Alex Cheong Pui Yin

7th October 2020 - 3 min read

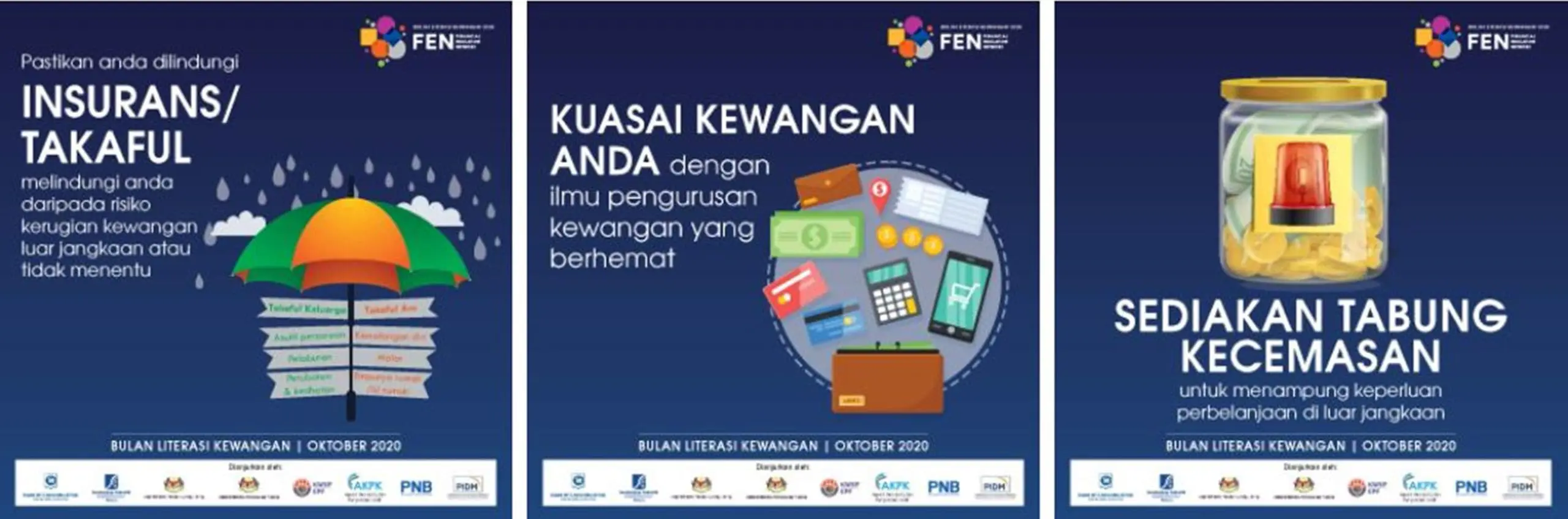

The Financial Education Network (FEN) has launched the Financial Literacy Month (FLM) 2020 to provide a variety of financial literacy initiatives and programmes for Malaysians throughout October. The introduction of these programmes, which are part of an ongoing effort to raise the level of financial literacy among Malaysians, is timely as many Malaysians are now facing considerable financial challenges following the onset of the Covid-19 pandemic.

Founded based on the theme of “Empowering Financial Freedom”, FLM 2020 offers more than 40 programmes to empower individuals so that they can learn to make informed financial decisions. It seeks to equip them with the necessary tools and knowledge to achieve their financial goals, manage their debts, and protect themselves from financial scams. As such, it covers a range of relevant topics – from insurance/takaful products to investments, to financial risk management – and is also targeted at Malaysians of all ages, including school children and youths.

The programmes offered through FLM 2020 are varied in format; they include introduction to self-help financial tools, financial education talks, webinars, quizzes, competitions, roundtable discussions, radio interviews, and virtual exhibitions. Here are some highlights that you can keep an eye out for during the month:

- Investing Strategies During Recession

- FE Talk: E-Payment Awareness

- FE Talk: Awareness On Repayment Obligations Post-Moratorium

- Briefings On Financial Fraud (Mule Accounts)

- RinggitPlus Financial Literacy Survey (FLS) 2020

- Financial Literacy Week

- Build A Diversified Portfolio With Exchange Traded Bonds & Sukuk

- Memilih Saham Menggunakan Analisa Teknikal

These programmes are organised by FEN members and partners, which include Bank Negara Malaysia (BNM), Securities Commission Malaysia, Ministry of Education, Ministry of Higher Education, Malaysia Deposit Insurance Corporation (PIDM), Employees Provident Fund (EPF), Permodalan Nasional Berhad (PNB), and Credit Counselling and Debt Management Agency (AKPK).

In its statement, FEN noted that FLM 2020 is designed to work hand-in-hand with the National Strategy for Financial Literacy 2019-2023, which centres around the following five main strategic priorities:

- Nurturing values from young

- Increasing access to financial management, tools, and resources

- Inculcating positive behaviour among targeted groups

- Boosting long-term financial and retirement planning

- Building and safeguarding wealth

FEN also implied the necessity of FLM 2020 as many Malaysians have displayed poor financial literacy, as indicated in BNM’s Financial Capability and Inclusion Demand Side Survey (2018). In the survey, one out of three Malaysians showed low confidence in their financial knowledge and planning, whereas 52% of Malaysians do not have sufficient emergency funds set aside for unexpected events. Meanwhile, almost half of the Malaysian population are not confident of having enough retirement savings.

You can head on over to FEN’s website to find out more about FLM 2020, as well as to see the full list of programmes that are open to the Malaysian public throughout October.

(Source: Financial Education Network)

Comments (0)