Alex Cheong Pui Yin

1st July 2020 - 3 min read

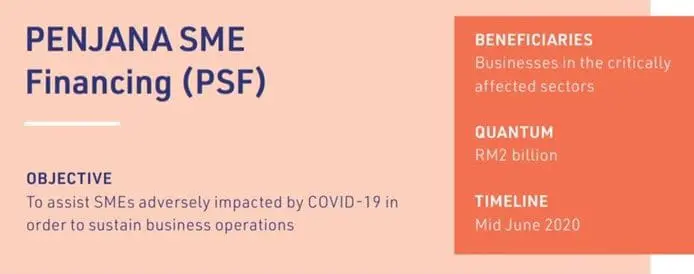

Hong Leong Bank (HLB) is offering help to its small and medium enterprise (SME) customers to obtain financial aid via the PENJANA SME Financing Scheme (PSF Scheme), having been approved as one of the scheme’s participating banks.

Through the PSF Scheme, eligible SMEs can apply for working capital loans of up to RM500,000 each, at a financing rate of 3.50% p.a. with no collaterals required. They are also allowed a term loan of up to 5 years, and are only required to pay for the interest during the first six months of the loan.

According to the bank, the scheme is open to all SMEs impacted by the Covid-19 pandemic and the movement control order (MCO), including emerging SMEs. In other words, SMEs that have been operating for a minimum of 12 months or have no credit/borrowing history are welcome to apply to the scheme as well.

The group managing director and chief executive officer of HLB, Domenic Fuda, said that cash flow remains a serious concern for SMEs even as Malaysia enters a recovery phase and businesses start to reopen. He added that economic recovery will take time, and SMEs will still need to contend with a low consumer sentiment post-MCO after suffering from a heavy blow to their finances.

Fuda further highlighted the struggles of new and emerging SMEs, stating that only 50% of such SMEs are able to sustain their businesses within the first five years of their establishment. “As a bank with a strong entrepreneurship heritage, we are here to facilitate them in rebooting their businesses with this financing scheme aimed at providing short-term financial buffers as a way to protect the business continuity plans,” he said.

Aside from resolving cash flow problems, Fuda also hoped that SMEs will use the scheme to enhance their resilience and help their businesses grow once the economy has recovered. “We have seen some SMEs pivoting to digitalisation and for goods and services borne out of this crisis. This drive for innovation and adapting to our new normal is essential for survival as well as future growth,” he emphasised.

The PSF Scheme was announced as part of the PENJANA recovery economic plan, and will see the banking sector offering RM2 billion of funding to affected SMEs. HLB will provide its PSF Scheme until 31 March 2021 or until the allocated RM2 billion shared by participating banks is depleted.

For more information, head on over to HLB’s PSF Scheme landing page. Alternatively, you can reach out to HLB’s SME relationship managers.

Comments (0)