Alex Cheong Pui Yin

11th March 2024 - 3 min read

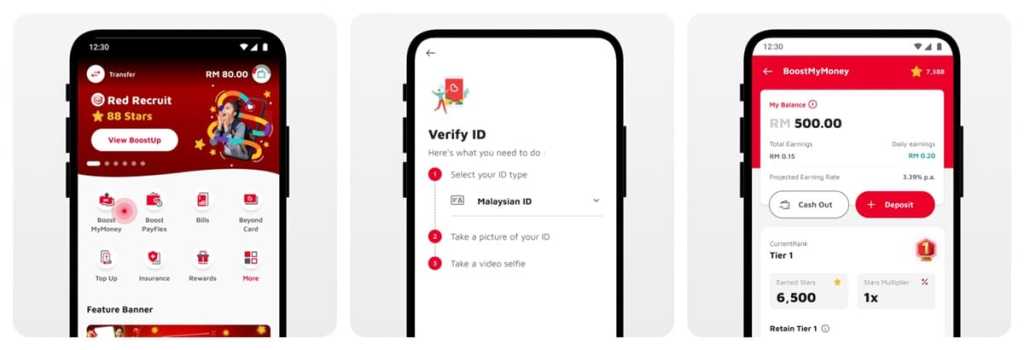

Boost has officially introduced a new investment feature by the name of BoostMyMoney, which lets you earn potential higher returns on your funds. Rolled out in partnership with UOB Asset Management (UOBAM) and housed within the Boost app, it also lets you get up to 3x Boost Stars for every RM1 of savings when you maintain a specified monthly average balance in your BoostMyMoney account.

In its FAQ, Boost shared that the underlying fund for its BoostMyMoney platform is the United Islamic Cash Management Fund, a shariah-compliant money market fund that is managed by UOBAM. Secure and low-risk, users can also start investing with just RM1, and there is no lock-in period (which means you can withdraw your funds anytime without losing your investment gains).

Meanwhile, to earn up to 3x Boost Stars, you are required to maintain a minimum of RM500 monthly average balance (MAB) for at least nine months. This particular benefit is tiered as per the following, where you must gradually work your way up the timeline:

| Tier | Months | Boost Star rewards (for each RM1) |

| 1 | Month 1 to 4 | 1x |

| 2 | Month 5 to 8 | 2x |

| 3 | Month 9 to 12 | 3x |

So if you were to start in March 2024 and manage to maintain the required minimum RM500 MAB all the way until November 2024 – February 2025, then you’ll be eligible to unlock the maximum 3x Boost Stars multiplier during this November – February period, giving you a total of 1,500 Boost Stars each month. These Boost Stars can then be used to redeem rewards from the BoostUP catalogue.

As for fees, note that there is an annual management fee of up to 0.5% p.a. on the net asset value (NAV) of the fund, as well as a trustee fee of up to 0.04% p.a.. Boost also highlighted that if your account is dormant for more than a year without any transactions, an RM8 fee will be imposed (although this fee is currently waived until further notice).

The BoostMyMoney feature is open only to registered Boost Premium users, so if you’d like to give it a try, you’ll need to first upgrade your Boost Wallet accordingly. You can do so by going to “Profile” on your Boost app, then clicking on “Upgrade to Premium Wallet”.

Once you’re ready, go ahead and sign up for the BoostMyMoney feature by tapping on the BoostMyMoney tile on your home screen, and then submitting the required information and verifying your identity. If the new offering is not immediately available on the home screen, tap on “More” and find it under the “Investment” section.

Upon setting up your account, you can proceed to make your first deposit (starting from as low as RM1), but do be aware that you’re only allowed to invest funds that are reloaded into your Boost Wallet via online banking. Funds reloaded through credit cards and Boost PayFlex funds are not eligible to be used for the BoostMyMoney feature.

In conjunction with the rollout of its BoostMyMoney platform, Boost is currently running two introductory promo. Under the first campaign – which is a sign-up campaign – you can earn yourself a CHAGEE voucher worth RM15 and 6,500 Boost Stars by making a first deposit (RM500 min) and maintain it for at least five days. Meanwhile, the second campaign lets you win the RM15 CHAGEE voucher just by making a minimum deposit of RM100 and maintaining it for at least five days. The first campaign is set to run until 31 December 2024, whereas the second campaign will continue until 4 April 2024.

Comments (0)