Alex Cheong Pui Yin

26th February 2024 - 3 min read

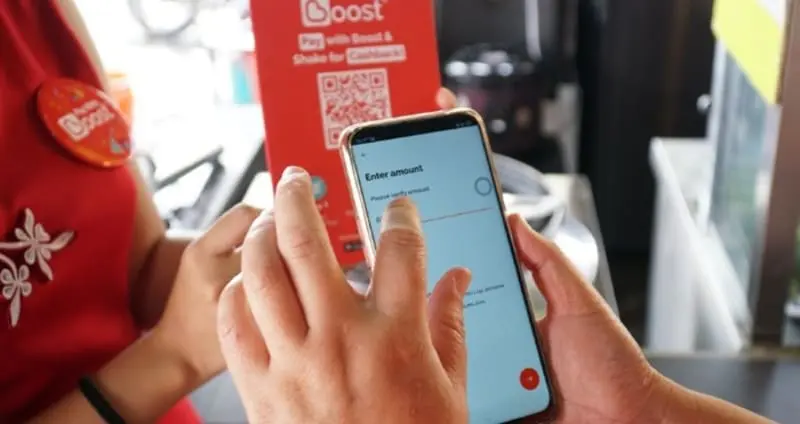

Boost has announced that it will be upgrading the wallet size of its Premium Wallet to RM10,000, effective 15 March 2024. Aside from that, it will also be removing the existing monthly credit card reload limit of RM2,000, and introducing a 1% convenience fee for those who wish to top up their e-wallet with credit cards (past an RM1,000 limit, where the fee will be waived).

In an email sent to its users, the e-wallet service provider said that once the update is implemented, all Basic Wallet users who verify their accounts will get to enjoy a Premium Wallet with an RM10,000 wallet size immediately. Existing Premium Wallet users can also tap into the new limit instantly after they perform a quick account verification.

For comparison, the current Premium Wallet has a wallet size of RM4,999, with a monthly transaction limit of RM4,999 and annual transaction limit of RM59,999.

To further note, Boost had also previously introduced a Premium 10k Wallet alongside its Premium Wallet, where selected users were allowed to enjoy an increased wallet size of RM10,000 as well as higher monthly and annual transaction limits. You were, however, only allowed to have either a Premium Wallet or a Premium 10k Wallet per ID.

Aside from this update, Boost also said that the monthly limit of RM2,000 that currently applies to credit card topups will be removed come 15 March. This means that you will soon be allowed to use credit cards to reload any amount into your Boost e-wallet (up to your wallet limit).

However, this new accessibility will also come with the introduction of a new 1% convenience fee for all credit card reloads that exceed the first RM1,000; the fee will be waived for credit card top-ups if it is still within this RM1,000 limit. This is somewhat similar to what was rolled out by Touch ‘n Go eWallet back in January 2023, although TNG eWallet itself has already implemented a new update where the 1% fee is now charged for all credit card reloads of any amount.

For those who are unfamiliar, here’s a brief example by Boost on how the new fee will work:

“If you wish to avoid the convenience fee altogether, you may do so by adding money to your Boost Wallet via other methods, such as debit card, online banking, or Boost PayFlex,” the e-wallet service provider shared in its email.

For more details about these updates, you can also head on over to Boost’s support page here.

Comments (0)