Samuel Chua

15th October 2025 - 4 min read

To tackle fuel subsidy leakages, the government has chosen to roll out the Budi95 programme rather than float RON95 petrol prices and issue cash transfers. The move is intended to curb petrol smuggling, a problem that has persisted due to Malaysia’s comparatively lower fuel prices in the region.

A Targeted Subsidy To Plug Leakages

According to Treasury secretary-general Datuk Johan Mahmood Merican, the Budi95 programme was introduced to ensure subsidies reach Malaysians who genuinely need them, while preventing misuse and smuggling.

Under the programme, Malaysians with valid driving licences continue to enjoy a subsidised RON95 petrol price of RM1.99 per litre. Meanwhile, non-citizens pay the market price of RM2.60 per litre.

Learning From Past Fuel Policy Challenges

Speaking at the Malaysian Economic Association’s post-Budget 2026 dialogue, Johan shared that Malaysia’s previous experience with fuel price hikes and cash transfers had influenced the government’s decision.

He referred to the period during Tun Abdullah Ahmad Badawi’s administration, when the government raised fuel prices and compensated citizens through cash payments.

“Perhaps the challenge then was that we did not manage the psychology very well,” Johan said. Malaysians viewed the cash transfers as bonuses, he explained, but later criticised the government for increasing prices and contributing to inflation.

Why Floating Fuel Prices Was Not The Chosen Path

While some economists advocate floating fuel prices and offsetting the impact through targeted cash transfers, Johan highlighted that Malaysia’s long-standing subsidy structure makes such a transition complex.

“One does not start from an empty slate. The government of Malaysia has been subsidising RON95 for a very long time,” he said.

He added that floating fuel prices could create unintended inequalities. For example, individuals living closer to their workplaces would benefit more from cash transfers, while those commuting from farther areas, such as from Seremban to Putrajaya, would be worse off due to higher fuel costs despite receiving the same transfer amount.

Building On Lessons From Diesel Subsidy Targeting

Johan also noted that the Budi95 model was designed based on lessons from the targeted diesel subsidy programme, which significantly reduced fuel smuggling.

“There was significant smuggling not just across borders, but within the country,” he said. “After implementing diesel targeting, we saw a drop in petrol station sales and a corresponding rise in commercial sales from oil companies directly to corporates.”

This shift indicated that diesel was being used more appropriately for industrial purposes rather than diverted from retail pumps.

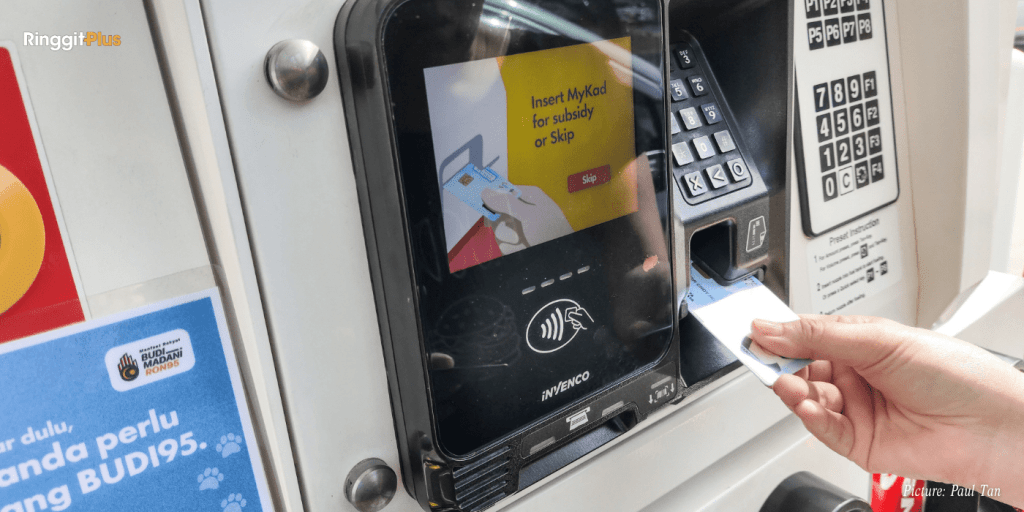

A Visible Subsidy At The Pump

Johan acknowledged that part of Budi95’s appeal lies in its visibility. Unlike cash transfers that go directly into bank accounts, motorists can see the discounted price reflected at the petrol pump.

He credited World Bank lead economist Apurva Sanghi for pointing out this “feel-good factor”. “You can see the number on the pump and the value of the transaction. You are paying a smaller amount based on the receipt, and that is the choice we have made, rightly or wrongly,” Johan said.

Economists Weigh In On Effectiveness

Earlier at the same event, Apurva commended the government for addressing fuel subsidy reforms, calling it the “elephant in the room”, but expressed doubts about Budi95’s long-term effectiveness in preventing smuggling.

He noted that global experience shows floating prices paired with targeted cash transfers is often the most effective way to reduce leakages. However, he added that such systems require robust and efficient cash transfer mechanisms, which may still need strengthening in Malaysia.

Apurva also highlighted that Malaysia’s diesel subsidy reform had succeeded in cutting smuggling largely because prices were allowed to float.

Follow us on our official WhatsApp channel for the latest money tips and updates.

Comments (0)