Alex Cheong Pui Yin

29th November 2023 - 6 min read

Sometimes, some of you may stumble into an occasion where you’ll need access to an immediate sum of cash – maybe for a medical emergency, or to cover home repairs, or other unexpected one-time expenses. Whatever the purpose, this may mean turning to personal loans: cash that you can borrow for any of your financial needs, typically without requiring collateral.

While you may be more familiar with RinggitPlus for credit cards and best-in-class sign up offers, we also work with banks and licensed lenders to apply for personal loans on our platform. In fact, we’ve been at this since 2017 with our first collaboration with RHB Bank.

Fast forward to today, we have simplified the application process through our WhatsApp chatbot, allowing for an efficient and more convenient experience, with personal loans and financing products across 14 banks and 7 licensed lenders. In fact, the application process takes less than 10 minutes – just as simple and as quick as applying for a credit card on RinggitPlus!

More importantly, our WhatsApp chatbot is also enhanced with our proprietary recommendation tool built into the chatbot, where you’ll be presented with a list of personal loan/financing products that you’re most likely to be approved based on your current financial situation – a unique proposition only provided by RinggitPlus. In some cases, you may even receive instant conditional approval on your loan application! With such advantages, it means that you can avoid situations where you’d make the effort to apply to different banks, only to hear back several weeks later that your applications have, unfortunately, been rejected.

If you’re interested in applying for a personal loan with RinggitPlus, here’s a step-by-step guide – rest assured, the whole process is really simple and straightforward!

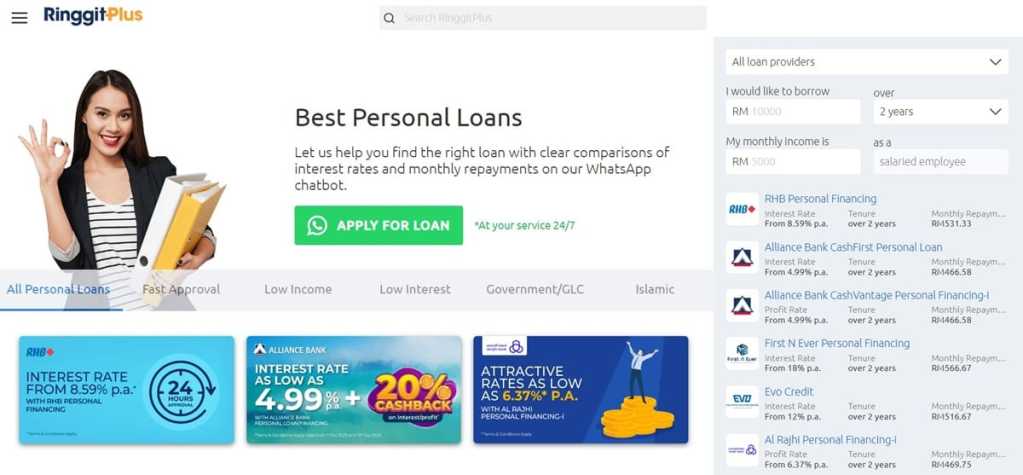

1) Visit our website!

The application process begins with a visit to our Personal Loans landing page on the RinggitPlus website, where you’ll see a list of all the personal loans and financing that we offer from various banks and licensed lenders. At this stage, you do not need to decide on any product yet, and you may also try out the loan calculator to identify what you need.

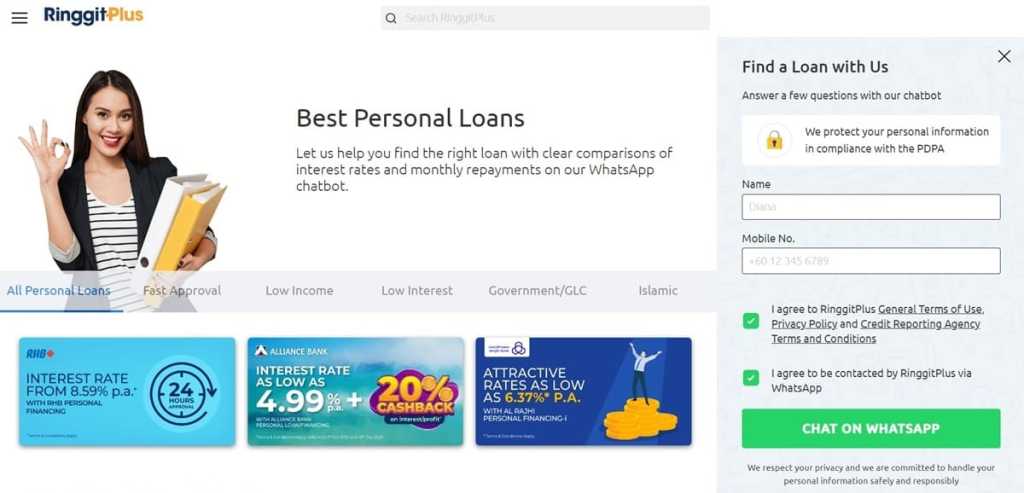

When you’re ready, simply click on the “Apply For Loan” button at the top of the page, where you’ll be prompted to key in your name and mobile number so that we can contact you on WhatsApp. Once done, keep an eye out for a WhatsApp message from us.

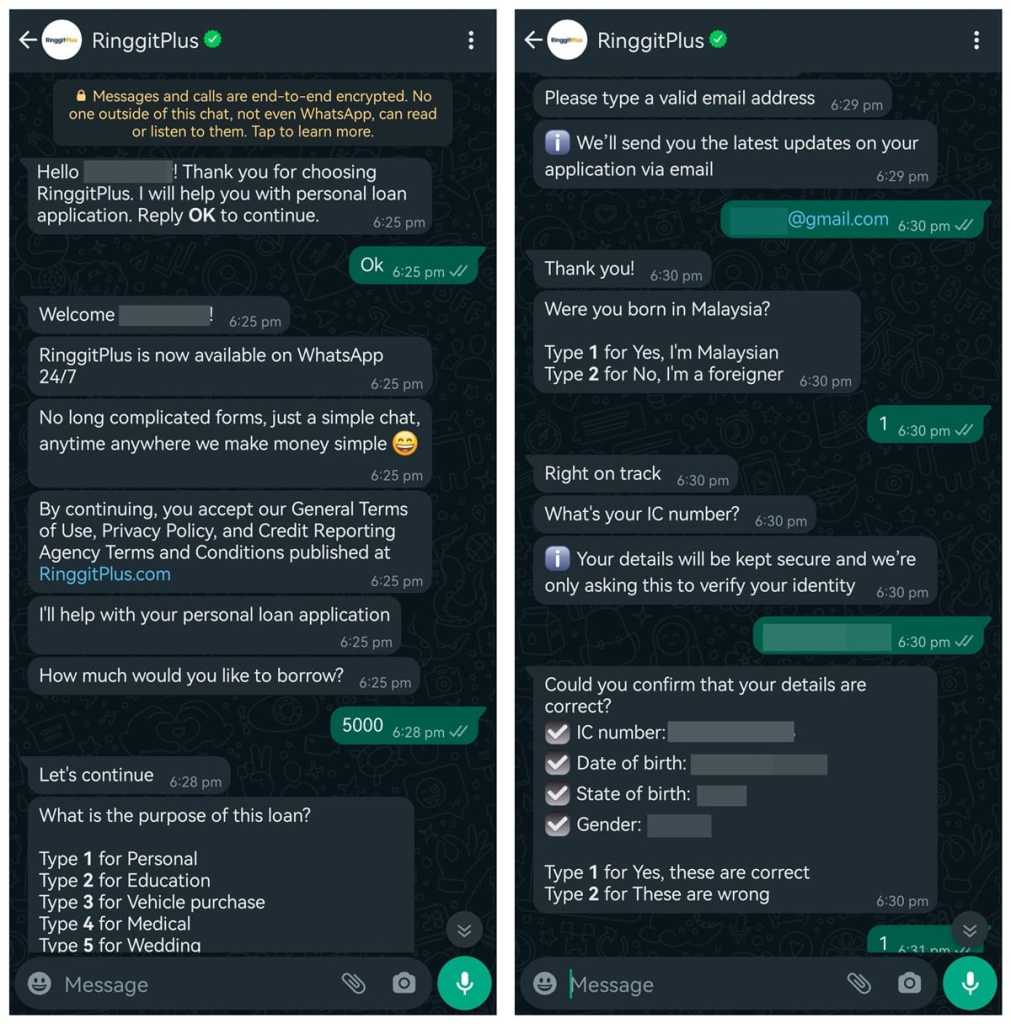

2) Share your loan amount and verify your identity

Once you receive our message on WhatsApp, you can input the amount that you’d like to borrow, as well as the purpose of this loan. Go ahead and choose from the 11 reasons listed for your convenience.

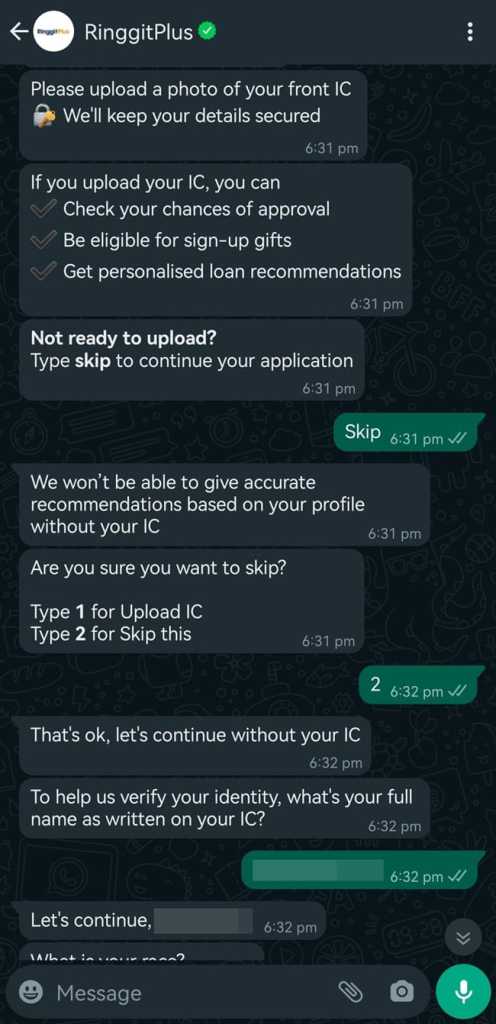

From there, you’ll be asked to share your email address, confirm your citizenship (Malaysian or foreigner), and your identity card (IC) number. During this process, you will also be requested to upload a photo of your IC, but this is optional – doing so will allow the recommendation tool to provide a more accurate list based on your profile.

If you wish to skip this process, you can still proceed with the application. Simply bypass the request, and you’ll be asked to share some personal details to verify your identity. These particulars include:

- Full name in your IC

- Race

- Bumiputera/Non-bumiputera

- Marital status

In addition to these personal details, you’ll also be required to share information related to your academic qualification, employment, as well as income and finances:

- Your dependents (people whom you’re supporting financially)

- Highest academic qualification

- Current residence

- Employment type, sector & industry

- Monthly loan payments/financial obligations

Your personal details will be processed in accordance with the Personal Data Protection Act (PDPA), and are required only for verification purposes as well as to help the recommendation tool to provide a list of personal loans and financing products that you’re most likely to be approved for.

3) Get your list of recommended loans!

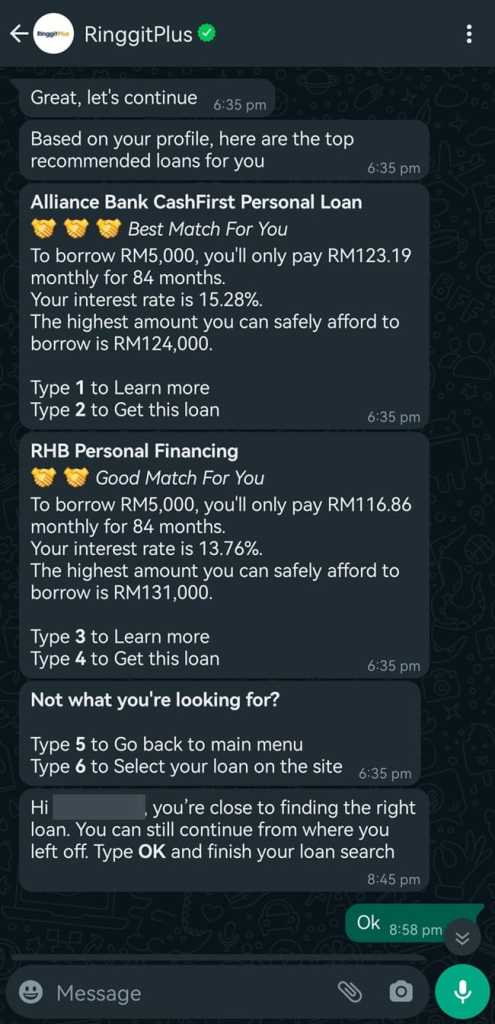

At the end of this chat – which should not take more than 10 minutes, at most – our WhatsApp chatbot will then share a list of the top recommended loans and financing for you!

As you can see in the screenshot shared, you’ll get a “Best Match”, followed by a “Good Match” for you, along with key information such as the interest rate, the tenure, the estimated monthly repayment, and the highest amount that you can borrow as a responsible borrower.

From there, you can then opt to either find out more about the recommended loans – in which you’ll be linked to our product pages so that you can read up on them – or to go ahead with your application.

4) Apply for your personal loan

If you choose to proceed with the application, you’ll be asked some extra questions for additional risk assessment (such as whether you have any credit cards that have been active for at least six months). Note that you will not be asked to submit any documents at this stage.

After completing your application via our WhatsApp chatbot, a representative from the bank or lender that you’ve applied to will give you a call within three working days. This is when you’ll be asked to submit relevant supporting documents for your application, including photocopies of your IC, bank statements, and salary slips.

And that’s it! The application process is complete, and the bank or financial institution will conduct the necessary assessments and provide a final outcome which will be communicated with you – this period will vary between banks and institutions. Upon approval, the disbursement of funds will also vary in duration depending on the financial institution.

***

So as you can see, applying for a personal loan with RinggitPlus is just as simple and as straightforward as applying for a credit card on our platform, and if you’re ready to do so, head on over to our website here! Of course, just as with any financial product, personal loans or financing can be useful tools for a variety of needs, but they should still be used responsibly – do check out the RinggitPlus Blog if you’d like to learn more about personal finance.

Comments (0)