Jasen Lee

14th June 2024 - 6 min read

Whether it is the sandy beaches, the historical monuments, the culinary delights, or even the shopping, there’s no denying that we all need a well-deserved holiday every now and then. Some people enjoy the holiday planning process too, from securing deals on accommodation and scouring travel fairs for the cheapest flights.

Savvy credit card users, on the other hand, know that they are already accelerating their holiday plans – just with their everyday spending! By earning rewards points from credit cards, they may redeem them for flights or hotel stays, substantially reducing their holiday budget.

For example, many CIMB credit cards offer Bonus Points for every RM1 spent, with multipliers for specific spending categories. On top of that, CIMB is now rewarding credit card users and accelerating their Bonus Points earning with the ongoing ‘More Points, More Holidays!’ campaign.

This campaign allows you to earn EXTRA Bonus Points every month for the following CIMB credit cards: CIMB Preferred Visa Infinite, CIMB Preferred Visa Infinite-i, CIMB Visa Infinite, and CIMB Visa Signature when you combine your daily spending with these cards.

Let’s take a closer look at the reward mechanics for each CIMB credit card:

| More Points, More Holidays! | |||

| CIMB Preferred Visa Infinite & CIMB Preferred Visa Infinite-i | CIMB Visa Infinite | CIMB Visa Signature | |

| Additional Bonus Points | Earn 35,000 Bonus Points monthly | Earn up to 15,000 Bonus Points monthly | Earn up to 7,500 Bonus Points monthly |

| Criteria to earn | – Be a CIMB Preferred client and maintain a minimum Asset Under Management (AUM) of RM250,000 in selected Deposits, Investment, and Bancassurance or Bancatakaful products; – Maintain a minimum average balance of RM50,000 in your CIMB Current or Savings Account/-i as part of the AUM requirement; – Spend a minimum of RM10,000 monthly on eligible transactions, including dining, travel, shopping, and more; – Monthly repayment to Preferred Visa Infinite and/or Preferred Visa Infinite-i credit card must be made via eligible CIMB Current or Savings Account/-i to be eligible for the campaign. | – Tier 1: Earn 7,500 Bonus Points when you spend a minimum of RM3,000 – RM4,999.99 on eligible transactions per campaign month. – Tier 2: Earn 15,000 Bonus Points when you spend a minimum of RM5,000 and above on eligible transactions per campaign month. – Monthly repayment to Visa Infinite credit card must be made via CIMB Current or Savings Account/-i to be eligible for the campaign. | – Tier 1: Earn 4,000 Bonus Points when you spend a minimum of RM2,000 – RM2,999.99 on eligible transactions per campaign month. – Tier 2: Earn 7,500 Bonus Points when you spend a minimum of RM3,000 and above on eligible transactions per campaign month. – Monthly repayment to Visa Signature credit card must be made via CIMB Current or Savings Account/-i to be eligible for the Campaign. |

| Campaign date | 3 April 2024 – 30 September 2024 | 10 May 2024 – 30 April 2025 | 10 May 2024 – 30 April 2025 |

Optimise Your Spending with CIMB Credit Cards

These CIMB credit cards are designed to reward not just your everyday spending but also offer better returns when you spend overseas. Additionally, these cards also come with perks that help make your holidays more comfortable and with peace of mind, such as complimentary lounge access and travel insurance.

Here’s a breakdown of Bonus Points you can earn by spending with these CIMB credit cards, along with the other benefits that come with them:

| CIMB Preferred Visa Infinite & CIMB Preferred Visa Infinite-i | CIMB Visa Infinite | CIMB Visa Signature | |

| Bonus Points for every RM1 spent | – Up to 8x Bonus Points on Overseas spend. – Up to 8x Bonus Points on Dining spend. – Up to 8x Bonus Points on Zakat/charity payments (only for CIMB Preferred Visa Infinite-i). – 1x Bonus Points for other local spends. | – 5x Bonus Points on Overseas spend. – 5x Bonus Points on Dining spend. – 1x Bonus Point on other local spends. | – 2x Bonus Points on overseas spend. – 1x Bonus Point on other local spends. |

| Travel perks | – 8x access to selected Plaza Premium First and Plaza Premium Lounges worldwide. – 12x access to Sky Lounge at Skypark, Subang Airport. – Complimentary travel insurance/Takaful coverage. | – 8x access to selected Plaza Premium Lounges worldwide. – 12x access to Sky Lounge at Skypark, Subang Airport. – Complimentary travel insurance | – 2x access to selected Plaza Premium Lounges worldwide. – 12x access to Sky Lounge at Skypark, Subang Airport. – Complimentary travel insurance |

| Eligibility | Available exclusively to CIMB Preferred clients. | Minimum annual income requirement: RM60,000 effective 20 May 2024 (revised from RM 120,000 income p.a.) | Minimum annual income requirement: RM36,000 effective 20 May 2024 (revised from RM 60,000 income p.a.) |

What can you do with CIMB Bonus Points Redemption?

CIMB Bonus Points are as good as cash! You can redeem a wide variety of options including flights, hotels, gadgets, household items, vouchers, and many more.

1) Redeem flights and hotel stays:

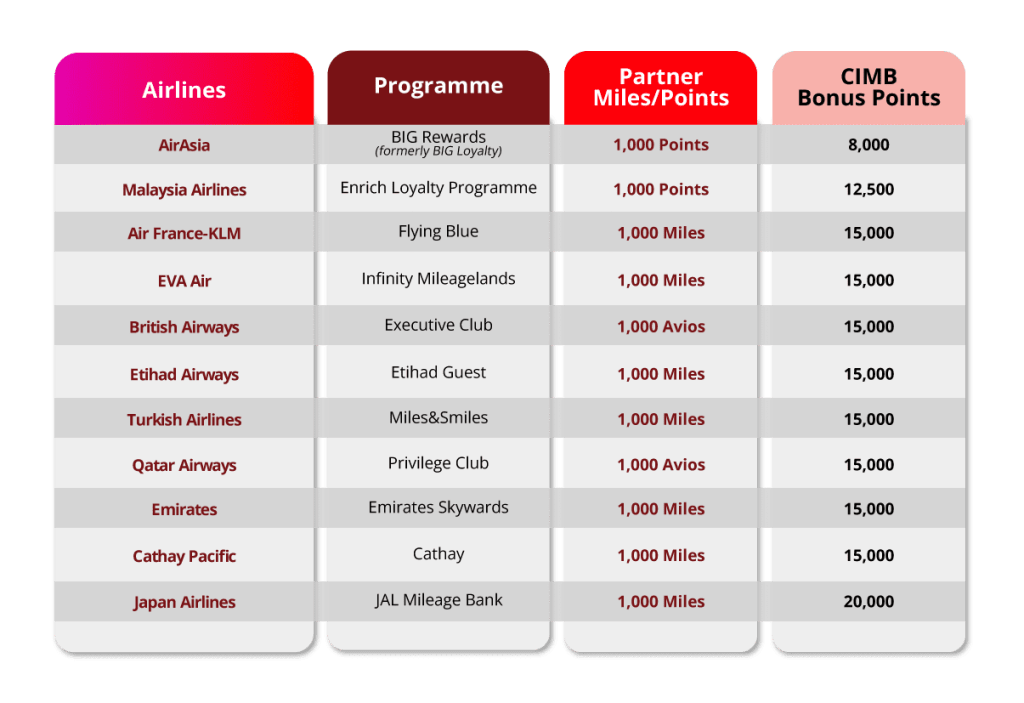

Enjoy the flexibility to redeem air miles from 11 airline partners where you can redeem 1,000 airline miles/points starting from 8,000 Bonus Points, and hotel stays with 3 hotel partners where you can redeem 1,000 hotel points starting from 10,000 Bonus Points. Our partners are listed below:

Click here to find out more about the reward redemptions.

2) Redeem a variety of items and e-vouchers:

You may also use your Bonus Points to redeem home essentials, gadgets, e-vouchers like Grab, Shopee, Touch n’ Go eWallet credit, and more.

Click here to see what other items or vouchers you can redeem to make the most out of your Bonus Points rewards.

3) Pay with points:

This feature lets you pay with your Bonus Points, just like cash, at over 10,000 participating merchants nationwide, including stores like Harvey Norman, Baskin Robbins, Senheng, Lotus’s, Machines, Isetan, and more, with a conversion rate of 500 Bonus Points = RM1.

Click here to find out more.

***

Why wait? Apply and transact with these CIMB credit cards for your everyday spending and accelerate your Bonus Points earnings. Plus, with the ‘More Points, More Holidays!’ campaign, your next holiday is closer than you think!

Furthermore, CIMB has recently revised the minimum annual income requirement specifically for the CIMB Visa Infinite credit card which has been halved from the previous RM120,000 per annum to the updated RM60,000 per annum. The same could be said for the CIMB Visa Signature credit card, which now requires a lower minimum annual income of RM36,000 in order to apply, as opposed to the previous minimum annual income of RM60,000 per annum.

Not a CIMB credit cardholder yet? Sign up for the CIMB Preferred Visa Infinite, CIMB Preferred Visa Infinite-i, CIMB Visa Infinite, or CIMB Visa Signature credit cards today, and enjoy the added benefit of annual fee waivers for all primary and supplementary cards.

Click the links below to find out more:

Terms and conditions apply.

CIMB Current/Savings Account/-i is protected by PIDM up to RM250,000 for each depositor.

Comments (0)