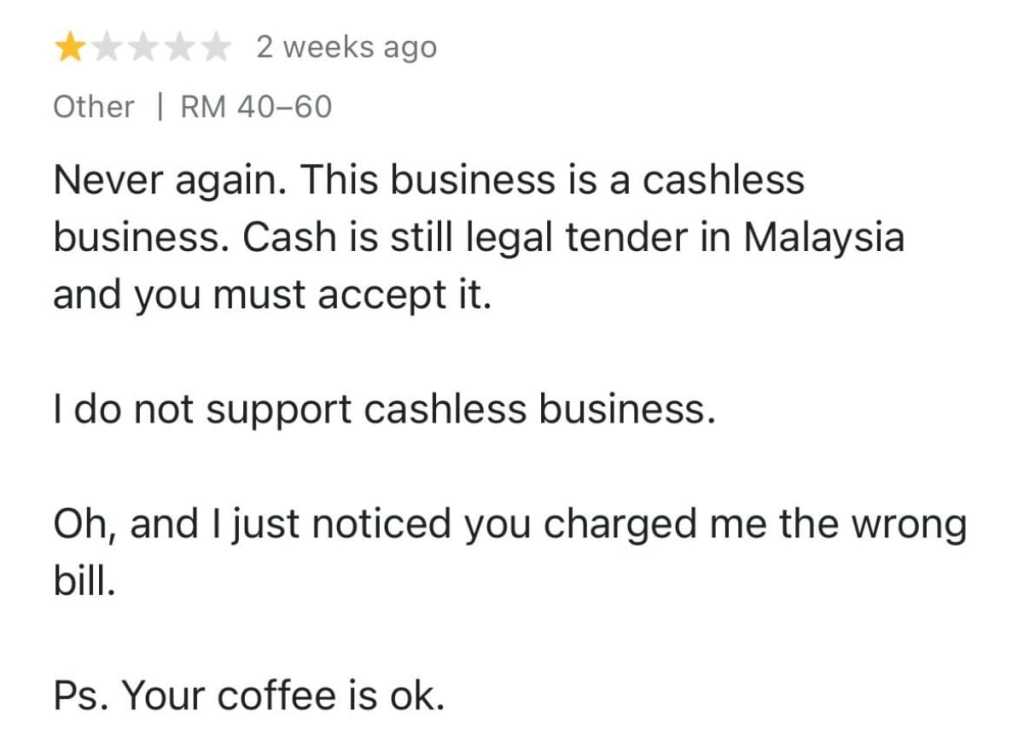

A cafe in Kuala Lumpur recently received a one-star Google review from a customer who criticised its cashless-only payment policy. The reviewer claimed they were unable to pay with cash, arguing that this contradicted the fact that cash remains legal tender in Malaysia. The review stated, “Cash is still a legal tender in Malaysia and you must accept it… Never again. This business is a cashless business.”

Although the customer described the coffee as “okay”, they also claimed they were charged the wrong bill and expressed frustration over not being able to pay using physical currency.

Cafe Responds Publicly, Clarifies Its Stance

The cafe responded to the review on Threads, expressing disappointment that the customer’s low rating was based solely on its payment policy. The café explained that its decision to go fully cashless was made to minimise human error, improve operational safety, and streamline the checkout process.

In its response, the cafe stated, “As for the bill? We’re very welcome if you let us know at the counter. We’d fix it immediately.” They also noted that the cafe provides free Wi-Fi to assist customers who may not have mobile data access when using e-wallets or digital banking.

Public Reaction: A Mixed Response from the Rakyat

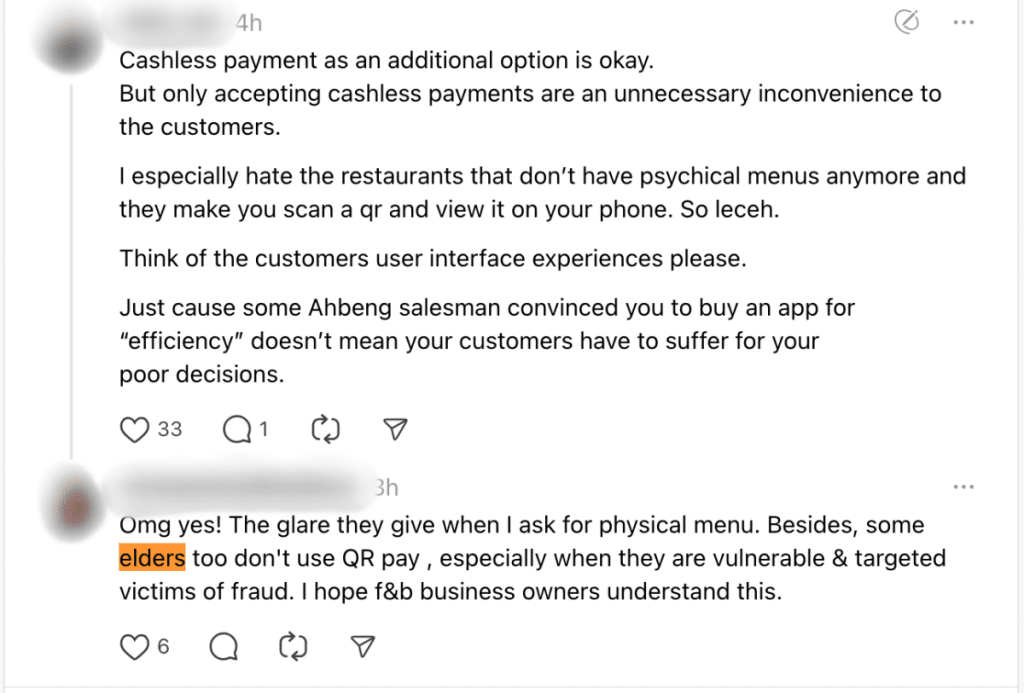

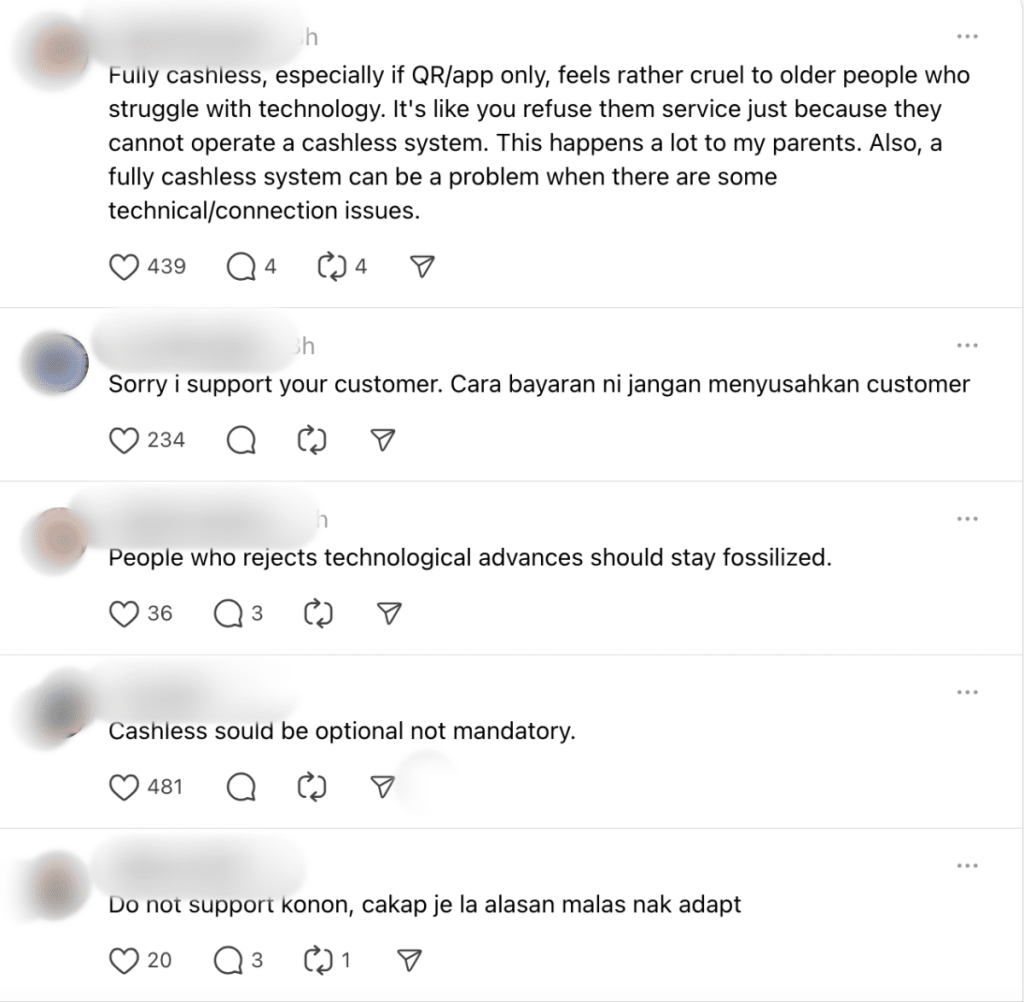

The exchange soon attracted attention on social media, particularly in the cafe’s Threads comment section, where users shared a range of opinions. Some supported the cafe’s decision, saying that businesses should be allowed to modernise and adopt cashless systems for efficiency. One user remarked that people who reject technological advances “should stay fossilised,” while another said that by 2025, paying with a smartwatch should already be the norm.

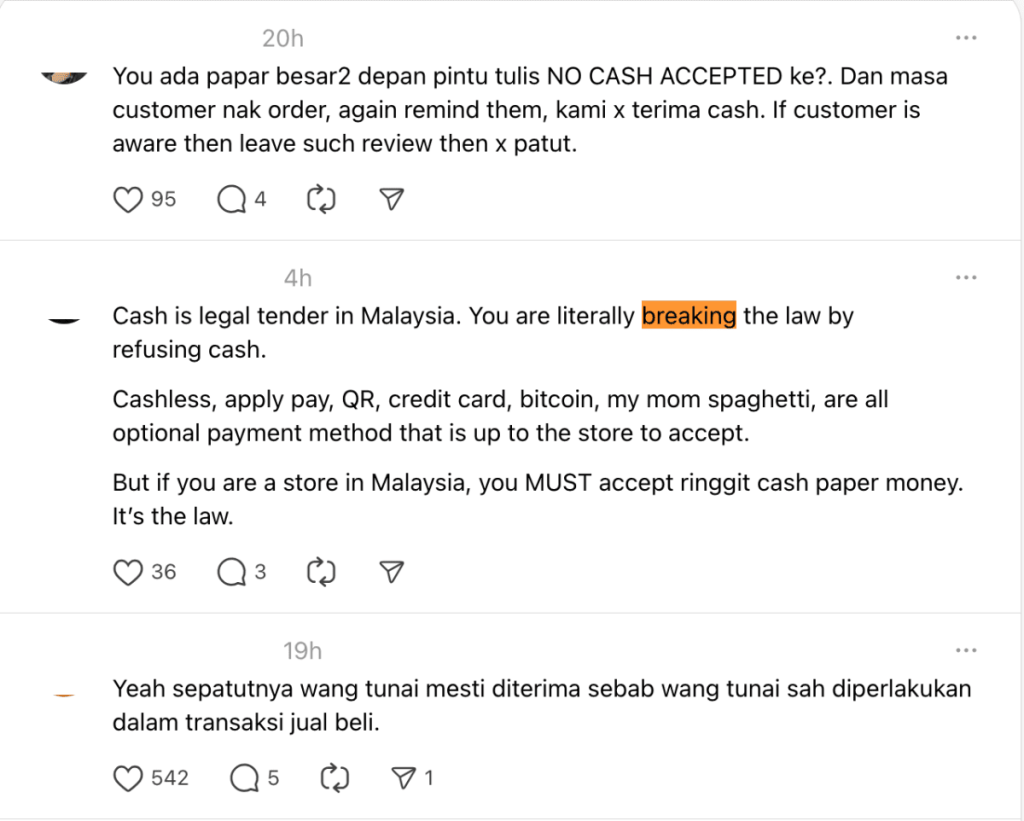

Others, however, felt that a cashless-only approach lacked inclusivity. Several pointed out that cash remains a legal form of payment in Malaysia, and businesses should still accept it. One user noted, “You’re literally breaking the law by refusing cash,” while another added that cafes should clearly state their payment policies at the entrance and during ordering.

Several users raised concerns about customer accessibility, especially for the elderly or those unfamiliar with mobile banking. One commenter shared, “Some elders don’t use e-wallets and are often victims of fraud. Business owners need to understand this.” Others recounted situations where their mobile banking apps crashed, their phones died, or internet connectivity was unavailable. One user asked, “What if the bank system is down? Are we supposed to write our order in a notebook?” Another added, “Even roadside stalls accept all types of payment. Why can’t you?”

Calls for Flexibility and Clearer Communication

While the discussion revealed polarised opinions, many users converged on a common point: businesses should offer flexibility in payment methods. Several commenters proposed hybrid models, where both cash and cashless options are available. One user suggested a workaround where staff could accept cash and complete the transaction using their own digital payment method, especially if the customer provides the exact amount.

Some cafe owners also weighed in, stating that going cashless can help prevent internal losses due to cash handling errors. Still, most agreed that payment policies must be clearly communicated, ideally at the entrance and before customers place an order, to avoid misunderstandings.

What Does This Mean for Businesses and Consumers?

The reaction to the cafe’s one-star review shows that, while Malaysia is moving toward a digital economy, many consumers still value or depend on cash. While the cashless model may offer benefits for businesses, a complete exclusion of physical payment methods can alienate certain customer groups, particularly the elderly, the unbanked, or those in areas with poor internet connectivity.

According to current Bank Negara Malaysia policy, cash is still a valid and enforceable method of payment. Although going fully cashless is not illegal, businesses may risk public criticism or lost customers if they do not accommodate those who prefer traditional payment methods.

One user pointed out that while digital adoption is encouraged, businesses should remember that not everyone is able to keep up at the same pace.

Insider Insight

“At RinggitPlus, we have always put the customer first, but in this case, I empathise with the cafe owner. As a small business owner, accepting and handling cash payments can be troublesome and, in the worst-case scenarios, can lead to loss or theft. According to Bank Negara’s 2024 Annual Report, ‘In 2024, e-payment transactions grew by 19% to 409 transactions per capita, meaning on average, every Malaysian makes at least one e-payment transaction per day.’ As the government continues to push for higher adoption of e-payments, I believe more small businesses will become 100% cashless.” Siew Yuen Tuck, Group CEO, RinggitPlus

Comments (2)

I support cashless only. cash is so burden

Thanks for sharing your perspective. Many people do prefer cashless payments for the convenience and speed, and for some businesses it also helps reduce operational issues related to cash handling. At the same time, the discussion around this cafe shows that payment preferences can vary widely depending on age, access to technology, and personal circumstances. Striking a balance between efficiency and inclusivity remains an ongoing conversation for businesses and consumers alike.