RinggitPlus

9th April 2013 - 4 min read

A few weeks ago we briefly discussed personal loans, what the different banking terms mean and the basic principles of money lending from financial institutions in our article – Personal Loans: Things You Need to Know. This week we expand a little more on the topic: going into the different types of personal loans available and which ones suit your financial needs best.

Traditional Personal Loans

A basic money lending transaction, people often take personal loans to purchase luxury items such as a new mobile phone or household items. Loans can range from as low as RM3,000 and go up to RM150,000 with tenures stretching from one to seven years.

Traditional bank loans could easily be distinguished as either a secured loan or unsecured loan; the former requiring the applicant to provide collateral in the form of an asset or a guarantor. But these days banks are offering a lot of attractive payment plans with added benefits that constantly blur the line between the two. With fancy terms such as ‘smart’ and ‘flexi’ being thrown at us promising speedy approvals, it can get pretty intimidating for first-timers.

Check out fast loans in Malaysia

Check out personal loans for low income in Malaysia

Home Loans

While people normally apply for a home loan to purchase a property it is not uncommon to also use this as means to refurbish an existing house. Aside from personal preference and aesthetics, renovations will help keep the market value of your home afloat.

Getting a home loan is not hard nowadays as banks recognize the need for more flexible borrowing terms. You’ll still need to do your homework first though, as there are a lot of pitfalls that come with a 20 – 30 year home loan. Have a read up of all the burdens of taking on a home loan before making any major decisions.

Car Loans

Sometimes referred to as a hire purchase, car loans are usually taken out to fund, as the name indicates, the purchase of a car. These days you can purchase a new car by paying as little as 10 percent of the market price. And depending on your financial standing, choose to pay it off up to a maximum of 9 years. Although looking for the lowest interest rate is important, so is your initial down payment. If you can afford to front more than 10 percent, do it! You’ll be surprised how much interest you’ll save with just an extra 5 percent.

Overdraft facility

A less conventional form of personal loan, an overdraft facility allows the account holder to withdraw an amount which exceeds the deposit. More prevalent in business loans, it is not unusual for banks to offer this as a form of personal loan. People often rely on overdrafts when they are in need of emergency funding.

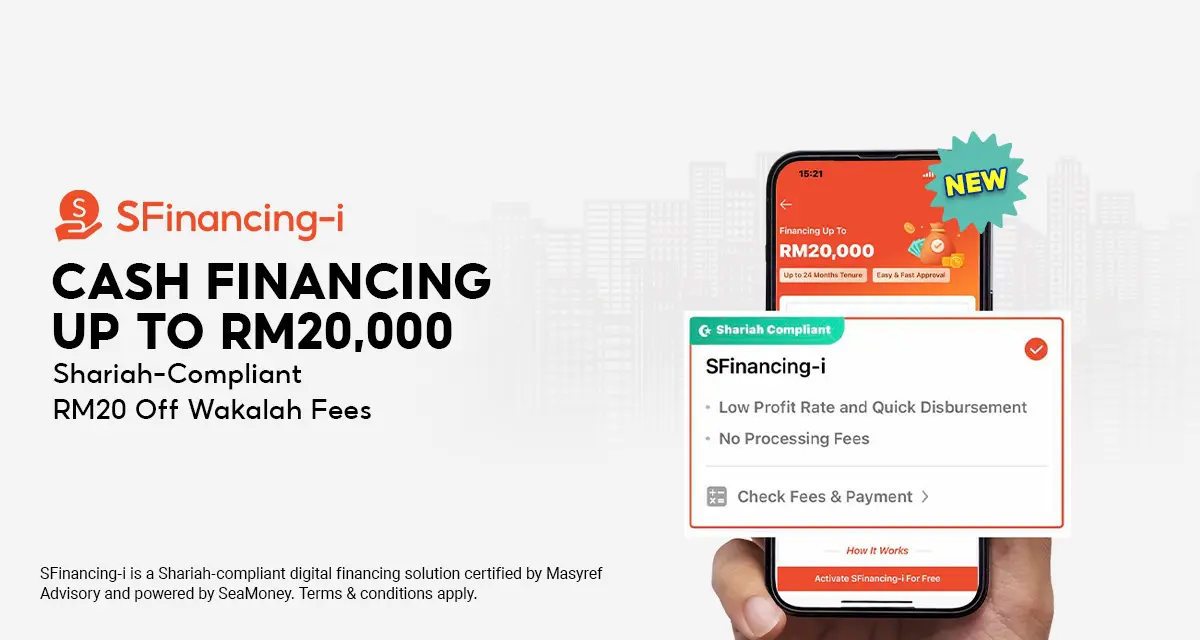

Syariah Compliant Loans

Syariah compliant loans are basically the same as conventional personal loans except that they adhere to Islamic principles of profit sharing. For instance, instead of providing you the money to purchase a new car the bank will instead acquire the vehicle on your behalf and lease it to you for an agreed period.

>> Apply for the best Islamic personal loans online

Islamic Banks also refrain from investments that encourage practices that violate Islamic ethics and moral values, such as gambling and alcohol consumption. Despite popular misconceptions, non-Muslims are eligible for Syariah compliant loans as well.

These are just the bare basics of the types of loans available. If you need to find out more check RinggitPlus often for more helpful tips on loans and personal financing. On top of that, remember to use our free personal loan calculator in Malaysia!

Image credited to Andrew Bain

Comments (0)