Jacie Tan

15th May 2020 - 2 min read

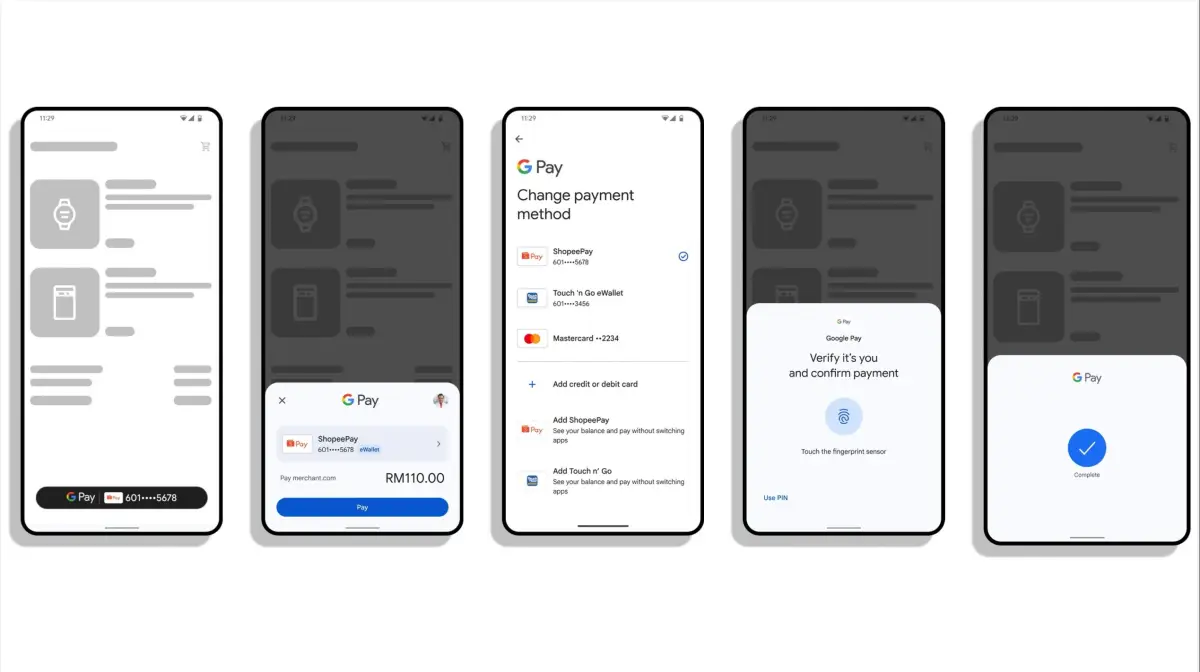

Boost has introduced a new low-cost and accessible contactless solution for businesses, the Boost Payment Link. The new feature allows merchants to easily send their customers a payment link via any messaging app, removing the need to invest in a point-of-sale (POS) or payment terminal or even having a static QR code to accept payments.

Through Boost Payment Link, traditional cash-based businesses can receive orders and payments online upfront before delivering their goods or services. This would be particularly useful for F&Bs, small grocers, or convenience stores during this conditional movement control order (CMCO) period where online orders and home delivery services are becoming the norm.

According to Boost CEO Mohd Khairil Abdullah, this latest feature is Boost’s way of helping businesses build resilience, adapt to simple digital solutions, and continue operating remotely. With movement restrictions introduced to contain the spread of Covid-19, many micro- and small-business owners who typically ran cash-based businesses faced the risk of shuttering due to the sudden drop in customers. More customers also began going cashless in order to limit the use of bank notes, seeking cleaner and safer ways to transact.

“Contactless everything is now the new normal. The pandemic and MCO has changed the way businesses and consumers engage with each other digitally, moving away from face-to-face interactions,” said Mohd Khairil. “The Boost Payment Link easily enables micro- and small- cash-based merchants to go cashless and protect their businesses with almost no investment required. All they need is a smartphone, a Boost account and data or WiFi connection.”

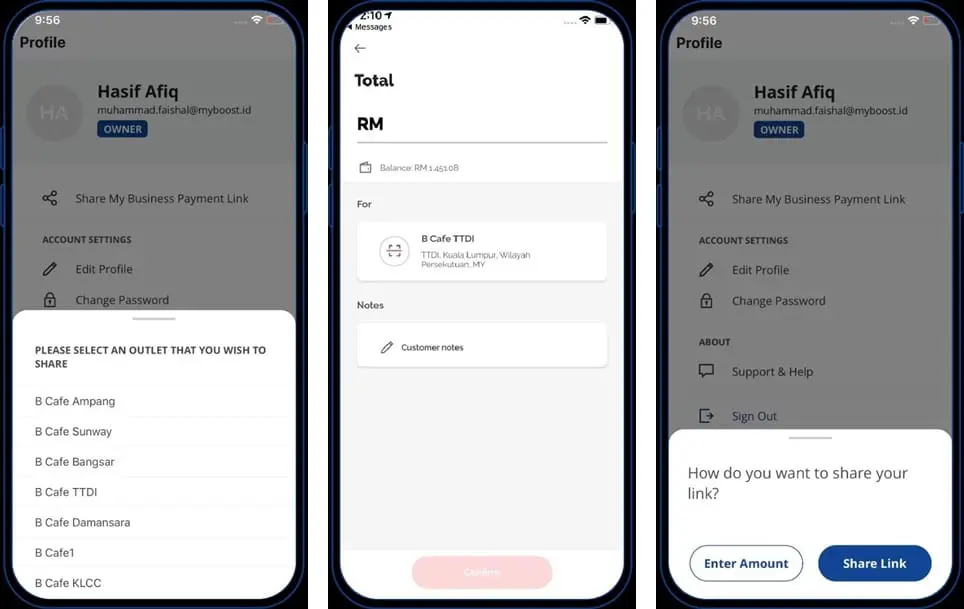

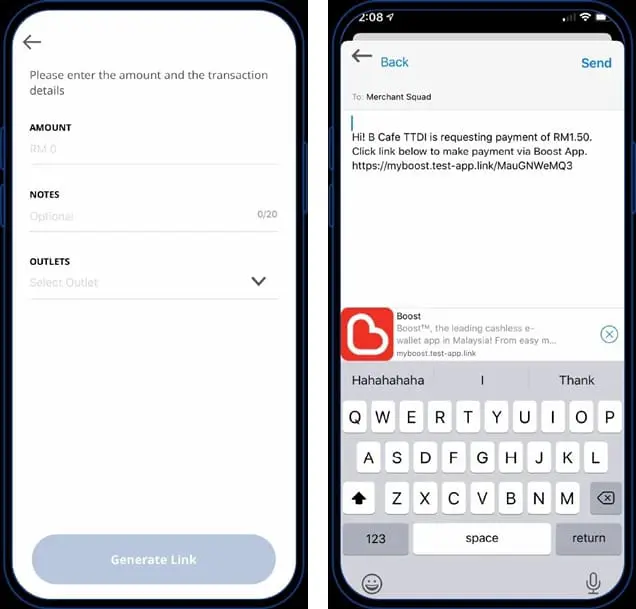

The Boost Payment Link is available for all Boost merchants via their Boost Business Account and can be found on the profile page. To share the payment link with customers, merchants just need to click “Share My Business Payment Link”, enter the amount that the customer is required to pay, and then select which email or messaging app to share the link. Lastly, customers only need to click on the received payment link to make payment via Boost.

Comments (0)