Pang Tun Yau

13th November 2018 - 2 min read

Bank savings accounts today offer next to nothing in terms of interest. With an average interest rate of just 0.2%, the amount you earn in interest is virtually insignificant. Surely there’s a better way to earn higher interest rates with our savings – at minimal effort?

Of course there is. With the exception of children’s savings accounts that offer as much as 3% interest per annum, some banks actually have various savings accounts for adults that offer better interest rates than their basic savings accounts – and most of the time, it is right there on their websites or bank branch; all it takes is just a quick browse.

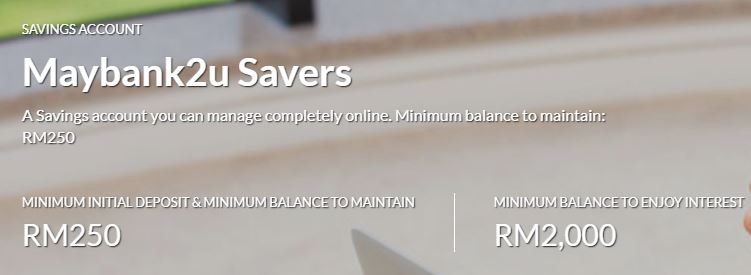

One of the most popular of these savings accounts is the Maybank m2u Savers and its Islamic variant, Maybank m2u Savers-i. With interest rates that start at 2% p.a., these savings plans offer ten times more interest than a conventional savings account. So what’s the catch?

As it turns out, the conditions aren’t as strict as one may think. The m2u Savers and Savers-i are “online-only” savings accounts, which means you perform all transactions on the accounts online – including opening and closing them. You’ll need a Maybank2u account for this, and any transactions performed over-the-counter involving this account that can be done online will incur additional charges.

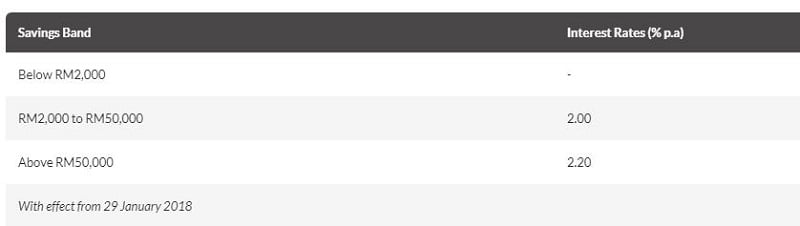

But most importantly, you need to know that the m2u Savers and Savers-i accounts have a tiered interest rate that’s based on the account balance.

Yes, that means there is also a minimum balance to be maintained in order to be eligible for the interest. Therefore, always ensure you have a minimum RM2,000 in the account (or maintain a RM50,000 balance if you want to enjoy 2.2% interest!)

As mentioned earlier, you’ll need a Maybank2u online banking account to be able to open an m2u Savers/Savers-i account. If you’re an existing Maybank customer, you should already have a Maybank2u account, making this process painless. Otherwise, you’ll need to go to a Maybank branch and open a basic savings account and get your Maybank2u account activated.

All things considered, this is one of the easiest ways to earn up to 10 times more interest on a savings account at little to no hassle. Add in the power of compounding interest and start seeing your savings grow!

Comments (1)

This is outdated, the m2usavers account now only gives 0.6% interest. not really worth it!