Alex Cheong Pui Yin

13th May 2024 - 5 min read

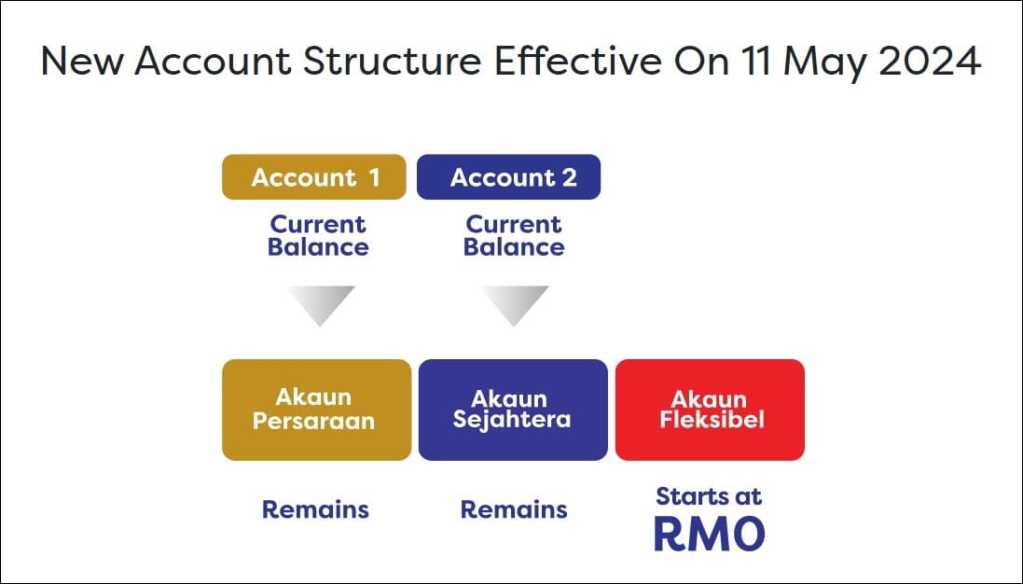

The Employees Provident Fund (EPF) has completed its account restructuring exercise over the weekend, which involves the introduction of a third account called Akaun Fleksibel for members who are aged 55 years old and below.

This new account allows the flexibility to withdraw at any time for short-term needs, and in conjunction with the launch of the account, eligible EPF members are also given a one-time opportunity to transfer some of their funds from Akaun 2 (now known as Akaun Sejahtera) to Akaun Fleksibel. This is so that they do not need to start their Akaun Fleksibel from RM0, in case there are emergencies in the future.

If you’re one of those who are interested in doing this initial amount transfer, we’ve prepared a detailed guide on how you can do so; you can check it out below!

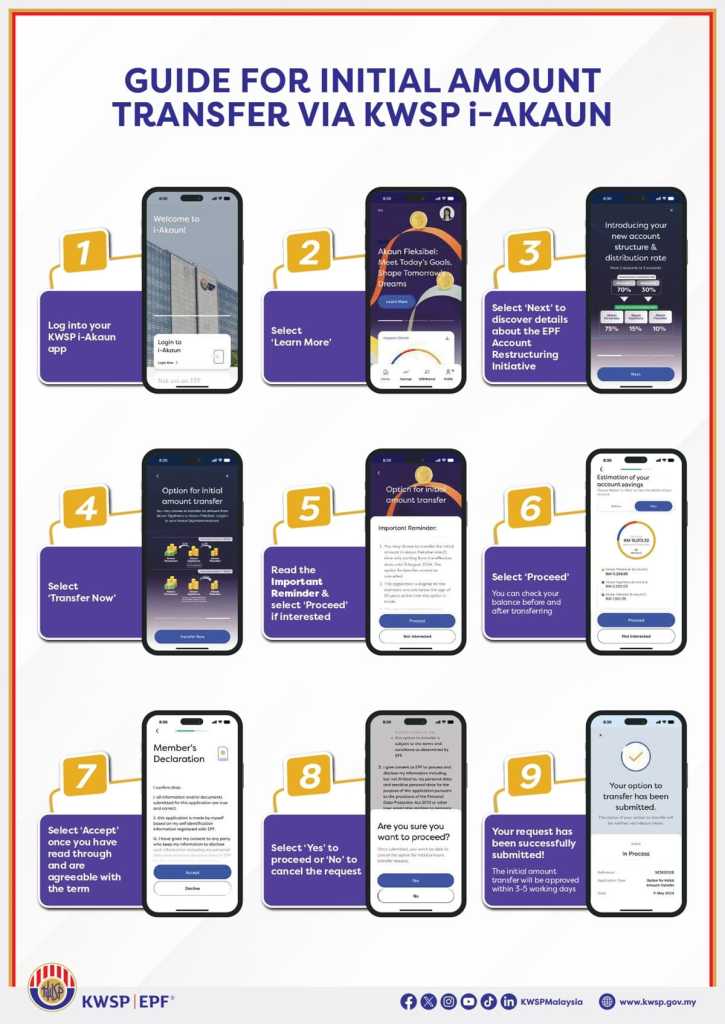

Akaun Fleksibel initial amount transfer: Step-by-step guide

To start, members can make the option for initial amount transfer between today until 31 August 2024, and there are two ways to do it:

- i-Akaun app

- Self-service terminals (SST) at any EPF branches

Note that if you opt to do this through the i-Akaun app, it’s recommended for you to use the new i-Akaun app with updated user interface, which is set to eventually replace the classic and older i-Akaun app.

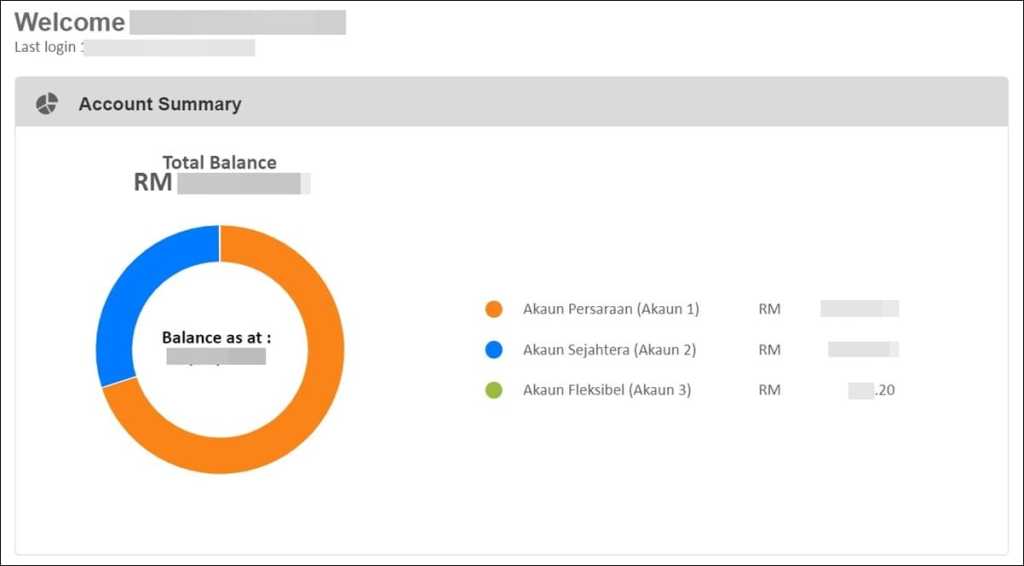

We’ve also checked to see if it is possible to apply for the transfer on the i-Akaun website, but it would appear that this function is not enabled for that platform (yet). You are, however, now able to view all your account balances on the website, including Akaun Fleksibel – as you can see in the visual below, contributions for Akaun Fleksibel has already begun!

As for those who would prefer to apply for the initial amount transfer through SSTs, here’s a list that highlights the operating hours of the terminals at EPF branches nationwide.

For this guide, we’ll be focusing solely on how to opt in for the initial amount transfer via the i-Akaun app – which is actually not at all complicated, as you can see below!

- Step 1: Log in to your i-Akaun app and tap on “Learn More” on the Akaun Fleksibel banner featured in the home screen.

- Step 2: Click on “Transfer Now” after looking through the carousel of explanatory notes, which explains the restructured EPF accounts (Akaun Persaraan, Akaun Sejahtera, and Akaun Fleksibel) and your initial amount transfer options.

- Step 3: Click on “Proceed”, and you’ll be shown your account balances before and after the transfer. If you’re happy with the amount, then tap on “Proceed” again.

- Step 4: Select “Accept” after reading the Member’s Declaration, after which you’ll be asked again to confirm if you’d like to proceed.

- Step 5: If you select “Yes” to continue, your request will be submitted, and you’re done! The initial amount transfer will be approved within three to five working days.

Important: Key things to remember about the Akaun Fleksibel initial amount transfer

Before you immediately jump into applying for the Akaun Fleksibel initial amount transfer allowed, there are a few things that you should take note about the option, starting with:

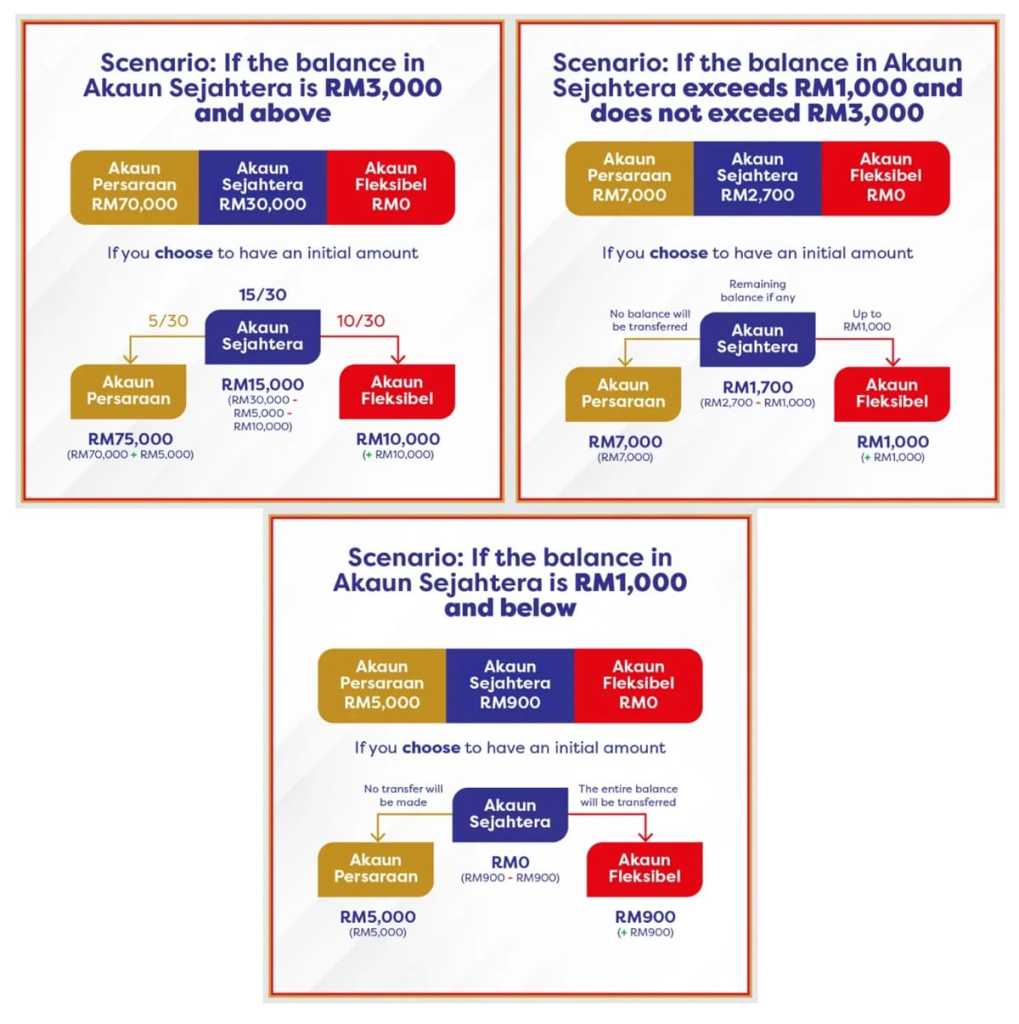

1) The initial transfer amount is pre-determined based on the current balance in your Akaun Sejahtera.

You will not be able to decide on the amount that you’d like to transfer from your Akaun Sejahtera to Akaun Fleksibel. Instead, depending on how much you currently have in your Akaun Sejahtera, the EPF will allow you to transfer up to 10/30 of your Akaun Sejahtera balance to Akaun Fleksibel. Here’s a table to summarise:

| Existing balance in Akaun Sejahtera | Breakdown of allocation and ratio of transfer |

| RM3,000 and above | – 10/30 of Akaun Sejahtera balance to be transferred to Akaun Fleksibel – 5/30 of Akaun Sejahtera balance to be transferred to Akaun Persaraan – 15/30 of Akaun Sejahtera balance to be retained |

| More than RM1,000 – less than RM3,000 | – RM1,000 to be transferred from Akaun Sejahtera to Akaun Fleksibel – Remaining Akaun Sejahtera balance to be retained – No transfers to Akaun Persaraan |

| Less than RM1,000 | Entire Akaun Sejahtera balance to be transferred to Akaun Fleksibel |

Here are several visuals from the EPF to help clarify things better for you:

2) Application cannot be cancelled once it is made.

Each member can only make one application for the initial amount transfer between today until the 31 August 2024 deadline. Additionally, you will not be able to withdraw or cancel your application once you have made it.

3) Your existing balances in Akaun Persaraan and Akaun Sejahtera remains unchanged if you opt out of the initial amount transfer.

If you do not opt in for the initial amount transfer, then your balances in Akaun Persaraan and Akaun Sejahtera will remain unchanged, and you will start your Akaun Fleksibel with RM0. Your subsequent EPF contributions will be credited into the three accounts (Akaun Persaraan, Akaun Sejahtera, and Akaun Fleksibel) with the updated ratio of 75:15:10, respectively.

***

With this, we hope that you now have a clearer idea as you go about your application to opt in for the Akaun Fleksibel initial amount transfer! Of course, do be aware as well that the whole EPF account restructuring exercise goes beyond just the Akaun Fleksibel initial amount transfer; you can find out all about the nitty gritty of it through our in-depth coverage here.

Comments (0)