Alex Cheong Pui Yin

5th January 2021 - 3 min read

Malaysia may see its first five digital banks by the first quarter of 2022, following Bank Negara Malaysia’s (BNM) publication of the policy document on the licencing framework for digital banks. Along with the issuance of the framework, the central bank has also begun accepting applications for the five digital banking licences that it intends to issue.

With regard to the publication of the policy document for the new framework, BNM said that it was created to enable innovative application of technology in banking products. This includes increasing access and promoting responsible usage of suitable financial solutions for the unserved and underserved groups within Malaysia.

(Image: Mashable)

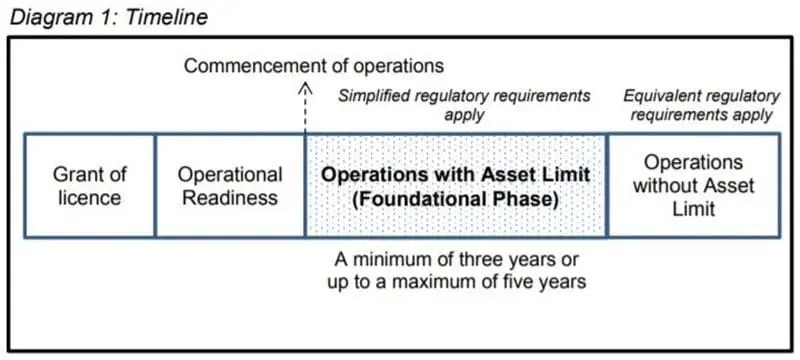

BNM also emphasised that the new licencing framework adopts a balanced approach in establishing the country’s digital banks. This allows for the setting up of digital banks with strong value propositions without compromising on the integrity and stability of the financial system, as well as depositors’ interests. With these goals in mind, these new banks are required to abide by a simplified regulatory framework in their initial three to five years of operation, during which they must have an asset threshold of not more than RM3 billion.

“This functions as a foundational phase for the licensees to demonstrate their viability and sound operation, and for the Bank to observe the performance of the licensed digital banks and attendant risks that arises from their operations,” said BNM in its press release.

On top of that, digital banks must also comply with requirements under the Financial Services Act 2013 (FSA) and Islamic Financial Services Act 2013 (IFSA), although they will be subjected to a less stringent set of regulatory requirements during the “foundational phase”.

Aside from issuing the new framework, BNM also announced that it is now ready to accept applications from entities that wish to make a bid for the digital banking licences that will be issued. The central bank is looking to issue up to five licences in total. These entities can begin to apply starting from now until 30 June 2021.

“Applicants should be guided by the application procedures described in this Policy Document as well as the Application Procedures for New Licences under the FSA and IFSA, and the Application Procedures for Acquisition of Interest in Shares and to be a Financial Holding Company,” said BNM, adding that notification on the grant of licence will be made by the first quarter of 2022.

(Image: The Sun Daily)

BNM’s plans for the digital banking framework had actually began way back in 2019, when it released an exposure draft on the licencing framework for digital banks in December. The draft, which sought to seek feedback from the public, was originally open for negotiation until March 2020. However, the deadline was subsequently delayed to 30 June 2020 due to the onslaught of Covid-19 and the subsequent implementation of the movement control order (MCO). After that, the central bank took time to review the responses obtained before eventually finalising the policy document on 31 December 2020.

Following BNM’s announcement of the exposure draft for the digital banking framework, various entities have expressed an interest in making a bid for it. These include major companies – such as AirAsia, Grab, Razer, Sunway, and BigPay – as well as state governments, like Johor and Sarawak.

(Source: Bank Negara Malaysia)

Comments (0)