RinggitPlus

27th November 2018 - 5 min read

While the video above may be funny and entertaining, it highlights a worrying state of financial awareness among Malaysians. Last month, we ran the 2018 Malaysian Financial Literacy Survey and found that as many as 59% of Malaysians do not have enough savings to last them for more than 3 months, and that 34% admitted to spending equal to or more than their monthly salary.

We found these to be some very disturbing numbers, and set out to dissect the results of the survey further. As it turns out, Malaysians’ attitude towards money is shocking, and needs to be addressed immediately. Here’s what we found.

1. Malaysians have no choice but to own a car.

This was one of the strongest patterns we found in the entire survey, with a total of 84% of respondents aged 25-44 currently servicing a car loan. This issue isn’t merely a financial one, as the public transportation network in the country is still limited (and unreliable at times), and alternatives such as Grab have been increasing its fares progressively. Young Malaysians today have no choice but to buy a car, even if the cost of living in urban areas is constantly increasing.

The government is trying to address this issue with the unlimited public transportation pass to be introduced in 2019, which will significantly reduce the cost of commute for many Malaysians. However, will it be enough to convince Malaysians to ditch their cars? Time will tell.

2. The more you earn, the more you save? WRONG.

Our survey results found that the “middle income trap” is very apparent among Malaysians: increased salaries do not equate to proportionally increased savings. We found that:

– 88% of Malaysians earning between RM2,000 to RM5,000 a month save less than RM1,000 monthly.

– 67% of Malaysians earning between RM5,000 to RM10,000 a month save less than RM1,000 monthly.

– 31% of Malaysians earning above RM10,000 a month save less than RM1,000 monthly.

What’s crystal clear is extremely worrying. Nearly a third of Malaysians who earn more than RM10,000 a month – widely considered a high-income group – do not even save 10% of their salaries. On the other hand, two-thirds of Malaysians who earn RM5,000 to RM10,000 a month also save less than RM1,000 a month.

Finally, one of the easiest correlations we found in the survey results was also a painful one to note. Nearly half of Malaysians (47%) who earn less than RM2,000 a month do not – or most likely, cannot – save money in a month.

Based on these trends, can Malaysians retire by the appropriate age? The next observations shed more light.

3. More than 30% of ALL Malaysians currently live paycheck to paycheck.

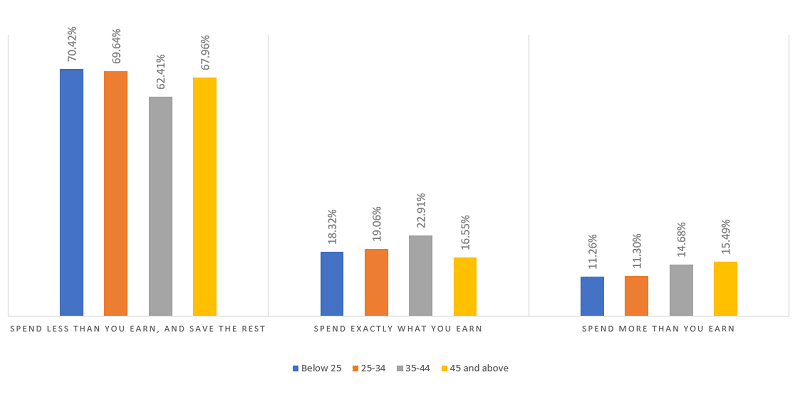

A big part of retirement planning comes from starting early. However, that doesn’t seem to be the case for many Malaysians. Delving further into the survey answers we found another shocking statistic: 30% or more respondents across all age groups have admitted to spending equal or more of what they earn each month! Here’s the breakdown:

Spending equal or more than what you earn each more means these Malaysians are living from paycheck to paycheck, rendering them unable to save any meaningful amount of money – let alone invest. Of course, these aren’t just the carefree souls who spend their money to sustain their lifestyles; others may be burdened by the costs of raising children as well as servicing home and car loans that leave them with nothing to save at the end of the month. Regardless, our survey indicates that there is a disturbing number of Malaysians living this way.

4. Women DO spend more than men!

We also decided to study if the stereotypes about gender and money are true. We found that female Malaysians tend to save less than males (30% vs 20%), and there is a huge difference in the number of men and women who save more than RM1,500 a month: just 8% of females compared to 19% of males.

At the same time, more Malaysian men own credit cards compared to women (67% vs 46%). There is a common preconception that the credit cards you own, the more you end up spending. Clearly, this isn’t the case for the men and women in Malaysia.

5. Retirement planning? What’s that?

All of the observations lead us to a distressing statement: at this rate, it is virtually impossible for Malaysians to even think about retiring with any money in the bank. And you know what? We could very well end up like that.

From our survey, we found that a staggering 47% of Malaysians aged 35 and above have not started saving for retirement. Of this amount, 13% of them are aged above 45. Given the standard retirement age of 55 or 60, can these Malaysians even retire by then?

Spending Our Way Into Financial Suicide

The results from the Malaysian Financial Literacy Survey 2018 is extremely worrying. Forget retirement planning, many Malaysians today are not even saving a meaningful amount of money each month, and instead are spending more than what they earn in some cases.

Whether it’s a lifestyle they choose to live or one they have no choice but to live, it is not sustainable and will only lead to financial complications later in life.

Comments (0)