Alex Cheong Pui Yin

22nd January 2024 - 4 min read

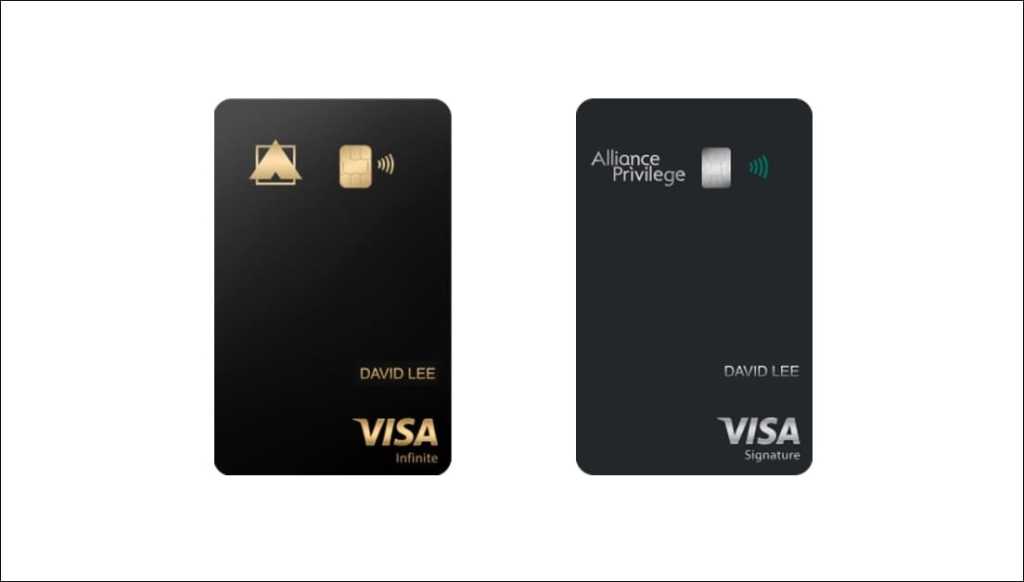

Alliance Bank is enhancing the complimentary lounge access benefit for its Visa Infinite and Privilege Visa Signature credit cardholders, which will soon offer up to 2x additional access to the Travel Club Lounge – on top of their existing Plaza Premium Lounge and Plaza Premium First access perk. Set to take effect on 9 February 2024, the bank also said that it will update the way it posts the Timeless Bonus Points (TBP) earned by cardholders in a statement cycle, rounding it down to the nearest tens when posting it to their credit card statements.

At present, the Alliance Bank Visa Infinite credit card offers 2x complimentary access to Plaza Premium Lounges worldwide each calendar year, whereas the Alliance Privilege Visa Signature card provides 4x annual access to Plaza Premium Lounges and Plaza Premium First lounges globally. With the enhanced complimentary lounge access benefit, cardholders will soon also be able to enjoy additional access to the Travel Club Lounges that are located in the KLIA Terminal 1 and Terminal 2, as well as the Kuching and Kota Kinabalu International Airport.

Here’s a table to summarise the updated lounge access benefit for Alliance Bank Visa Infinite and Alliance Visa Signature cardholders:

| Credit cards | Current complimentary lounge access benefit | Updated complimentary lounge access benefit (effective 9 February) |

| Alliance Bank Visa Infinite credit card | 2x per calendar year to Plaza Premium Lounges worldwide | – 2x per calendar year to Plaza Premium Lounges worldwide – 1x per calendar year to Travel Club Lounge |

| Alliance Privilege Visa Signature credit card | 4x per calendar year to Plaza Premium First and Plaza Premium Lounges worldwide | – 4x per calendar year to Plaza Premium First and Plaza Premium Lounges worldwide – 2x per calendar year to Travel Club Lounge |

Aside from this update, the other benefits and features of the two credit cards remain unchanged. Alliance Bank Visa Infinite cardholders will continue to earn 8x TBP on every RM1 spent on online shopping transactions and e-wallet reloads, 5x TBP on overseas, dining, and grocery transactions, as well as 1x TBP on other retail and contactless transactions. Similarly, Alliance Privilege Visa Signature card will also still offer up to 8% cashback for your personal and business expenses – including online shopping, petrol, groceries, dining, utilities, and other retail spend – if you meet the necessary requirements.

The minimum annual income requirement and annual fees of both cards, too, remain the same. To apply for the Alliance Bank Visa Infinite credit card, you must have a minimum annual income of RM60,000, while the card’s annual fee is set at RM438. The Alliance Privilege Visa Signature card, on the other hand, is available to those who earn a minimum of RM48,000 per year, and its annual fee stands at RM148.

In addition to this, Alliance Bank also shared that starting from 9 February, it will begin to round down the total TBP earned by cardholders in a statement cycle (earning rate of RM1 = 1 TBP) to the nearest tens when posting it to their statement. This differs slightly from its current treatment, where the TBP earned by cardholders will be rounded down to the nearest full TBP. Furthermore, Alliance Bank also said that when this update kicks in, you must earn a minimum of 10 TBP during each statement cycle in order for the points to be posted to your credit card account.

Here are a few examples from Alliance Bank to illustrate the upcoming changes:

| Example 1 | Example 2 | Example 3 | Example 4 | |

| Total TBP earned in a statement cycle | 1,288 | 115 | 1,054 | 8 |

| Total TBP posted into credit card statement | 1,280 | 110 | 1,050 | 0 |

Both of these revisions will be reflected in Alliance Bank’s product disclosure sheet (PDS) for credit cards soon, updated from its current 1 December 2023 version.

(Source: Alliance Bank [1, 2])

Comments (0)