Alex Cheong Pui Yin

27th March 2023 - 2 min read

Deputy Finance Minister II, Steven Sim has addressed the discontinuation of tax relief for Skim Simpanan Pendidikan Nasional (SSPN) deposits, noting that the government has decided not to extend the benefit starting from this year. This comes as the re-tabling of Budget 2023 did not include an extension to this tax relief.

The deputy finance minister said that this decision is primarily attributed to the fact that the government has already introduced several other tax exemptions and deductions for individuals under the revised national budget. These include a 2% reduction on individual income tax rates for selected income brackets, as well as an increased medical expenses tax exemption (from RM8,000 to RM10,000).

“The National Higher Education Fund Corporation (PTPTN) also allowed borrowers with monthly income of less than RM1,800 to defer their repayments,” said Sim. On top of the payment deferment, PTPTN is also offering repayment discounts of up to 20% for those who repay their PTPTN loans in bulk.

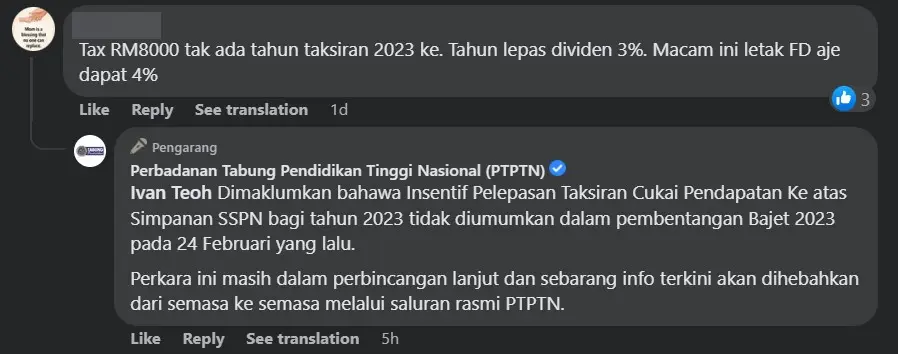

That said, PTPTN has yet to confirm the discontinuation of this tax relief. As of the time of writing, the SSPN website continues to state that this matter is still under discussion, and any latest details will be shared through its official platforms. Similarly, PTPTN’s social media team also responded to public queries about the matter with a similar message, as of this afternoon.

Meanwhile, the revised Budget 2023 – also known as the Supply Bill – has yet to be officially passed. It was tabled by Prime Minister Datuk Seri Anwar Ibrahim on 24 February 2023 for a second reading, and was subsequently passed at the policy stage in Dewan Rakyat with a majority voice vote on 9 March 2023. It still has to be brought to Dewan Negara to be passed, and then presented to the Yang di-Pertuan Agong for approval.

The tax relief for SSPN has been a key incentive in encouraging depositors to save with SSPN under their children’s name. The relief was initially offered at RM6,000, but was subsequently increased to RM8,000 under Budget 2019.

(Source: Astro Awani)

Comments (1)

I will stop my regular PTPTN deposits.