Alex Cheong Pui Yin

18th January 2021 - 3 min read

Shopee has introduced a new payment feature that lets its Malaysian users purchase items and pay for them at a later date. Aptly named SPayLater, the feature is available only through the Shopee app, and it allows you to “postpone” the payments for your current purchases to the following month or convert them into monthly instalments of up to six months.

Applicable to Malaysians who are 18 years of age and above with a valid MyKad, the SPayLater feature includes four payment options: BuyNowPayLater (BNPL), and monthly instalments of two, three, and six months. Here’s a table from Shopee that shows you how each option works:

| SPayLater payment options | Processing fee | Late payment fee |

| Buy Now, Pay Later (BNPL) | 0% |

1.5% monthly on overdue amount |

| 2-month instalment |

1.25% per month on order amount |

|

| 3-month instalment | ||

| 6-month instalment |

In short, Shopee users who take the BNPL option will have to pay the full amount of their purchases in the following month, with no fees charged. Those who opt for monthly instalments, meanwhile, will need to pay a 1.25% processing fee on their order amount each month.

Aside from that, all Shopee users who tap into the SPayLater feature must also make sure to clear their bills within the stipulated timeframe, or they will be hit with a late payment fee of 1.5% each month on the overdue amount. According to Shopee’s FAQ, all payments must be made by the 10th of every month.

So for instance, if your purchases are made between 1 to 30 January under the BNPL option, you must settle your bill anywhere between 1 to 10 February. If you opted for the 2-month instalment, you’ll need to pay the instalments between 1 to 10 February and 1 to 10 March. A similar schedule applies to the other monthly instalments as well. You can pay your SPayLater bills using the ShopeePay e-wallet, online banking, or cash at 7-Eleven.

Note as well that all users tapping into the SPayLater feature will be granted a spending cap, subject to a maximum limit of RM3,000. This cap will differ from user to user, and it will be determined by various factors, such as your spending behaviour and purchasing pattern on Shopee, as well as repayment history.

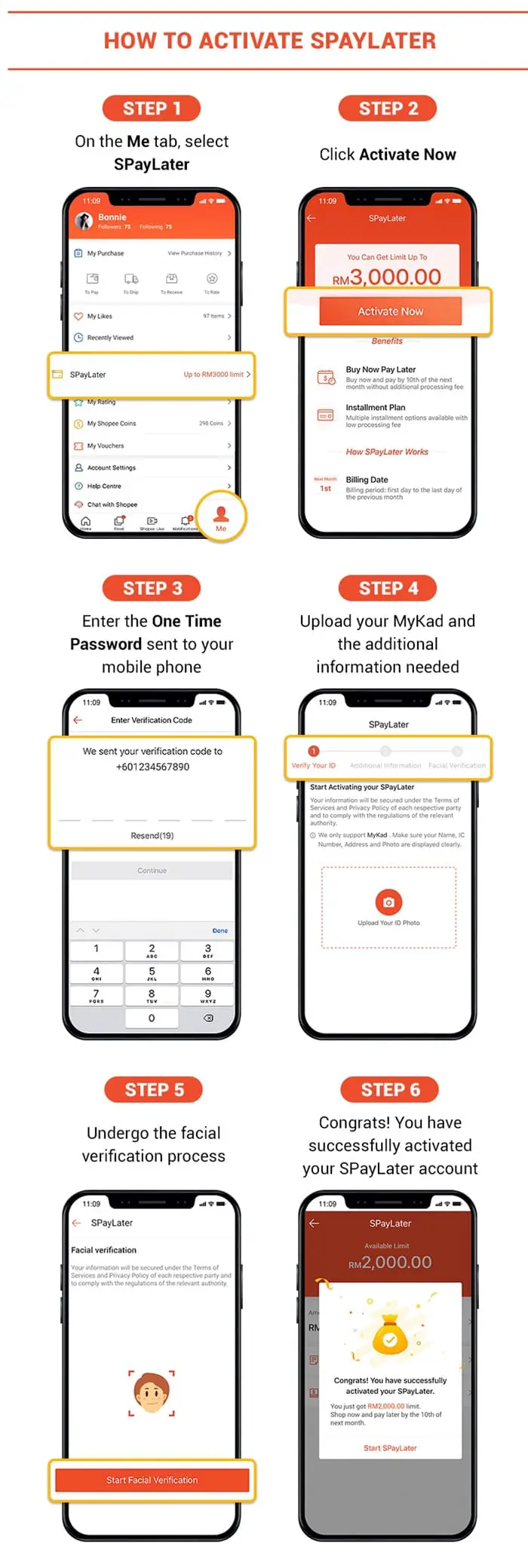

According to Shopee, SPayLater is currently only available to selected users who get a notification in the app. However, its website contains a page to show how to activate SPayLater, as shown below:

Once you have activated it, SPayLater will appear as one of your payment options during the checkout process. You’ll also be able to select your preferred instalment plans then.

Shopee is the latest player in the growing BNPL scene, with many fintech startups deep in the water. While it trails another giant, Grab which launched its own PayLater feature back in 2019 and recently enhanced it with 0% instalment options, SPayLater is already present in two other markets: Indonesia and Thailand.

SPayLater is managed by SeaMoney, the fintech arm of unicorn startup Sea, the parent company of Shopee as well as the popular gaming company, Garena. From its website, SeaMoney looks to also dabble in other traditional banking services, including consumer cash loans as well as financing for sellers on Shopee. Subject to regulatory approval, these could likely be introduced in Malaysia as well, considering Shopee is rumoured to be interested in one of the five digital banking licenses in Malaysia and has already secured one for Singapore.

Comments (0)