Alex Cheong Pui Yin

17th May 2024 - 3 min read

GXBank is set to roll out its referral programme to users, where they will be rewarded when they successfully get their referees – such as family members and friends – to sign up for a GXBank account using their referral links. The launch of the feature will, however, take place in stages as it is still being tested, and only a group of selected users have been chosen to help in the beta test at present.

In an email sent to these chosen users, GXBank said that those who are keen to participate can fill out the registration form shared with them. More information on the programme will also be sent to them in time.

In line with this message, GXBank has also published the T&C document and FAQ for the referral campaign, which is set to run from today until 31 July 2024. In these documents, it is clarified that the campaign will be carried out in two phases, during which eligible GXBank users will be entitled to a referral reward of RM8 when their referee successfully signs up for a GXBank account:

- From start until 31 July: Selected individuals who receive a notification from GXBank

- From 27 May until 31 July: All individual customers of GXBank with a GX Account

To clarify, each GXBank user is allowed to earn multiple rewards from successful referrals during the campaign period, but note that each referral link has a sixty-day validity period. As such, make sure that your referee onboards before your link expires (although you can re-send your referral link again)!

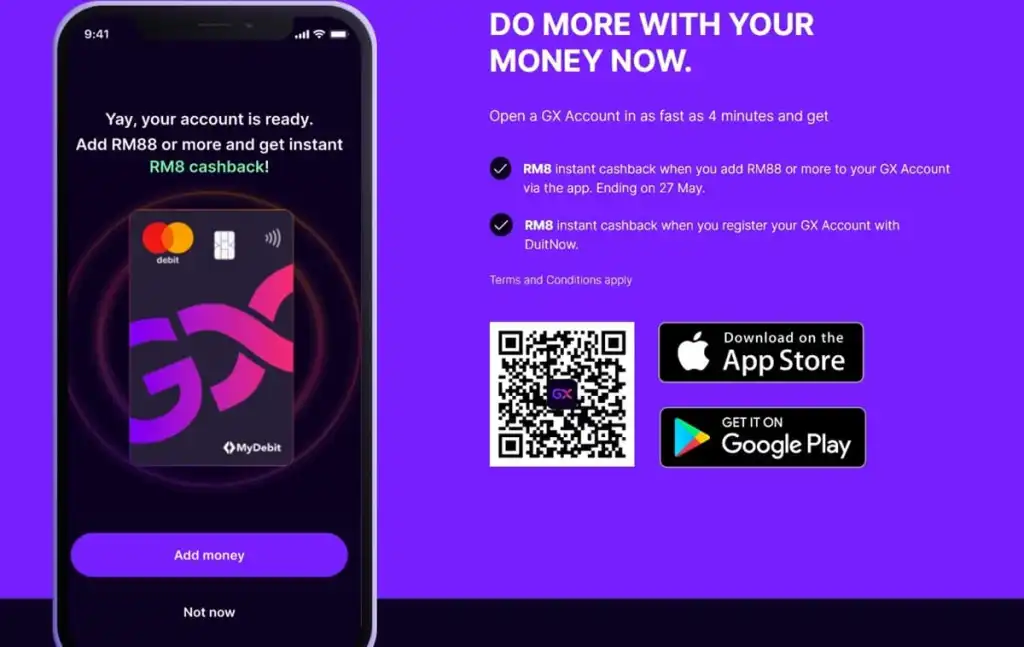

GXBank also said that your RM8 referral reward will be credited into your GX Account instantly once your referee has successfully opened a new GX Account using your link. In some exceptional cases, however, this process may take up to two weeks.

If you’re one of the lucky few who have been selected to register and participate in the beta testing of this new feature – ahead of its scheduled public launch on 27 May – you can join this campaign by tapping on “Me”, and then “Share with Friends”. This will allow you to send your referral link and code to family members and friends who are not yet existing GXBank customers.

Aside from this upcoming referral programme, GXBank has also recently enabled several other new features on its platform, such as the DuitNow QR payment and scheduled transfer features. It is also set to roll out protection and lending products throughout the year, including a cybercrime and scam insurance in the third quarter of 2024.

Comments (0)