Jacie Tan

25th May 2021 - 2 min read

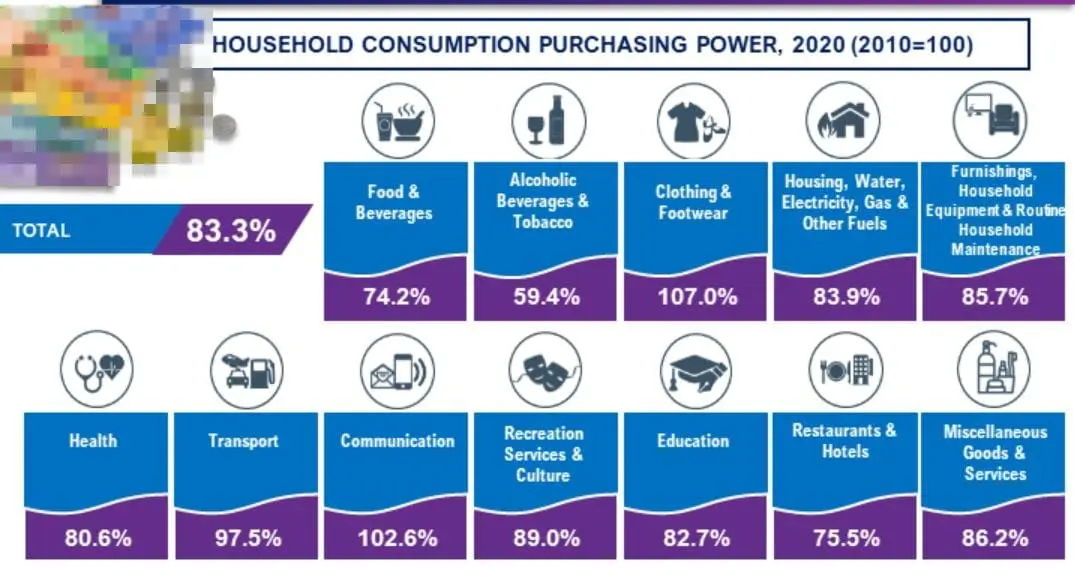

The purchasing power of Malaysia’s household consumption declined by 16.7% over the past decade to 83.3% in 2020, according to an analysis on the Consumer Price Index (CPI). These figures were revealed in a report released by the Department of Statistics Malaysia (DOSM).

Chief Statistician Dato Sri Dr Mohd Uzir Mahidin said that within the 12 main groups, the purchasing power for Alcoholic Beverages & Tobacco recorded the highest decrease by 40.6%. This was followed by Food & Beverages, which decreased by 25.8% in purchasing power to settle at 74.2%, and Restaurants & Hotels which decreased by 24.5% at 75.5%.

Meanwhile, the two groups of goods and services that recorded a purchasing power of more than 100% were Communications (102.6%) and Clothing & Footwear (107%). “This illustrates that households were able to enjoy communication services, clothing and footwear at cheaper prices as compared to 10 years ago,” said Mohd Uzir.

Besides that, it was found that the inflation for urban areas in 2020 rose more than in rural areas. As such, purchasing power in urban areas faced a bigger decrease by 17.1% compared to the 14.7% decline in rural areas.

As for the effect of Covid-19, Mohd Uzir highlighted that it was indirectly reflected as Malaysia recorded a negative inflation of 1.2% for 2020. The most affected group was transport (-10%), followed by housing, water, electricity, gas and other fuels (-1.7%), and clothing and footwear (-0.8%). However, there were groups that recorded high inflation like miscellaneous goods and services (2.7%), food and beverages (1.3%), and communication (1.1%).

While the inflation for food and beverages did remain in the positive at 1.3%, this was the lowest inflation rate recorded in a decade. The highest inflation for this group was recorded in 2011 at 4.8%.

(Source: DOSM)

Comments (0)