Katrina Balan Quiroz

18th June 2021 - 6 min read

E-commerce has experienced a boom over the last year with an 87% growth in 2020 compared to 2019 as Malaysians opted to shop online as a result of the pandemic. At the same time, ‘buy now, pay later’ (BNPL) – a payment method that offers consumers an option to pay in instalments – has also become more popular. In Malaysia, a local BNPL service provider was reported to have processed over RM 10 million in transactions in just a few months.

But the BNPL concept is not new. Previously, it was offered only by banks as part of their credit card features, allowing cardholders to pay for their retail transactions in instalments. This means consumers need to apply for a credit card to be eligible for instalment plans, which usually comes with extensive application and financial verification processes that can limit accessibility. However, with more than 9.6 million credit cards in circulation in Malaysia as of March 2021, credit card debt is also one of the reasons for Malaysians to declare bankruptcy. 1 in 10 Malaysians declared bankruptcy due to credit card debt in 2020.

Why are credit card-less payment services like Buy Now Pay Later (BNPL) becoming so popular now?

The simple answer is Convenience.

With BNPL services, it is a simple registration process with no detailed applications or financial documents needed. It is also cashless, so BNPL users can easily spread the payments debited from their bank accounts or credit cards over three, four- or six-month instalments. The payments are also interest-free for on-time payments and there is no hidden interest that will build up for late payments. However, different BNPL providers may charge a flat fee to reactivate your account should you miss a payment.

Tips On How To Shop On BNPL Guilt Free

While BNPL is a convenient option for consumers, it is also easy to lose control and overspend, so it is very important to exercise discretion. Here are five key questions to ask yourself the next time you want to shop for something.

- Is it a NEED or a WANT?

When shopping, first, ask yourself – Do I NEED this, or do I WANT this?

A NEED can be categorised as:

Basic Necessities – things needed to survive such as utilities, rent, food, education, travel/vehicle upkeep, credit card bills etc.

Special Occasions – gifts for our loved ones during festive seasons such as Hari Raya/Chinese New Year/Christmas/Deepavali, and special occasions such as anniversaries or weddings, Father’s or Mother’s day, and birthdays.

Emergencies – unplanned emergency needs such as medical bills, electrical appliances you use frequently that need replacing, car or home repairs, etc.

If your item does not fall into these categories, then it is probably a WANT.

For example, are you thinking about buying new headphones (though your current ones still function well) instead of paying rent? Rent should win!

Pro Tip: Spend on what you need first, while taking time to decide on what you want.

- How much can I spend?

Before buying those expensive headphones, it is important to decide how much you can save once you have determined what you must pay for the things you need. Planning a monthly budget can help you with that. In fact, savings should be considered equally as important as basic necessities because savings can help alleviate stress when emergencies inevitably arise.

Pro Tip: It is recommended that you save at least 20% of your average monthly net income.

- Will it burst my budget, even with an instalment plan?

Sometimes, it is easy to convince yourself that dividing the cost of the headphones over a few months will make them affordable. In principle, that is probably true. However, you also need to consider that every month, you will need to deduct a certain sum to pay off those earphones. How will these instalments affect your monthly budget in the coming months, when you consider what other necessities you will need to buy?

- Do I have other instalment plans?

Similar to #2, while you consider paying for an item with an instalment plan, you should also factor in other existing instalment plans that you may have. This means, for the next few months, you may be potentially allocating more into your instalment plans and not enough into your other necessary expenses and savings.

- Always RESEARCH

With many BNPL services in the market, it is advisable to compare each option to find the best plan to suit your needs and monthly budget. Some services may offer cashback, rewards points, or a more manageable limit, so pick the best option for you!

And also, research on other headphones that may be just as good, but not as expensive.

PayLater by Grab

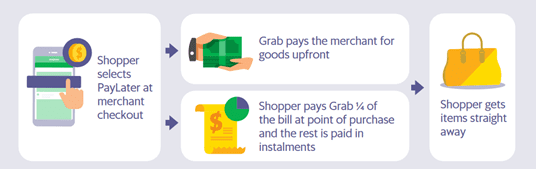

PayLater is one of the latest payment options that allows eligible consumers to purchase and spread out their payments to manage their cash flow.

Under this latest feature, consumers have more flexible payment options:

- Pay in instalments – split the bill into four monthly payments.

- Pay next month – consolidate the monthly spend into one bill, pay at the start of the following month.

This means you can shop online now and choose to pay next month or in four monthly instalments. For instance, instead of paying the full price on the headphones upfront, you can split the bill into four monthly instalments with no interest charged.

Why Consider Paylater?

- Completely interest-free and with no extra fees when you pay on time.

- A whole range of features, like auto deduct bills, to help you stay on top of all your spending.

- Can be used for your Grab spending too, to consolidate monthly Grab spends into one bill and pay next month.

- No upfront costs.

With PayLater by Grab, paying for needs and wants like electronic gadgets, clothes, baby milk powder, and kitchen appliances can be done in a more transparent manner, while prioritising privacy and security to avoid any risk of fraudulent transactions. This is useful for frequent Grab users who want to manage a monthly budget and also use multiple Grab services like transport, food, mart, and online shopping.

PayLater by Grab is also more secure as it only requires a registered mobile number at check out in store when shopping. Each transaction is also verified with a One-Time Password (OTP) sent to your mobile with real time notifications for every successful transaction, payment deduction or refunds – all in the Grab app.

With all the benefits in BNPL payments in mind, always remember to research and understand what works best. The same goes when considering any digital payment options.

For more information on how PayLater can help you spend responsibly, visit HERE

Comments (0)