Sharon Bentley

9th August 2021 - 8 min read

Just like saving, the habit of making smart financial decisions should be practiced as early as possible – and better late than never. This is especially true for those who have just started to venture into the working world after graduating college or university. The newfound sense of independence may feel like a honeymoon and it can be tempting to splurge your hard-earned money on impulse purchases.

So when do you know which decision is better? While smart financial decisions are unique to each individual according to their current situation – there are some instances where certain decisions made can universally bring good to everyone. These smart financial decisions may help keep you on track towards bigger financial goals, help prevent your finances from snowballing into negative debts, and allow you to build a good financial standing from the get-go.

To help you get started on the right foot, here’s a collection of personal finance tips to help you make better decisions.

Start Saving Today or Splurge Now, Save Later?

Saving for emergency funds should be a part of your monthly commitment, regardless of the amount that you can afford to set aside each month. After all, a penny saved is a penny earned. You can also try the concept of “paying yourself first” where after receiving your monthly salary, set aside a certain portion of your income for savings and plan your expenses according to what’s left. It is advisable to save about 6 months’ worth of your monthly expenses to prepare you for emergencies.

Save Hard or Save SMART?

If you have been budgeting all your expenses without a miss – but still find yourself unable to achieve a certain financial goal, you might want to relook into your saving method. Try SMART saving which stands for Specific, Measurable, Achievable, Realistic, and Time-Based saving. Your financial goal should have these SMART qualities that can enable you to save more efficiently.

Here’s an example of a SMART financial goal: In 3 years, I want to save RM50,000 to make a down payment for my dream home.

This goal is specific as it covers the exact amount of money to save within a specific time frame. The goal to make a down payment for a home is also realistic, and therefore is achievable.

Should You Wait Until You’re Earning More To Start Reducing Your Debt?

Start working on reducing your debt as soon as you can instead of letting it accumulate over time. Most loans when accumulated will result in higher repayment amounts due to incurred interest rates, if applicable.

Especially for fresh graduates, your biggest repayment commitment could be a student loan such as PTPTN or MARA. It is understandable to want to wait until you are earning more before you start repaying your loan, but irregular and late repayment can affect your credit score. In an extreme case, you could also be blacklisted and restricted from travelling overseas.

Meanwhile, for credit card debts, be sure to immediately repay them in full as soon as you can to avoid it snowballing into a bigger amount to be cleared at the end of the month.

Keep To Budget-Friendly Rentals

We’ve all been through this scenario before in the early days of our careers; we get our first paycheck and with a lump sum of money in our hands, we want to spend it all on the biggest house, the nicest car, or whatnot, and forgo what’s truly important at the end of the day – our future and financial security.

When planning your budget, you can start with the biggest number on your expenses sheet, which would probably be your home rental, especially when you are a recent graduate. Paying more than what you need to for rent would not only leave a huge dent in your pockets every month but also might delay your journey towards home ownership. Hence, it’s important to set a budget for your rental which you can easily do nowadays via online calculators that will compute specified amounts tailored to your income and other living expenses.

Building Your Credit Score: How To Start?

To elaborate on the credit score briefly mentioned above, a credit score is a number that denotes how credit-worthy an individual is. Your creditworthiness is evaluated based on your credit history; which includes your payment history, credit mixture that you currently have, length of your credit history, and more. Banks use this as an indicator of whether you can be trusted to repay the credit on time.

A good credit score will help you go a long way in the future when you plan to make bigger financial commitments such as applying for a credit card with a higher credit limit or purchasing your first home. On a side note, having no debt does not equal having a good credit score either, as there is no record that could prove your creditworthiness.

You can start building your credit score by paying your PTPTN or MARA repayment regularly and on time. Besides that, you can also apply for an entry-level credit card to consolidate and auto-bill all your monthly expenses to be paid on time. However, being disciplined and paying your credit card bill on time is crucial, or it could backfire and impact your credit score negatively.

Earn As You Spend or Spend And Earn Nothing?

The answer to this should come easily because after all, who doesn’t like receiving extra benefits such as bonus points, cashback, and gifts on top of their spending? You get to accumulate bonus points or cashback that would translate into more savings over time for every spending or payment that you have to do anyway.

Thanks to digital technology these days, you can easily earn these extra benefits just by making payments using your debit card, credit card, or e-wallet although the value of these benefits differs according to the providers.

Take the CIMB e Credit Card, for example, which offers cardholders rewards everyday for both online and offline spending.

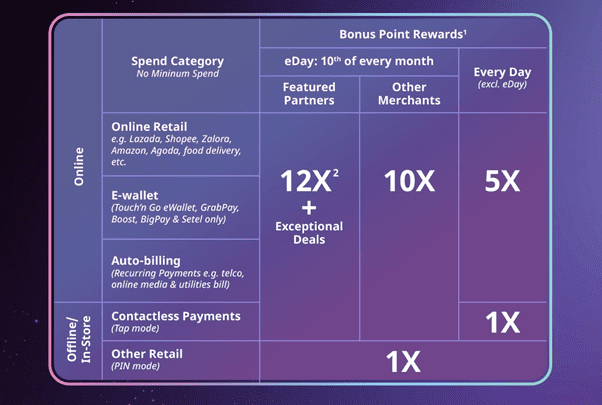

The CIMB e Credit Card offers 5x Bonus Points (BP) on most of the essential online transactions these days which include online shopping, auto-billing expenditure (for example, household bills, insurance premium, monthly PTPTN repayment), and e-wallet reloads although contactless and ordinary PIN payments will grant only 1x BP.

The highlight of the CIMB e Credit Card, however, lies on the 10th of every month which is also called the eDay. On eDay, instead of 5x BP, you will get 12x BP plus exceptional deals with Featured Partners and 10x BP with other merchants when spending on online shopping, auto-billing expenditure, and e-wallet reloads. Contactless payment via tap will also grant users 12x BP and 10x BP for Featured Partners and other merchants respectively, with the PIN method remaining at 1xBP.

So, what can you do with your Bonus Points (BP)?

You can use your BP to redeem cashback from the CIMB rewards catalogue and take advantage of the CIMB e Credit Card’s feature “Pay With Points” to settle your credit card account balance or offset your payment with participating merchants. Furthermore, CIMB boasts its conversion rate of 400 Bonus Points to redeem RM1 as the best bonus points conversion in comparison with the other banks in Malaysia.

This means that with every payment made with CIMB e Credit Card, you also earn benefits that help you save more. And the best part is that the CIMB e Credit Card is an entry-level card that comes with a minimum annual income requirement of RM24,000 or RM2,000 per month – suitable for fresh graduates and those who have just entered the workforce.

Enjoy 0% Flexi Payment Plan (FPP) For A Limited Time Only

Good news for CIMB e Credit Card and other CIMB Bank credit cards holders. From 1 August – 30 September 2021, you will be able to enjoy a 0% Flexi Payment Plan with a minimum spend of RM500 in a single transaction, on these spend categories; Education, Health, and Medical, and any online spend.

With CIMB Bank 0% FPP, you can now buy the latest gadgets from Shopee, the ergonomic working chair that you always wanted from Lazada, or the outfit you’ve been eyeing from ZALORA and break your payments into 12-month instalment with ZERO fees & charges. That way, you can still maintain your monthly cash flow and make payments for your necessities.

The campaign will run for 2 months only, so don’t miss out and fill the cart with your must-have items today. Once you have met the minimum spend, you will receive an SMS from CIMB Bank. Reply to the SMS to enjoy 0% FPP. It’s that simple!

***

So there you have it – when faced with financial choices, make the decisions that will put you on the path of a healthy financial journey. If you would like to find out more about the CIMB e Credit Card, you can do so here.

Comments (0)