RinggitPlus

30th June 2025 - 2 min read

On 28 June 2025, the Ministry of Finance (MOF) announced 3 major changes to the Sales and Service Tax (SST) framework. These adjustments, which take effect tomorrow, 1 July 2025, follow public and industry feedback on earlier proposals made in early June.

Here are the 3 key amendments to the SST that will take effect on 1 July 2025:

1. Selected Imported Fruits Exempted from SST

Imported fruits such as apples, oranges, mandarin oranges, and dates will no longer be subject to SST.

MOF reiterated that the MADANI Government will not impose SST on daily essential goods, whether locally produced or imported, including rice, chicken, beef, vegetables and eggs.

Local fish varieties, including selar, tongkol, cencaru, and sardines, whether frozen, chilled or fresh, will also continue to be exempt from SST.

2. Higher Annual Sales Threshold for SST

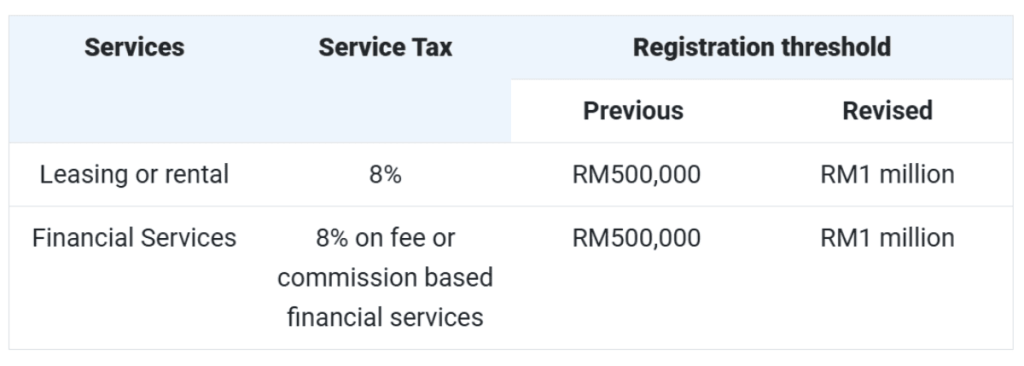

The SST registration threshold for leasing, rental, and financial services has been raised from RM500,000 to RM1 million in annual turnover. Businesses below this threshold will not need to charge SST, offering relief particularly to micro and small enterprises.

3. Beauty Services No Longer Subject to SST Expansion

Proposed SST charges on beauty-related services including facials, manicures, pedicures, haircuts and barber services have been withdrawn.

The decision came after public concern and consultations with stakeholders in the beauty and grooming industry.

Stay tuned for more SST updates.

(Source: MOF)

Comments (0)