Nur Adilah Ramli

7th April 2022 - 3 min read

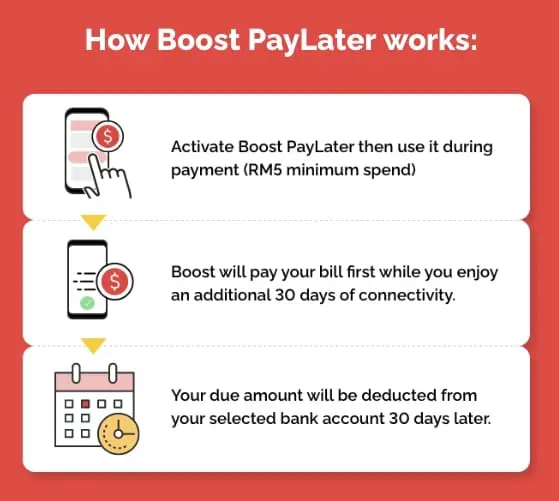

Boost has rolled out its buy-now-pay-later (BNPL) feature, Boost PayLater, allowing users to pay for their purchases either via an instalment plan or 30 days later. The feature is currently only available for mobile prepaid and postpaid bills, but will be extended to more services soon.

A syariah-compliant product, the new interest-free feature – which allows instant approvals with no collaterals required – comes in two payment plans: Boost PayLater Instalment Plan and Pay in 30 Days Plan.

The Boost PayLater Instalment Plan enables you to split your payment into instalments over a stipulated period of time. The Pay in 30 Days Plan, meanwhile, lets you pay your bills 30 days after making your purchases. Based on the Boost PayLater ’s FAQ, the latter plan also allows you to offset your bills with vouchers and Boost Stars, thus enabling you to enjoy more savings.

Users who wish to tap into either of the Boost PayLater plans will need to meet the following criteria:

- A Malaysian residing in Malaysia with an active transaction history using Boost within the last three months; or

- A foreigner residing in Malaysia with an active transaction history using a credit card within the last six months

- Aged between 21 and 60

- A Boost Premium user with either a Silver Sergeant or Gold General rank

Note that while the Boost PayLater Instalment Plan is available for any Boost Premium users, the Pay in 30 Days Plan is specifically limited to those with good credit history, who may need financial assistance to pay their mobile prepaid or postpaid bills. Additionally, users will be pre-scored based on their credit history, profile, and other relevant information to determine their eligibility and spend limit for the Boost PayLater plans.

Once you are enrolled in any of the Boost PayLater plans, you can make use of the payment methods for online as well as in-store payments. After selecting the items that you would like to purchase, simply choose Boost PayLater as your payment method, and select either the Boost PayLater Instalment Plan or the Pay in 30 Days Plan. Boost will then process your request for approval, following which you can proceed to meet your initial instalment obligation or pay up in 30 days, depending on your selected plan.

With regard to fees, you may be subject to sales and services tax (SST), as well as stamping, processing, and wakalah fees. For the Pay in 30 Days Plan, 2% of wakalah fee or a minimum of RM2.50 up to RM10 may be applicable.

As for repayment obligations, make sure to have your bank account set up with Boost as your outstanding balance will be automatically deducted from the selected account when the due date arrives. Ensure as well that you have sufficient balance in your account, or you may risk being charged a late payment compensation (ta’widh) or charges on the overdue amount if the payment does not go through. Aside from this repayment method, Boost is also planning to collect outstanding payments via the Boost e-wallet in the near future, allowing for greater convenience.

In conjunction with the rollout of the Boost PayLater feature, Boost is running a wakalah fee waiver campaign until 30 June 2022, offering a waiver on the wakalah fee for users who spend a minimum of RM5 on bill payment and prepaid top-ups using Boost PayLater. You can enjoy the waiver for multiple transactions throughout the campaign period.

(Source: Boost)

Comments (0)