Alex Cheong Pui Yin

6th July 2022 - 2 min read

Shopee has announced several updates to the use terms of its buy-now-pay-later (BNPL) service, SPayLater, including its new status as a shariah-compliant payment method. Additionally, it has also revised the processing fee and the late charges of the service, as well as introduced a new billing schedule.

With regard to SPayLater’s shariah compliance, the BNPL service is now certified as a shariah-compliant payment method by global shariah advisory firm, Amanie Advisors (registered with the Securities Commission (SC)). In a notice, it was noted that SPayLater is “consistent with the shariah permissibility on Bay’ Bithaman Ajil (deferred payment sale), where the parties in a sale transaction agree to make the payment in a deferred basis.”

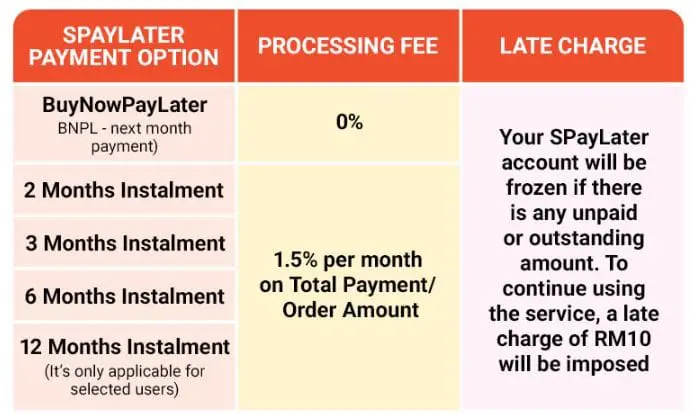

Aside from that, SPayLater has also revised the processing fees and late charges for its payment plans as per the following rates:

Prior to this, SPayLater users who opt for monthly instalments of two months and above had to pay a lower processing fee of 1.25% per month on the order amount. Meanwhile, the late payment fee charged back then was 1.5% monthly on the overdue amount.

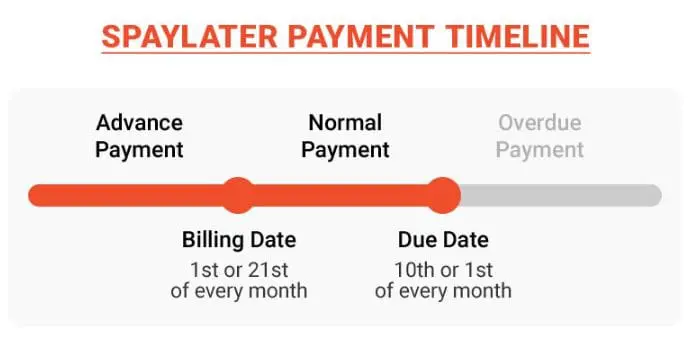

In addition to that, Shopee also introduced two different payment cycles (billing dates and due dates) for new SPayLater users, thereby providing them with some flexibility in managing their repayment schedules. Before this, SPayLater customers only had one option for their billing cycle – with the billing date set to the 1st of the month, and payment due by 10th of the month. Now, however, you can choose your preferred repayment schedule from either of the billing cycles:

| Options | Details |

| Option 1 | Billing date: 1st of the month Due date: 10th of the month |

| Option 2 | Billing date: 21st of the month Due date: 1st of next month |

Shopee’s SPayLater was first rolled out in January 2021, and it allows you to “postpone” the payments for your current purchases to the following month, or convert them into monthly instalments. SPayLater used to be enabled only for purchases made on the Shopee platform (minimum purchase of RM15 with selected merchants and products), but it has now also been made available for checkouts at selected physical stores (minimum purchase of RM1).

(Source: Shopee)

Comments (0)