Alex Cheong Pui Yin

9th December 2020 - 3 min read

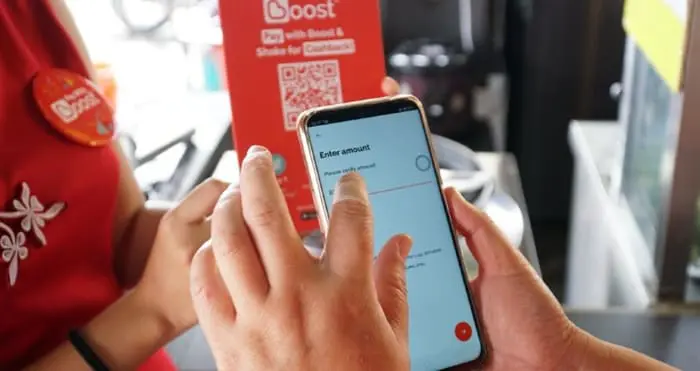

(Image: The Star)

Chief executive officer of Boost Malaysia, Mohd Khairil Abdullah reiterated today that Covid-19 has significantly accelerated the adoption of e-commerce and digitalisation among small and medium enterprises (SMEs) and micro-SMEs (MSMEs) in Malaysia.

Speaking in the first session of a virtual roundtable series organised by Boost – titled “The Next Normal” – Khairil shared some data that pointed to the substantial growth. According to him, online-related payments for the SMEs and MSMEs on Boost has grown by 2.2x in the three months since the start of the movement control order (MCO). Meanwhile, the e-commerce platform’s merchant base has expanded by more than 60%, led by SMEs and micro-SMEs.

Khairil also pointed out that prior to the onslaught by the Covid-19 pandemic, many businesses did not see the benefits and necessity of e-commerce. “But once you come down to the core of not being able to do business because you don’t have a cashless solution, that’s actually forcing a lot of the rethink, especially during the MCO,” he said.

“We were creating solutions where you can continue to sell your nasi lemak from your kitchen and you don’t even have to open up your shop. You just need to adopt some form of cashless way of doing transactions. So, I think that the shift (towards digitalisation) has changed, and it is happening massively,” added Khairil.

Khairul further observed parallels between the growth of cashless payments and business digitalisation in Malaysia with the adoption of M-PESA in Kenya during the outbreak of Ebola in Africa in 2014 to 2016. For context, M-PESA is a mobile-based payment service that was first introduced in Africa all the way back in 2007.

“One of the reasons why M-PESA really exploded was Ebola, because the virus made it very necessary for people to move away from handing over cash to some form of cashless adoption,” said Khairil. In line with this comparison, Khairil thinks that business digitalisation and the adoption of cashless payments will also happen a lot faster in Malaysia in part because of Covid-19.

(Image: Harian Metro)

This first session of Boost’s “The Next Normal” roundtable series had sought to discuss issues concerning the digitalisation of traditional businesses, such as future opportunities and potential pitfalls that these SMEs and MSMEs might encounter. Aside from Khairil, the session’s panel was also joined by the chief operating officer of the Malaysia Digital Economy Corporation (MDEC), Datuk Ng Wan Peng, and the national vice president of the SME Association of Malaysia, Chin Chee Seong.

Comments (0)