Alex Cheong Pui Yin

14th February 2023 - 2 min read

Bank Negara Malaysia (BNM) deputy governor Datuk Marzunisham Omar has urged residents in rural areas and micro-entrepreneurs to adopt e-payments as they offer various benefits, instead of merely sticking to conventional payment methods.

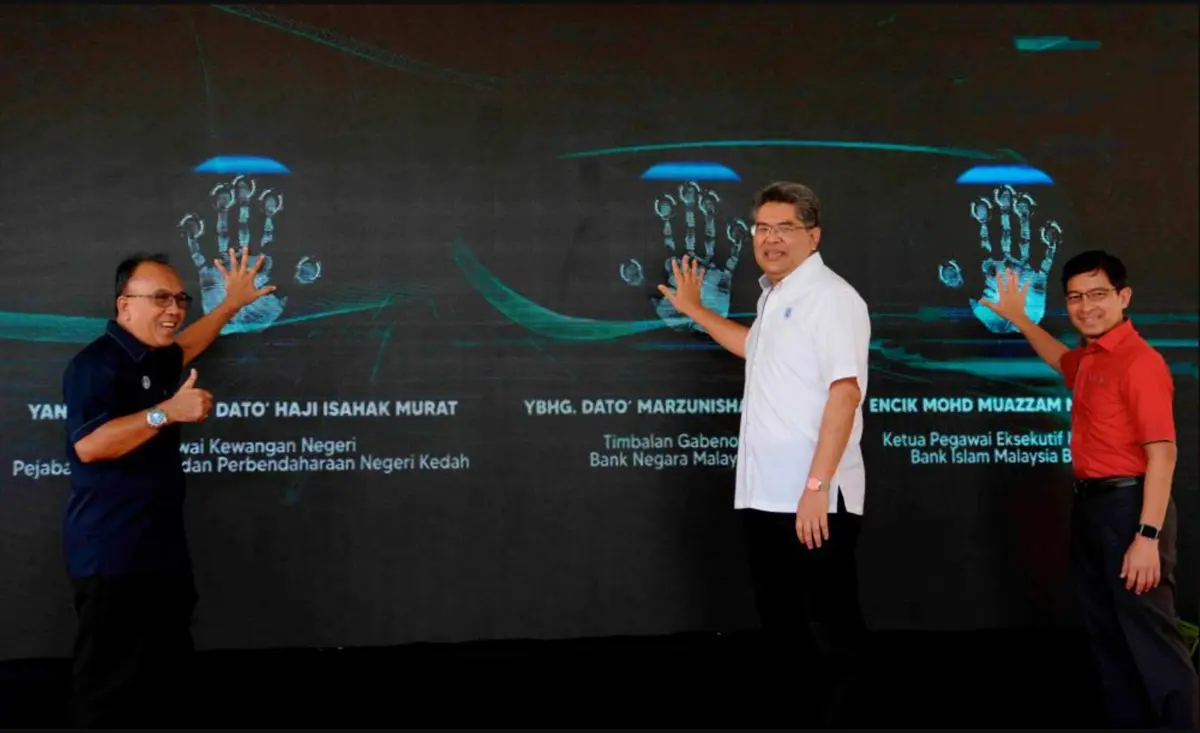

“More consumers and merchants have started to familiarise themselves using various e-payment facilities such as debit cards, credit cards, QR codes, internet banking, and e-wallets during the recent Covid-19 pandemic. All transactions can be carried out at your fingertips, including paying bills, repaying loans, and transferring money to children who are studying,” said the deputy governor during the launch of the e-Duit Desa programme in Jeniang.

Additionally, Datuk Marzunisham stressed that e-payments should be considered as an alternative payment method that can help to save time and effort when performing transactions, and enable merchants to become more competitive as well. “Transactions can be recorded directly, facilitating account management and loan applications in the future. Traders do not have to worry about providing small change to return the balance either,” he shared.

Datuk Marzunisham further stated that the use of e-payments in rural areas is already on the rise, but it is necessary to help the people understand how to use them safely and avoid getting scammed. In light of that, BNM will work hand in hand with Malaysian banking institutions to increase public awareness as well as encourage more people to switch to e-payments – with e-Duit Desa being one of many initiatives that have been lined up to this end.

The e-Duit Desa programme in Jeniang is the first of such programmes to be implemented in Kedah, and seeks to help build the residents’ confidence in the use of e-payments. Ultimately, it is hoped that the district will eventually go cashless.

(Sources: BNM, The Edge Markets)

Comments (0)