Alex Cheong Pui Yin

3rd April 2023 - 2 min read

OCBC Bank has announced a revision to the benefits of its OCBC Titanium Mastercard credit card (blue/pink), offering up to 7% cashback on online and e-wallet spend, as well as 0.1% cashback on other retail expenses. The revision is set to take effect on 21 April 2023.

Following this latest update, OCBC Titanium Mastercard’s cashback will be calculated as per the following structure, with its cashback for online and e-wallet, specifically, tiered according to the cardholder’s spent amount:

| Tiers | Amount spent/Transactions | Cashback | Cashback cap |

| Tier 1 | Online & e-wallet spend of up to RM1,000 | 0.07% | N/A |

| Tier 2 | Subsequent online & e-wallet spend of above RM1,000 to RM1,500 | 7% | RM20 per month |

| Tier 3 | Subsequent online & e-wallet spend above RM1,500 | 0.55% | N/A |

| – | All other retail expenses (no tiers) | 0.1% | N/A |

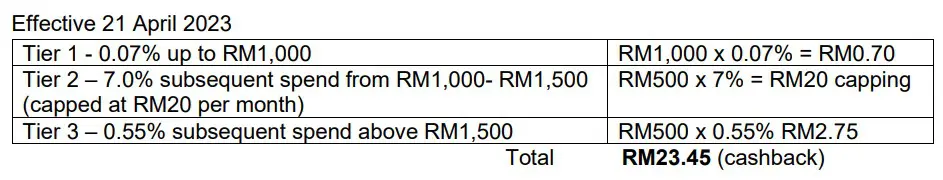

So as you can see, the cashback rate will not be applied as a flat rate on all your online and e-wallet expenses. Rather, it will be tiered according to specific amounts of your total spend. To further clarify how the revised features of the OCBC Titanium Mastercard card work, here’s a sample calculation from the bank, with the assumption that you’ve spent a total of RM2,000 on online and e-wallet transactions:

Additionally, OCBC highlighted that cashback will only be provided for the following e-wallet service providers:

- Alipay

- Boost

- Grab

- Lazada Wallet

- Touch ‘n Go (TNG) eWallet

- BigPay

- Fave

- KiplePay

- Shopee

Meanwhile, eligible retail spend allowed under this card includes local and overseas purchases, e-commerce and online purchases, e-wallet transactions, auto-debits and recurring payments, instalment payment plans, and mail/telephone orders. Transactions such as easy payment plans, and balance transfers, on the other hand, are excluded.

Other than that, the bank also noted that OCBC Titanium Mastercard cardholders will be entitled for cashback on insurance premiums paid using the card, except for Great Eastern life or general insurance (Great Eastern policyholders will need to check out the OCBC Great Eastern Platinum card instead).

Aside from these revisions, the card’s other features remain unchanged. You will still need a minimum annual income of RM72,000 to apply for the card, and it is free for life.

For comparison, the current benefits of the OCBC Titanium Mastercard card allow cardholders to earn unlimited 1% cashback on online and overseas spend. This is in addition to 0.1% cashback on all other retail spend. OCBC said that this latest revision was made to ensure that the card remains relevant to consumers.

(Source: OCBC)

Comments (0)