Alex Cheong Pui Yin

25th October 2022 - 4 min read

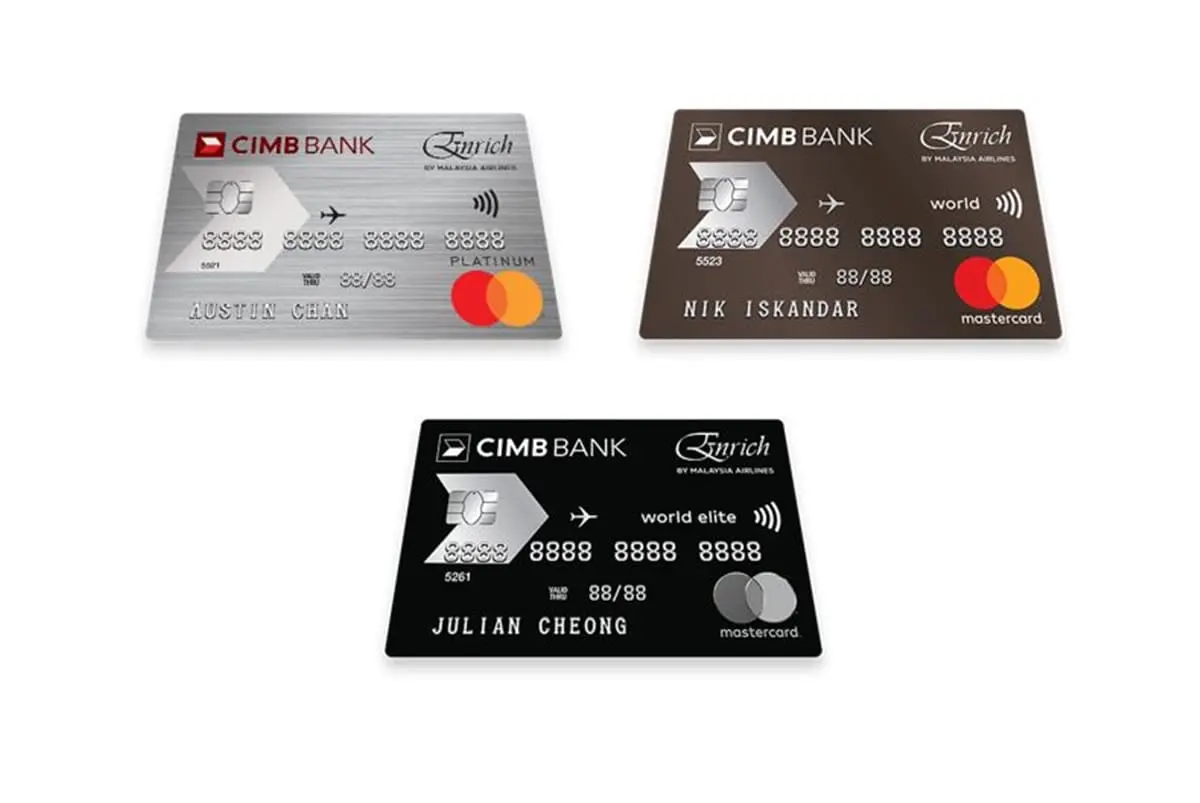

A while back, CIMB had shared a fair bit of details regarding its new set of CIMB Travel credit cards, which were intended to replace the bank’s discontinued Enrich co-branded cards. These early details included the cards’ Bonus Points earning rates as well as travel benefits.

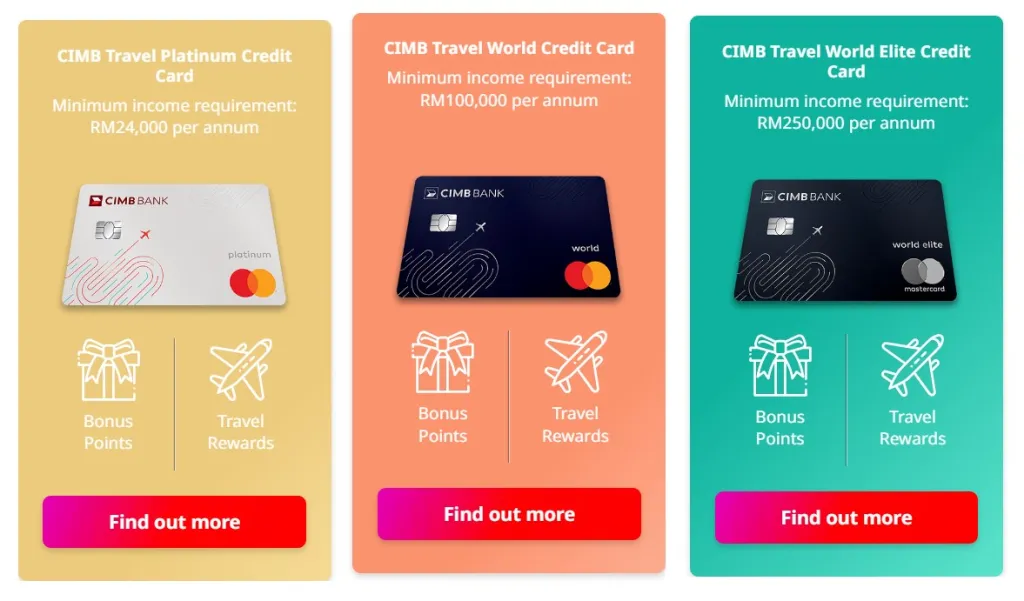

With the cards – consisting of the CIMB Travel Platinum Credit Card, the CIMB Travel World Credit Card, and the CIMB Travel World Elite Credit Card – now officially open for application, CIMB has officially revealed the new cardfaces as well as release further information on some of its card benefits.

As a pleasant surprise, the bank also announced an additional annual fee waiver promo for those who are interested in applying for the cards.

Cardfaces and minimum income requirements

As you can see in the image above, the design of the new CIMB Travel credit cards take on a clearly minimalistic theme. Aside from featuring a clean background of solid colour, the cards also come stamped with CIMB and Mastercard’s logo, as well as a simple motif of flight route with a plane, signifying – you guessed it – travel.

The CIMB Travel Platinum Credit Card and CIMB Travel World Credit Card are both coloured a metallic platinum and navy blue, respectively. Meanwhile, the grayscale and embossed Mastercard logo gives the CIMB Travel World Elite Credit Card a premium look.

Aside from the cardfaces, CIMB also revealed the minimum income requirement for all three cards, listed as below:

- CIMB Travel Platinum Credit Card: RM24,000 per annum

- CIMB Travel World Credit Card: RM100,000 per annum

- CIMB Travel World Elite Credit Card: RM250,000 per annum

Marriott Vacation Club: Complimentary 4-night stay

Alongside the above info, CIMB also released additional details regarding a hotel benefit that is specific to the CIMB Travel World and CIMB Travel World Elite Credit Cards: a complimentary 4-night stay at participating Marriott Vacation Club properties.

Prior to its launch, CIMB did not make known some of the terms and conditions to this particular perk, such as which particular property that cardholders can apply to. Now, it is revealed that cardholders will be able to choose their complimentary stay from one of the two following resorts, along with their respective package details:

| Properties | Package details |

| Bali Nusa Dua Gardens (Bali, Indonesia) | – Guestroom accommodating up to 2 adults – Complimentary in-room check-in |

| Mai Khao Beach (Phuket, Thailand) | – Apartment with two bedrooms, accommodating up to 6 persons – Complimentary in-room check-in |

Not only that, depending on availability upon request prior to travel date, cardholders may also be eligible for an upgrade to a preferred room category and/or additional nights at a discounted rate.

More importantly, this offer is only available for reservations made from now until 31 October 2023, with travel dates being valid for 18 months from the date of booking (and 30 days or more from the date of the registration of the package). Additionally, each cardholder is only limited to one redemption of the complimentary 4-night stay hotel perk.

We did a quick search of the room rates for both resorts, with Marriott’s Bali Nusa Dua Gardens starting from RM827 and Marriott’s Mai Khao Beach larger accommodation starting from RM1,105. This perk alone already makes the CIMB Travel World and Travel World Elite a highly rewarding card.

Additional promo: Annual fee waiver

As had been revealed earlier, both the CIMB Travel World or CIMB Travel World Elite Credit Cards come with an annual fee charge of RM554.72 and RM1,215.09, respectively (while the fee for the CIMB Travel Platinum card is automatically waived). This fee can be waived (50% or 100%) when you spend a specified minimum amount per annum.

In conjunction with the official launch of the cards, however, there is now an ongoing campaign between today until 31 December 2023 that allows new cardholders to enjoy these same 50% or 100% waivers at a discounted total spend (within 60 days from card approval date).

Here’s a table to summarise the key details that you need to know:

| Cards | Annual fee waiver | Original annual spending requirement | Total spending requirement under campaign (within 60 days from card approval date) |

| CIMB Travel World Credit Card | 50% 100% | RM60,000 & above RM120,000 & above | RM1,000 & above RM3,000 & above |

| CIMB Travel World Elite Credit Card | 50% 100% | RM120,000 & above RM240,000 & above | RM1,000 & above RM3,000 & above |

***

The new CIMB Travel credit cards have stirred up quite a bit of interest within the air miles credit card community. With the ability to earn up to 10 Bonus Points for every RM1 spent, increased flexibility in air miles redemption via Bonus Points (as compared to the previous Enrich cards), and various other new perks, these new cards can be serious contenders within the air miles card space.

Meanwhile, if this is your first time hearing about these new CIMB Travel Credit Cards, head on over to our previous coverage here to find out more about them.

Comments (2)

Do these cards

1. Get points from reload into eWallets?

2. Have Krisflyer for points redemption?

New cardholders to enjoy these same 50% or 100% waivers at a discounted total spend (within 60 days from card approval date) is for the first year only?