Alex Cheong Pui Yin

18th February 2022 - 2 min read

Hong Leong Bank (HLB) is making some revisions to the features of its HLB Essential credit card, namely introducing a monthly cap to its cashback benefit and updating the fees and charges for its cash advance service. These changes are set to take effect on 1 May 2022.

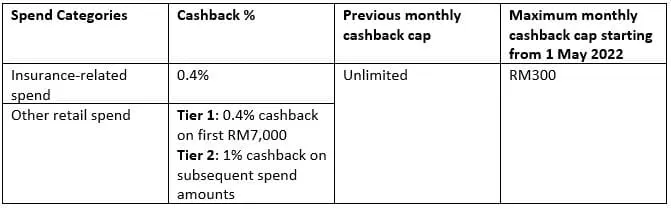

Following this update, cardholders will still be able to earn 0.4% cashback on insurance-related expenses, and tiered cashback rewards of up to 1% for other retail spend – as per the existing arrangement. However, unlike at present, you will no longer be able to enjoy unlimited monthly cashback; instead, the maximum amount of cashback that you can earn each month will be capped at RM300.

Here’s a quick summary on how the HLB Essential credit card will work starting from 1 May:

On top of that, HLB is also updating the fees and charges for the Essential card’s cash advance service. Currently, these fees are provided at a lower rate as compared to other banks, as a form of privilege for Essential cardholders – although HLB does mention that it reserves the right to impose the standard rate (5% per transaction or RM20, whichever higher) at its sole discretion.

Come 1 May, the new cash advance fees and charges will be implemented as follows:

| Fees and charges | Current rates (before 1 May 2022) | New rates (effective 1 May 2022) |

| Cash advance fee | 2% of the amount advanced, or a minimum of RM5 per transaction, whichever is higher | 5% of the amount advanced, or a minimum of RM20 per transaction, whichever is higher |

| Cash advance finance charges | 10.8% p.a. of the cash advance amount calculated on a daily basis from transaction date until full repayment date | 18% p.a. of the cash advance amount calculated on a daily basis from transaction date until full repayment date |

HLB further clarified that all outstanding cash advance balances on the Essential credit card – including previous cash advance withdrawals – will be subjected to the revised finance charge (18% p.a.) once these changes take effect.

Finally, other features of the Essential credit card will remain unchanged. The annual fee is still set at RM100 for the principal card, and RM50 for supplementary cards.

(Source: Hong Leong Bank)

Comments (0)